Despite increasing the prices of fertilisers, electricity and gas, the next fiscal year (FY2023-24) will see an additional allocation for gross subsidies to adjust to the amount required in excess of the allocation for the current fiscal year.

However, the net subsidy will be less in the next fiscal year, finance officials have said.

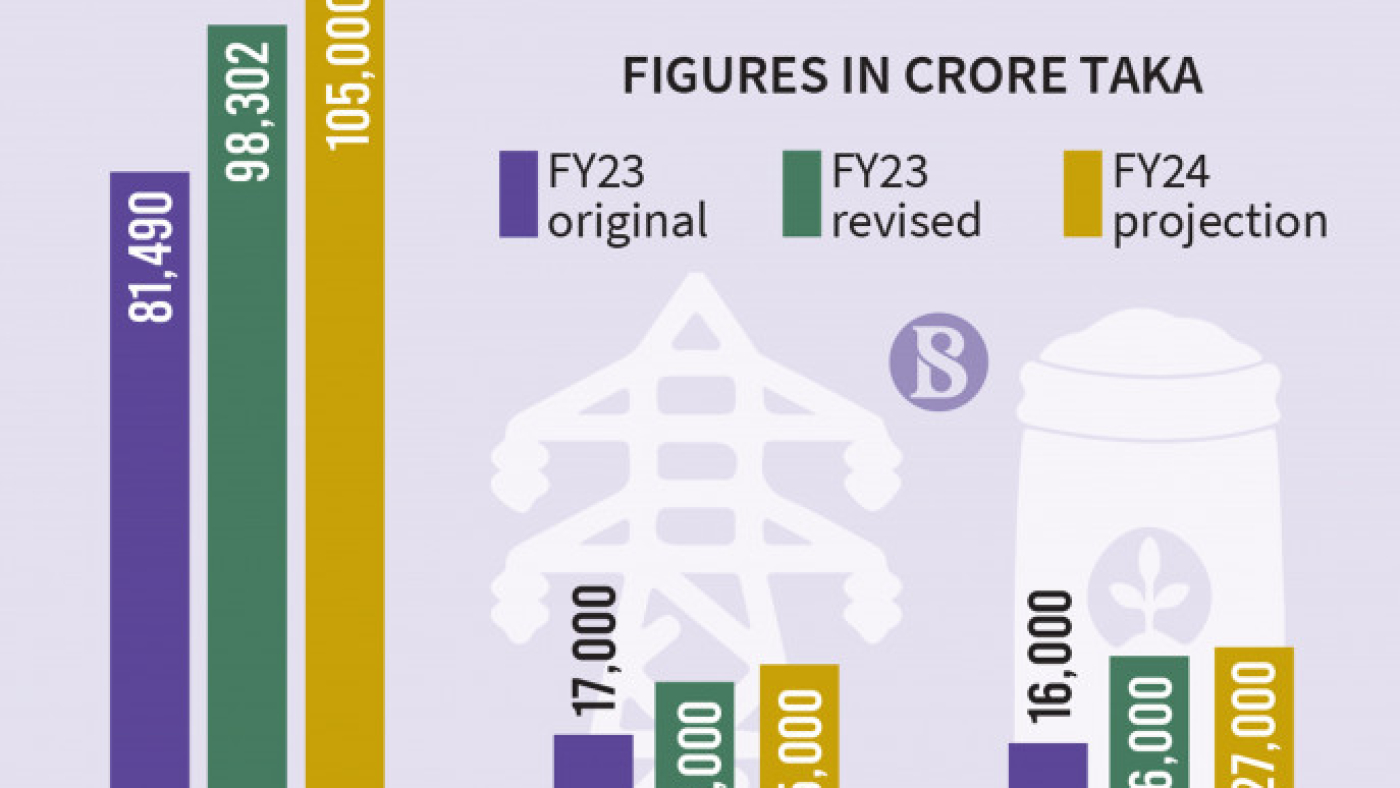

In the current fiscal year’s budget, the government allocated Tk81,490 crore for subsidies, stimuluses and cash loans. In the budget of the next fiscal year, the total allocation for these sectors may be increased to Tk1,05,000 crore. While the amount of net subsidy in the new fiscal year has not increased, additional allocation is being kept mainly to meet the subsidy arrears of the current fiscal year.

The visiting IMF team, reviewing the implementation of the loan conditions, has accepted this move of the ministry of finance to adjust the subsidy spending.

An official of the Finance Division told The Business Standard that the IMF mission raised questions about increasing the subsidy allocation in the next fiscal year’s budget.

“We have informed them that the amount of net subsidy will be much less in the next fiscal year compared to this year. However, the amount of money that needs to be allocated to handle the subsidy pressure this year, could not be allocated. As a result, there are arrears in various sectors, which will be met by allocations in the budget of the next fiscal year,” said the official.

As per IMF loan conditions, the current fiscal year allocation for agriculture, food and export subsidies, social security, pension and gratuities is Tk1,82,600 crore. In the budget of the next fiscal year, the allocation will be Tk1,82,300 crores.

But in the next fiscal year’s budget, apart from subsidies, export incentives, allocation for pensions, interest on savings certificates and social security will be around Tk2,30,000 crore.

Finance Division officials said that in the budget of the current fiscal year, the allocation for subsidy in the power sector was Tk17,000 crore. Electricity prices have been hiked three times after the power department demanded an additional subsidy of Tk32,500 crore.

This has saved the government Tk9,200 crore. On the other hand, the revised budget increased the allocation for subsidy to the power sector to Tk23,000 crore.

Which means, the power sector needed a total subsidy of Tk49,500 crore this year and the power sector is getting Tk31,200 crore after price increase while the additional subsidy remains due.

After increasing the price three times this time, the price of electricity will increase again by next June. This will reduce the net subsidy demand next year. But due to the arrears of this year’s subsidy, around Tk25,000 crore is being kept in the new budget to pay it.

Same is the case with fertilisers. In the budget for the last fiscal year, there was an allocation of Tk9,100 crore for subsidies in agriculture. But the increase in fertiliser prices required a subsidy of Tk28,000 crore in the last fiscal. In last year’s revised budget, Tk15,173 crore has been allocated for the subsidy on agriculture. As a result, last year’s agricultural subsidy was also deficient.

Tk16,000 crores have been allocated for agriculture for this year. But the agriculture ministry sought an additional subsidy of Tk40,247 crore. That is, in total, Tk56,247 crore rupees are needed to meet the subsidy in the agricultural sector this year. But in the revised budget, the allocation was increased to Tk26,000 crores. As a result, a large part of this year’s agricultural subsidy remains arrears.

The government has already decided to increase the price of all types of fertilisers by Tk5 per kg saving Tk7,000 crore. As a result, the demand for subsidies will decrease in the new fiscal year. But to meet the arrears, the amount of agricultural subsidy may be increased to about Tk27,000 crore in the next fiscal year.

Finance Division officials said due to the increase in the prices of fuel oil, fertilisers, food products and gas in the international market due to the Ukraine-Russia war, the subsidy demand of various ministries in the current fiscal year is more than double the total allocation. As a result, the ministries have claimed a total subsidy of Tk1,86,595 crore in the current fiscal year.

Finance ministry officials said that despite increasing the allocation in the revised budget, apart from increasing the prices, subsidies of about Tk50,000 crore remain outstanding in various sectors this year, except for fuel oil, which the ministries are unable to pay due to lack of allocation.

Finance Division officials said that in the budget of the current fiscal year, about Tk5,995 crores were allocated for food subsidy and in the revised budget, an additional allocation of Tk812 crores was kept. An allocation of Tk8,000 crore has been estimated for food subsidy in the coming fiscal year.