The bourse indices continued their upward trend for the third consecutive session as cautious investors demonstrated a willingness to buy following a significant correction.

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), witnessed a notable surge on Monday (8 April). Analysts in the sector attribute this rise to the expected reappointment of Shibli Rubayat Ul Islam as the Bangladesh Securities and Exchange Commission (BSEC) chairman for another four years.

The bourse indices continued their upward trend for the third consecutive session as cautious investors demonstrated a willingness to buy following a significant correction.

According to market insiders, the BSEC chairman’s reappointment news has a positive effect on investors. One of the reasons for the decline in the indices over the past few weeks was the appointment issue. The market may extend the upward momentum if a circular is issued soon.

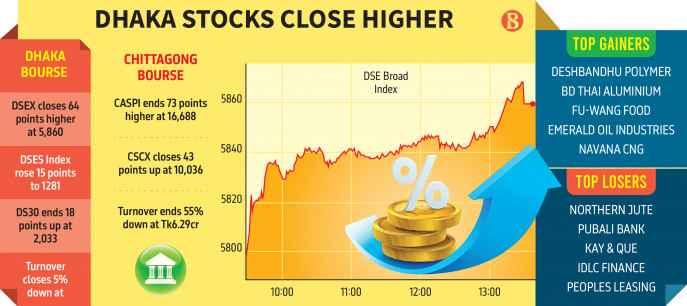

During Monday’s session, the DSEX rose 64 points to reach 5,860, while the blue-chip index DS30 saw a gain of 18 points, settling at 2,033 and the DSES Index increased by 15 points to 1281.

Among the stocks traded, 316 advanced, 36 declined, and 40 remained unchanged.

However, turnover slightly decreased to Tk415 crore, compared to Tk436 crore in the previous session.

Deshbandhu Polymer, Bd Thai Aluminium, captured the DSE top gainer list followed by Fu Wang Food, Emerald Oil Industries, Navana CNG, Olympic Accessories, Anlimayarn Dyeing and Aftab Automobiles Ltd.

On the other hand, Northern Jute, and Pubali Bank captured the DSE top loser list followed by Kay & Que, IDLC Finance, and Peoples Leasing.

At the DSE, the top three most traded stocks were Alif Industries, Taufika Foods, and Malek Spinning Mills Ltd.

EBL Securities wrote in its daily market commentary that the capital bourse of the country extended its upbeat vibe as bargain hunters continued to take positions in lucrative issues in anticipation of a potential turnaround from the prolonged bearish sentiment across the trading floor.

The indices remained upbeat throughout the session as buyers remained predominant across the trading floor.

However, trading activities remained stagnant, with market turnover further declining by 4.9% to Tk4.2 billion as against Tk4.4 billion in the previous session, as cautious investors prefer to stay on the sidelines to observe the sustainability of the current upbeat vibe in the market, the brokerage house said in its commentary.

On the sectoral front, Bank 18.7% issues exerted the highest turnover, followed by Textile 15.4% and Pharma 14.2% sectors.

All the sectors displayed positive returns, out of which Services 2.9%, General Insurance 2.4% and Ceramic 2.4% exhibited the most positive returns on the bourse today.

The port city bourse, Chattogram Stock Exchange (CSE), also settled on green terrain. The selected indices (CSCX) and All Share Price Index (CASPI) advanced by 42.6 and 73.4 points, respectively.

Source: The Business Standard