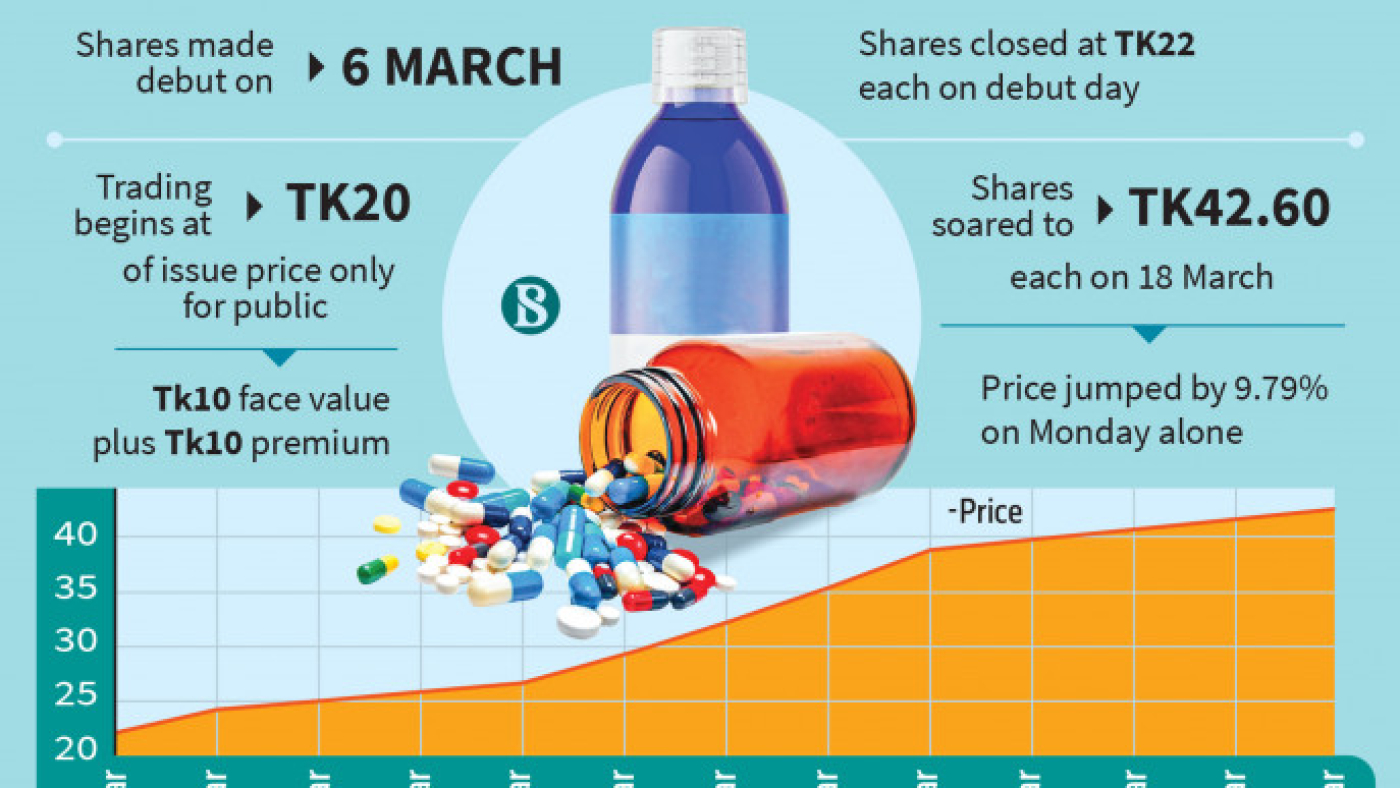

Price jumps to Tk42.6 after starting at Tk20, the issue price, on 6 March

Share price of newly listed Asiatic Laboratories doubled on Monday in only eight days into debuting trades on the two bourses.

On 6 March, the local drug maker started trading shares under N category at the issue price of Tk20 each.

Since then, its share price at the Dhaka Stock Exchange (DSE) have kept soaring to reach Tk42.60 each on Monday, marking 9.79% rise over the previous session.

On the first trading day, the share price rose by 10%, the highest limit of circuit breaker for a single day.

Although issued at Tk20 for the general shareholders, the share price for eligible investors was Tk50, as per conditions set by the regulator.

Asiatic Laboratories got enlisted under pharmaceuticals and chemical category after it raised Tk95crore from the market through an Initial Public Offering (IPO) under book building method.

The funds were raised aimed at beginning anti-cancer drug production.

General investors were allotted 86 shares each in the IPO, while non-resident Bangladeshis (NRBs) got 143 shares against a Tk10,000 deposit.

Earlier, in August 2022, the Bangladesh Securities and Exchange Commission (BSEC) allowed Asiatic to determine cut-off price of its shares.

The cut-off price was fixed at Tk50 each by the eligible investors.

In January 2023, the BSEC had suspended the company’s IPO subscription over allegations of false declaration for land ownership, inaccurate financial reporting and fraudulent reports of share money deposits.

Because of violations of securities laws and proven allegations, the BSEC in October last year slapped a fine of Tk50 lakh on each of its directors and the issue manager.

A month later, the commission withdrew the suspension on Asiatic’s IPO subscription.

According to a stock filing on Tuesday, its profit after tax was Tk26.85 crore at the end of FY22, while basic earnings per share (EPS) stood at Tk3.06.

In FY21, the company’s profit after tax was Tk32.05 crore and basic EPS Tk3.65.

Source: The Business Standard

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.