Highlights:

- India’s leading chemical company Indokem to invest Tk1,500cr

- Belgium-based Azelis to initially invest around Tk1,200cr

- Japan-based tire maker Bridgestone to invest Tk2,000cr

- China’s Sinovac Biotech to start producing Plasma-Derived Medical Products with Tk5,000 cr investment

One of the top Indian chemical companies Indokem is gearing up to invest some Tk1,500 crore in Bangladesh. The company has already received investment approval from the Bangladesh Investment Development Authority (Bida) and set up a camp office in Dhaka.

Indokem has now applied to the Registrar of Joint Stock Companies and Firms (RJSC), seeking permission to open a branch in Bangladesh. They have also sought allocation of land in a private economic zone to set up factories.

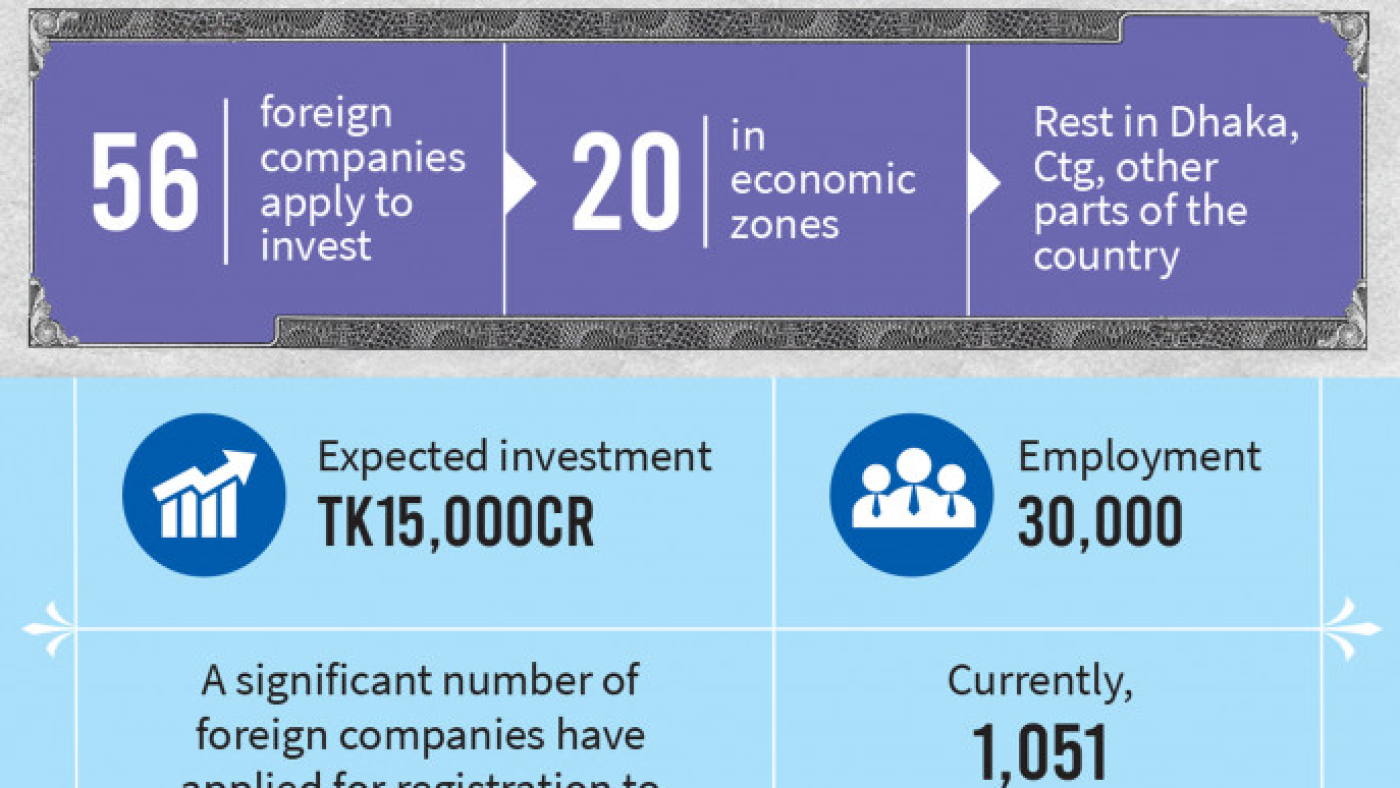

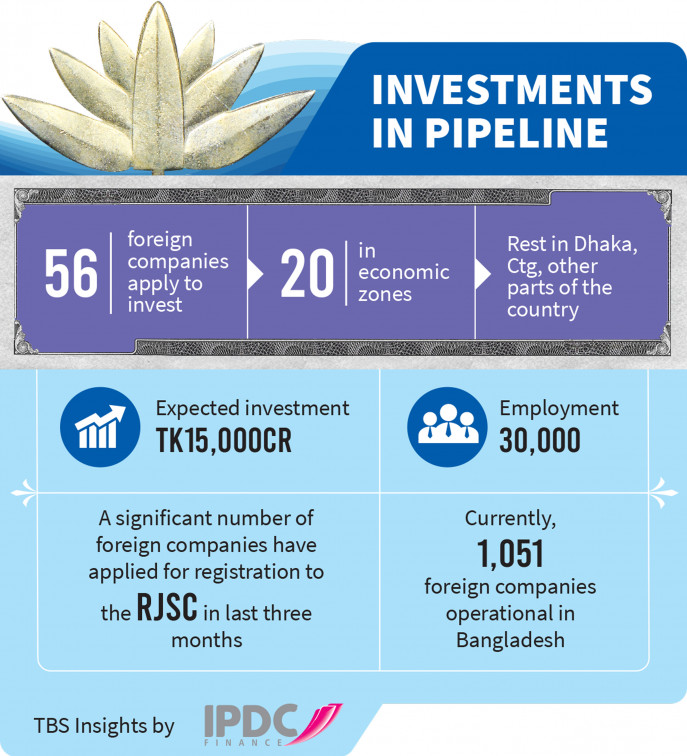

Aside from Indokem, 56 other big and small multinational companies (MNCs) have applied to the RJSC this year, seeking permission to open their branches to import, produce and export various products and to market locally.

According to a source in RJSC, these applications are under process.

These companies will invest more than Tk15,000 crore and once they start operation, 30,000 new jobs will be created, RJSC and Bida sources say.

If necessary approvals of these companies are completed this year, they will be able to conduct business and production by next year, Bida officials say.

Sheikh Shoebul Alam NDC, registrar at the office of RJSC, told The Business Standard that a significant number of foreign companies have applied to the RJSC in the last three months.

“The RJSC received these applications from January to 10 March. So many applications in such a short period would be a first,” said Sheikh Shoebul Alam.

Explaining the growing number of interested companies, he said, “It’s because Bangladesh is now known to the world as an investment hub. Especially, the government’s plan to implement 100 economic zones is attracting such investments.”

“Foreign companies are interested in investing in Bangladesh due to the cheap labour and the large market in the country, he added.”

Owner of a reputed law firm, which is assisting nine of the 56 companies in the approval process, said if these companies get all approvals required from the government, this just might be the year of highest foreign investment in the country so far.

According to the RJSC sources there are 2,79,167 public, private limited companies, foreign companies, partnership firms and one person companies in the country as of last February. Among them 1,051 are foreign companies.

According to Bida data, “New foreign investment worth about Tk11,643 crore came in 2021 and Tk15,000 crore in 2022. Bangladesh Bank data says in 2022, foreign companies including new and old ones have invested about $3.5 billion.

Belgium based multinational company “Azelis”, one of the world’s leading multinational companies supplying raw materials for pharma, food, agricultural, chemicals for the textile, personal care (cosmetics) and life science products, is going to begin its operations in Bangladesh with a huge investment.

According to a source, the company will initially invest around TK1,200 crore in Bangladesh.

Aparna Khurana, managing director, Azelis-India told The Business Standard, “Azelis plans to lead in the Bangladesh Market.”

She did not disclose the figure of investment but hinted that the figure will be higher than other companies in the sector in Bangladesh.

RJSC sources said, application of the Belgium-based MNC is under process.

Japan-based motor tire manufacturer Bridgestone Corporation has already secured approval from Bida to set up a factory for manufacturing tires for the local market and also to export to various countries.

Their application is also under process and expected to get final approval by May-June, said RJSC sources.

A Bangladeshi official of Bridgestone Corporation told TBS that the company will initially invest around Tk2,000 crore.

The official said that Bida has already approved their proposal.

Bridgestone has sought land at the Bangladesh Special Economic Zone (BSEZ) in Araihazar, Narayanganj.

After the approval of RJSC, some 17 different types of approvals are required for foreign companies to set up a factory. Bida’s One Stop Service Centre assists the companies with these necessary approvals.

The Chinese company Sinovac Biotech, which makes a Covid-19 vaccine, is going to start producing Plasma-Derived Medical Products (PDMP) in Bangladesh with an investment of Tk5,000 crore.

An official of Sinovac Biotech (Bangladesh) Ltd told TBS that they are also waiting for the approval from the RJSC.

Kevin Zhang, general manager of Sinovac Biotech (Bangladesh) Ltd, told TBS “Bangladesh is one of the most important targeted countries to produce and manufacture plasma-based medicine. Before coming to Bangladesh, we have already established some branches in South America, Chile, Colombia and Turkey. We plan to establish more branches in different countries.”

As of now, Bangladesh, like other low- and middle-income countries, imports 100% of the plasma-based products, requiring a lot of foreign currency.

Barrister Omar Sadat, president of Bangladesh-German Chamber of Commerce and Industry (BGCCI) said that foreign investment is constantly increasing in Bangladesh. However, there are obstacles to approvals that need to be resolved.

“The government wants to increase foreign investment. But due to some bureaucratic complications, many foreign companies often turn away,” he pointed out,

According to Bida sources, of the 56 companies, 20 will invest in different economic zones while the rest will set up their point of operation and manufacturing plants in different regions of the country, including the outskirts of Dhaka and Chattogram.

Commerce Minister Tipu Munshi said the government is working to attract such multinational and foreign companies to invest in Bangladesh.

“The government will provide all kinds of facilities to foreign companies to do business and manufacture in Bangladesh,” he said, adding, “The Government will be able to collect huge revenues and at the same time a large number of people will find employment.”

Source: The Business Standard.