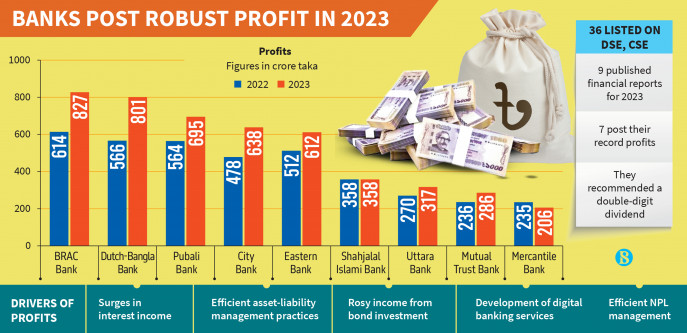

Despite economic challenges amid ongoing inflation and a dollar crisis, seven listed banks achieved record profits in 2023, credited to their effective business policies and strategies.

Out of the 36 banks listed on the stock exchanges, nine have published their financial reports and recommended dividends for 2023.

According to the financial statements, Dutch-Bangla Bank achieved a 42% growth in profit to Tk801 crore in 2023 compared to the previous year, marking the highest profit in its history. It also recommended a 17.50% cash dividend and 17.50% stock dividend for the shareholders.

BRAC Bank’s profits jumped by 35% to Tk827 crore, while Pubali Bank saw a surge of 23% to Tk695 crore in profits.

BRAC Bank declared a 10% cash dividend and 10% stock dividends for the last year, while Pubali Bank recommended a 12.50% cash dividend and 12.50% stock dividends.

City Bank’s profits rose by 33% to Tk638 crore, while Eastern Bank’s profits grew by 20% to Tk612 crore.

City Bank proposed a 15% cash dividend and 10% stock dividends, and Eastern Bank declared a 12.50% cash dividend and 12.50% stock dividends for the last year.

Additionally, Shahjalal Islami Bank experienced a moderate increase to Tk358 crore in profits, and Uttara Bank’s profits rose by 17% to Tk317 crore.

Shahjalal Islami Bank recommended a 14% cash dividend, and Uttara Bank proposed a 17.50% cash dividend and 12.50% stock dividends.

This achievement was attributed to the banks’ ability to control their cost of deposits, expand their performing loan book, and generate substantial revenue from investments in government securities, according to industry insiders.

However, they added that the exchange gain was not as impressive as in 2022.

Eastern Bank in its annual report for 2023 said that Bangladesh is facing unprecedented macroeconomic pressures since 2022 which are reflected in unabated inflation, rapid depletion of foreign exchange reserves and mounting pressure on foreign exchange liquidity.

Consequently, private sector credit growth shrank to 10.13% in December 2023 compared to 12.89% in December 2022. Confidence in the macro economy has been weakened hurting FDI inflows and causing downgrade of the country’s credit ratings.

All these made the already fragile banking sector very weak. Lack of good governance, liquidity crisis and high loan default rate made the banking sector to yield subpar performance putting the overall economy at risk, it added.

Moreover, Mutual Trust Bank posted a 21% growth in profit to Tk286 crore in 2023, although it is not the highest in its history. It proposed a 10% cash dividend to the shareholders.

Only Mercantile Bank failed to achieve growth in profit; rather, its profit dropped by 12% to Tk206 crore in the last year compared to the previous year. Despite profit drop, it declared a 10% cash dividend for the last year.

Selim RF Hussain, managing director of BRAC Bank, told The Business Standard, the bank achieved its highest-ever profit last year, primarily propelled by interest income.

He added that the bank’s loan disbursement and deposit collection experienced growth surpassing the banking sector average, which was made possible through the development of digital banking services.

In the annual report of the Eastern Bank, Ali Reza Iftekhar, managing director at the bank, said when customer confidence in low performing banks dwindled last year mainly due to governance concerns, Eastern Bank continued to grow as a preferred bank for customers for its track record of championing compliance.

In 2023, the bank achieved the milestone of exceeding Tk600 crore profit, reflecting efficient ALM practice, prudent risk management and varied cost rationalisation measures during persistently high inflation, he added.

Asset and liability management, known as ALM, is the practice of managing financial risks that arise due to mismatches between the assets and liabilities as part of an investment strategy in financial accounting.

A senior officer at Dutch-Bangla Bank, told TBS on condition of anonymity that the robust profit achieved by the bank was mainly driven by the growth of high-quality loans and a faster increase in return on loans compared to the cost of deposits during 2023, as opposed to 2022, under the SMART rate mechanism.

Earlier, the Bangladesh Bank’s derivation of a new lending rate formula for commercial banks has helped alleviate their deposit cost pressure. According to the new lending rate policy, the rate will be based on the weighted average rate of a six-month treasury bill plus a 3% premium, which has been effective from 1 July 2023.

Default loan

The country’s banking sector experienced a steep rise in default loans by Tk25,000 crore in 2023 amid election-centric political uncertainties and a severe dollar shortage that slowed down business activities, rendering many borrowers unable to continue debt servicing.

At the end of December last year, the total default loan in the banking sector stood at Tk1.45 lakh crore, accounting for 9% of the total loans, which amounted to Tk16.17 lakh crore, according to Bangladesh Bank data.

The Bangladesh Bank recently unveiled its roadmap aimed at reducing default loans to 8% by June 2026 to comply with a condition imposed by the International Monetary Fund (IMF) as part of a $4.7 billion loan package.