Floor price was imposed on 28 July 2022

Having a bitter experience of radical market restriction, the securities regulator has withdrawn the floor price after nearly one and half years of market suffocation.

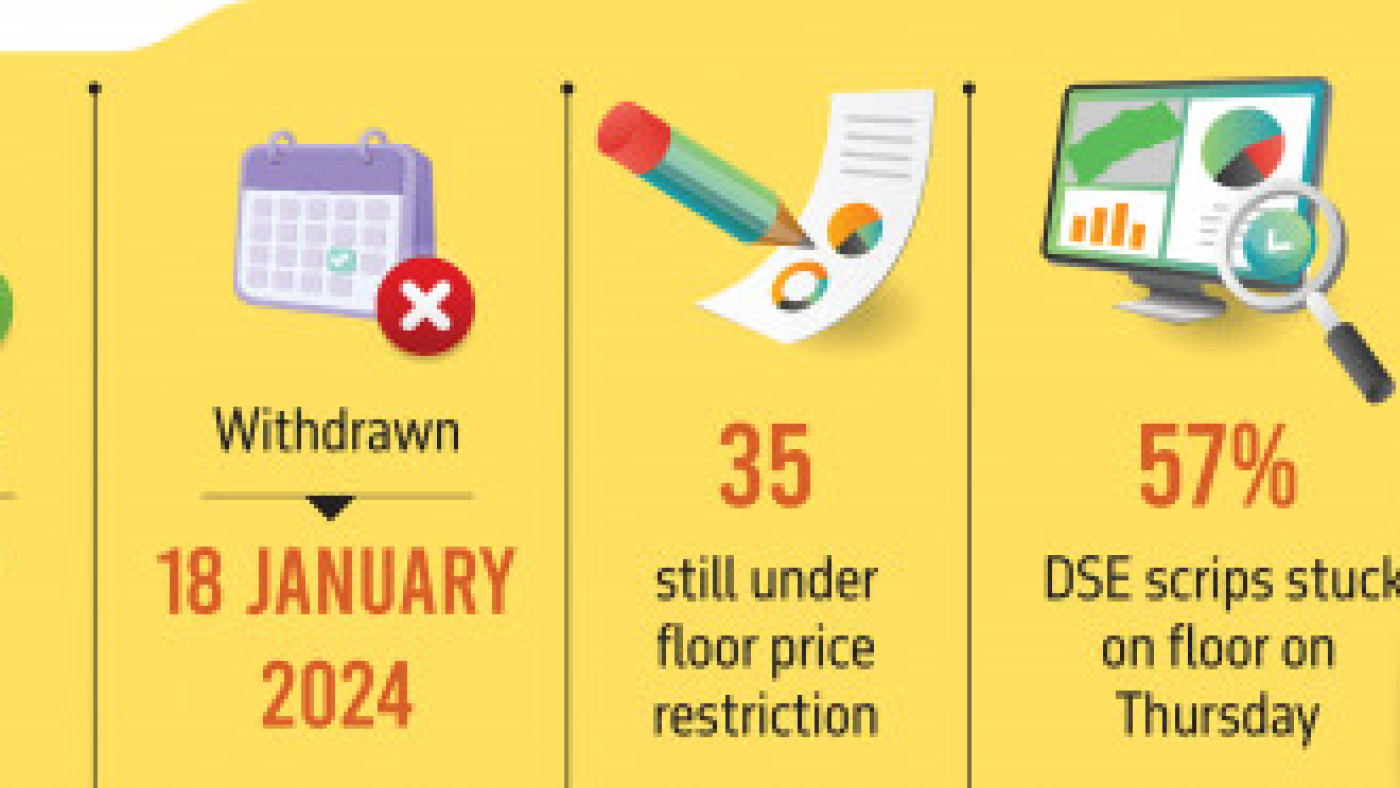

However, 35 stocks, believed to be at a risk of freefall and drag the indices sharply down without the floor, will remain under the restriction until further notice, the Bangladesh Securities and Exchange Commission (BSEC) said in an order to the bourses this evening.

Prices of the remaining 379 stocks, mutual funds, corporate bonds and debentures listed with the Dhaka Stock Exchange (DSE) are free to move within the regular daily range of up to 10% from the previous closing price, technically called circuit breaker.

BSEC Chairman Professor Shibli Rubayat-Ul Islam said the regulator had several factors in consideration to select the stocks to continue with the floor.

“These include valuation, recent buy-sell orders patterns at floor prices and impact on the indices,” he added.

The decision will have immediate effect, meaning there will be no floor price restriction on the listed securities from Sunday, except for 35 large cap ones.

Still under restriction

The exceptions are Anwar Galvanizing, Baraka Power, British American Tobacco, Beximco Ltd, Bangladesh Submarine Cable Company, BSRM Ltd, BSRM Steels, Confidence Cement, DBH Finance, Doreen Power, Envoy Textile, Grameenphone, HR Textile, IDLC Finance, Index Agro, Islami Bank, KDS Accessories, Khulna Power, Kattali Textile, Malek Spinning, Meghna Petroleum, National Housing Finance, National Polymer, Orion Pharma, Padma Oil, Renata, Robi Axiata, Saiham Cotton, Shasha Denim, Sonali Paper, Sonar Bangla Insurance, Shinepukur Ceramics, Shahjibazar Power, Summit Power and United Power.

Floor price saga

After the first Covid-19 case in the country, when the stock market was at a multi-year low, the BSEC in March, 2020 imposed floor price on individual scrips that did not allow any price to go beyond the floor.

The move back then helped the market rebound as almost all the stocks bounced back with the economic reopening in June 2020, and DSEX, the major index of the Dhaka bourse, surged to over 7,300 in October 2021, from 4,000 in June 2020.

Meanwhile, investors almost forgot the floor prices during the bull-run and the regulator withdrew the restriction.

The market entered a normal course of price correction and the Ukraine War started in February 2022 and triggered a downturn trend.

The regulator, on 28 July that year, repeated the same floor price restriction when the DSEX was at the 6,000 mark and investors were intimidated by the rising inflation, interest rates and declining corporate earnings — it was an opposite scenario of that in 2020 when stimulus funds were flooding the market and companies were enjoying the benefits of cheap money.

The rest one and half year was a story of market suffocation, worthless holding of stocks for months as investors of majority scrips were deprived of exit opportunities and a drastic drop in the secondary market buying-selling.

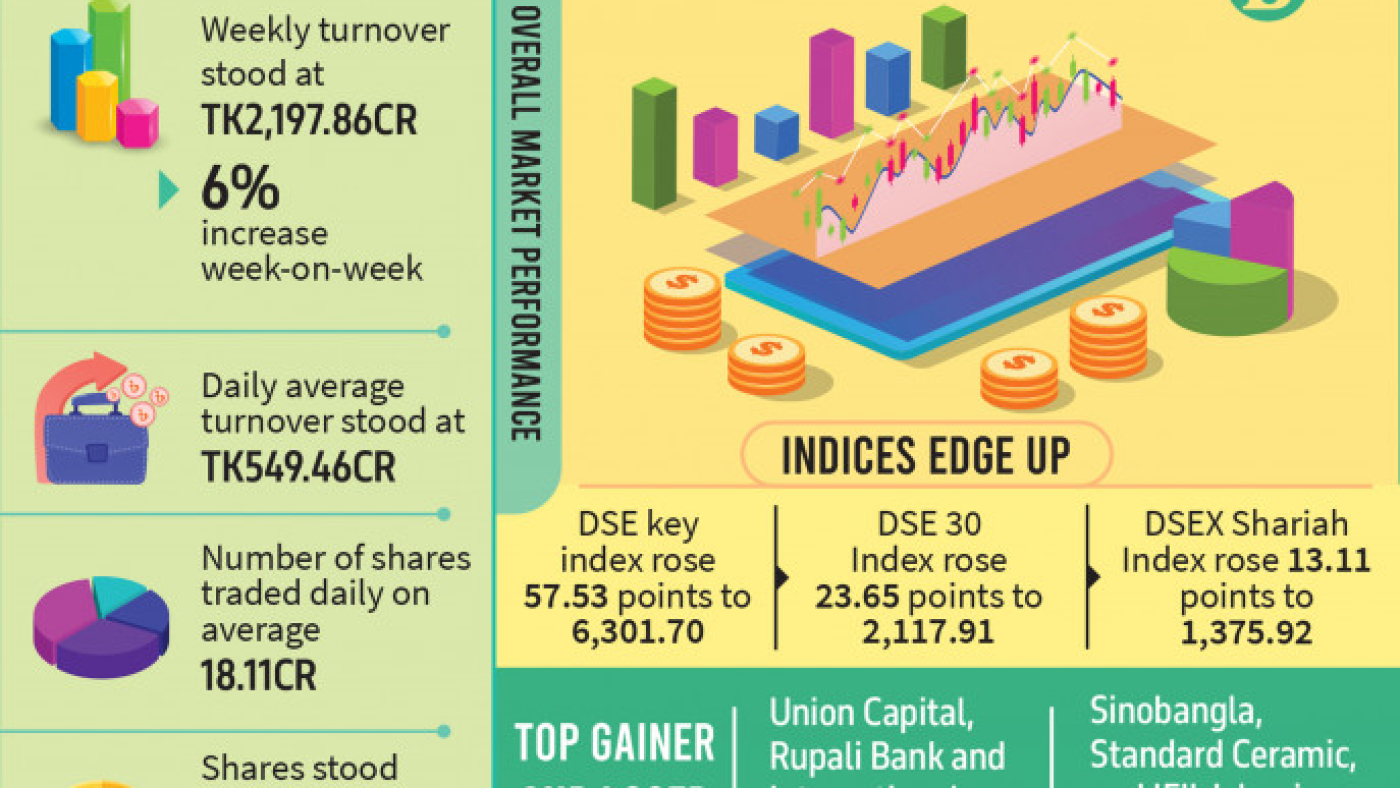

For instance, on Thursday, 235 of the 414 DSE-listed stocks, mutual funds, corporate bonds and debentures had no buyer at the floor price.

Meanwhile in 2023, DSE turnover squeezed by 40% as large cap scrips were mostly out of trading and the major index was almost flat.

The game of navigating around market situations became impossible for investors.

DSE Brokers Association (DBA) of Bangladesh President MD Saiful Islam said the stock market was in a turbulence under the floor as it hurt the basic principle of the liquid markets — letting investors buy and sell at agreed prices.

Around 80% of the brokerage firms were unable to earn enough revenue to meet their operating expenses, while a large number of the firms could not retain even half of their employees ultimately.

Capital market suffered reputation damage

The Bangladesh capital market has had a significant reputation damage among the world’s investors due to the frequent market interferences by the regulator, according to investment professionals.

Echoing them, Richard D Rozario, former president of DBA, said such restrictions should never repeat, if the country wants a vibrant capital market.

DBA Vice President Md Saifuddin, a chartered financial analyst leading a top-tier brokerage firm IDLC Securities, said Bangladesh is going to be a trillion dollar economy by the end of the decade and every year it will need to utilise its $250 billion of national savings in economic development.

Regulator calls for responsible behaviour

“Such restrictions are never good for a market,” acknowledged BSEC Chairman Professor Shibli Rubayat-Ul Islam.

The regulator had to opt for it due to the market structure as market activities are dominated by retail investors and the government wants to protect their interest, he said, adding that the other markets are institutional investors-dominated.

“We hope such regulatory interventions will not repeat in the capital market if investors and market intermediaries behave responsibly,” he added.

Echoing analysts, he said, many stocks were significantly undervalued and investors were avoiding them citing the fear of floor prices. Without a floor, such stocks should attract them.

DSE Director Shakil Rizvi in an interview with TBS said floor was a psychological barrier for the average investors in grabbing the opportunities to buy a number of good stocks at cheaper prices, while prudent investors were doing the opposite for months.

Rizvi, the managing director of DSE broker-dealer firm Shakil Rizvi Stock Ltd, said he was patiently holding undervalued blue-chip stocks and earned a decent dividend yield of around 5% in 2023.

“I am using the cash from dividends to buy more of the good stocks so that I can enjoy more capital gains after market rallies later,” he added.

When smart investors absorb all the shocks from impatient, panicked investors, quality stocks strongly rebound, he cited from the behavioural patterns he observed in his stock market career since 1987.

Meanwhile, leveraged investors who used borrowed money to maximise gains from stocks are in fear of capital erosion and even forced selloff if the market falls free.

“This should not be allowed after so many dramatic market interventions,” said Amir Hossain, a retail investor in the capital who bought several stocks at the floor prices expecting that the regulator would continue the restriction until it became unnecessary.

“I am frustrated seeing the unpredictability of regulations, even the course of the regulatory interventions,” he added.

The Capital Market Stabilization Fund recently announced a Tk100 crore fund to lend to market intermediaries so that they can buy stocks at cheaper prices.