Highlights

- Now the 169 scrips’ prices can fall up to 10% a day until hitting the floor price

- Of the 168 scrips, one mutual fund was delisted in the meantime

- Asia Insurance and Far Chemical were added

- New floor will be equal to the average of closing prices from 26 Feb to 1 Mar

- But if the previous floor is lower for any of the 169 scrips, that one will be considered as floor

In an effort to end an ineffective downside restriction, the Bangladesh Securities and Exchange Commission (BSEC) reinstated the floor price for 169 small-cap scrips on Wednesday.

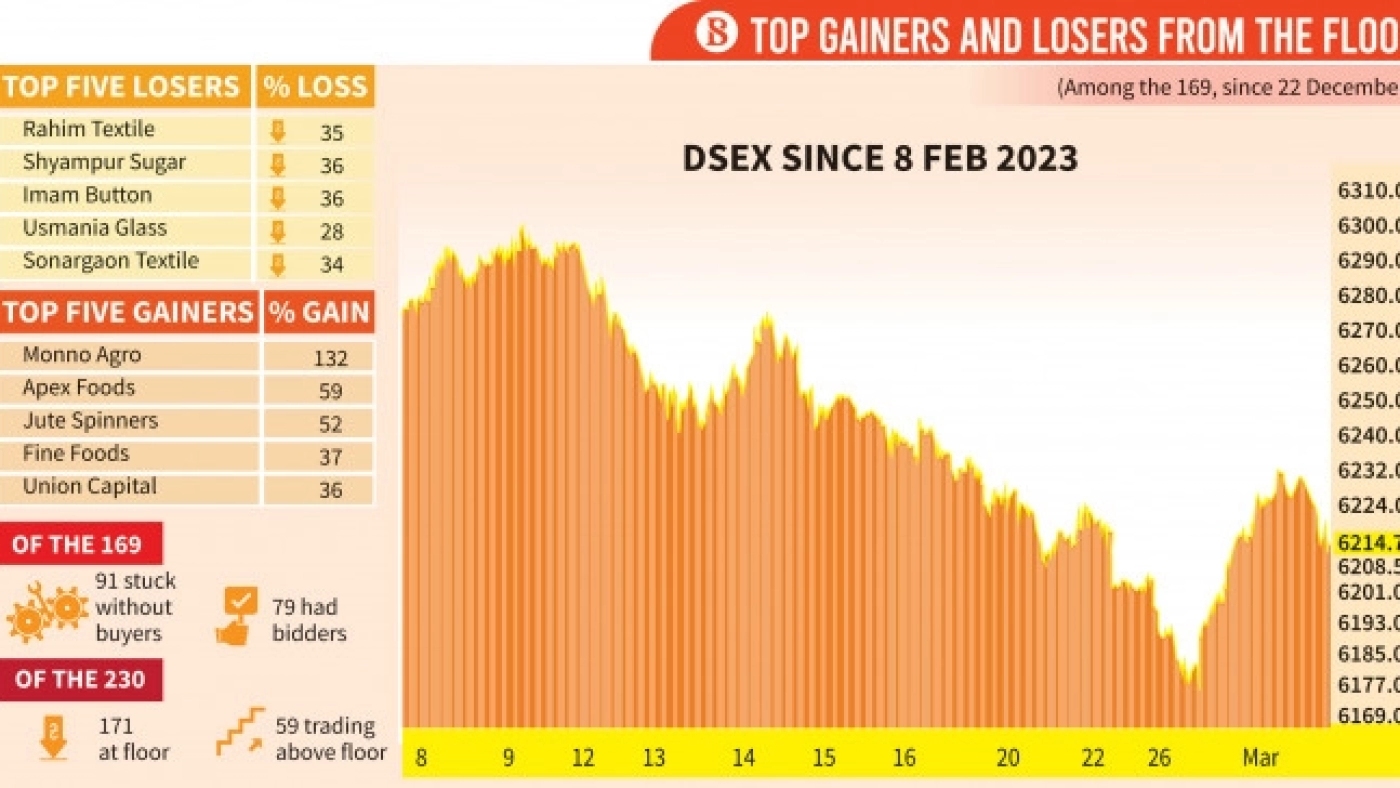

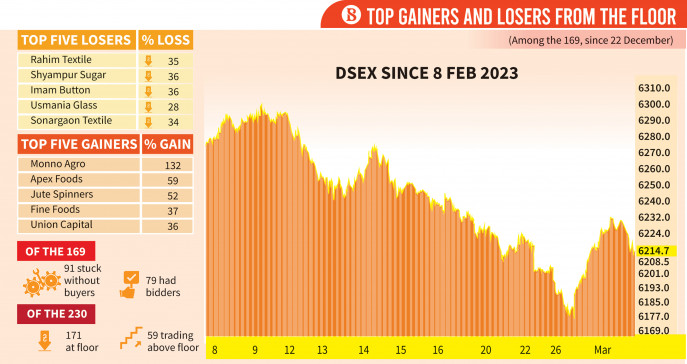

On 21 December 2022, the market regulator removed the floor for 168 stocks and restricted their daily fall limit to 1%.

As a result of the repeal of that order, the prices of those scrips can fall up to the regular lower circuit breaker limit – 10% a day – until hitting the floor price.

Of the 168 scrips, one mutual fund was delisted in the meantime, and the regulator added Asia Insurance and Far Chemical, making it a list of 169 scrips in total.

Now, the average of the closing prices of those 169 scrips for four trading sessions – 26 February to 1 March – would be their new floor prices, according to the BSEC’s 1 March order.

But if the previous floor price, that was announced on 28 July last year, is lower than the new floor, then the lower one would be effective, according to the order.

The 169 scrips represent roughly 5% of the market capitalisation of all the listed scrips in the Dhaka Stock Exchange (DSE).

Stockbrokers and investors said the commission’s 21 December move to withdraw the floor from 168 scrips was a blow to a large number of investors, as 100 of those scrips lost their market value as of 1 March, including the 39 that fell by 20%-35%.

The worst part of the fall was investors were unable to exit from the falling knives as there had been no buyers due to the narrow bottom circuit, investors said.

However, 27 of the scrips were above the 28 July floor on 1 March, and the remaining were flat as the minimum tick price gap was higher than 1% of the scrips’ market prices.

The smallest gap between two prices of a share or mutual fund is Tk0.1 in the DSE and CSE.

The floor prices and the narrowed down lower circuit drastically affected the liquidity in the bourses, as investors were deprived of exit opportunities regardless of whether they needed money to withdraw from investment accounts, or to buy any other security.

When buyers wait for a scrip’s price to fall, they refrain from bidding for it. And at an extreme point of pessimism, the number of DSE scrips having bidders dropped drastically to 62, and 337 of the 399 DSE shares, mutual funds and corporate bonds had no buyer.

However, as the regulator on Sunday and Monday busted market rumours that it might withdraw the floor price from another set of scrips, the market started to recover and 138 scrips had bidders during the closing bell on Wednesday.

79 of the 169 scrips came back in active trading, up from only 15 on Sunday, while of the 232 scrips with intact floor, 173 were stuck there and 59 were trading above floor on the day.

How the market performed on Wednesday

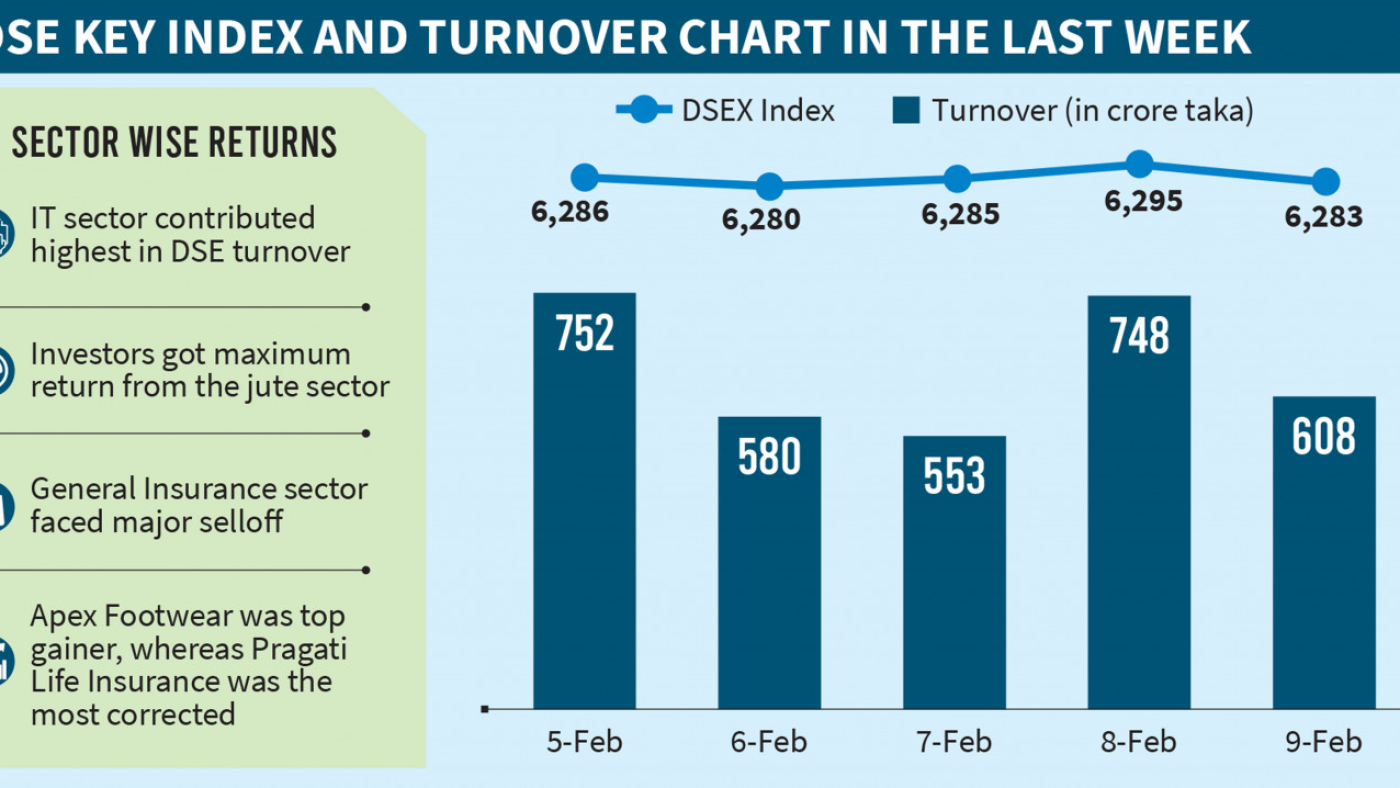

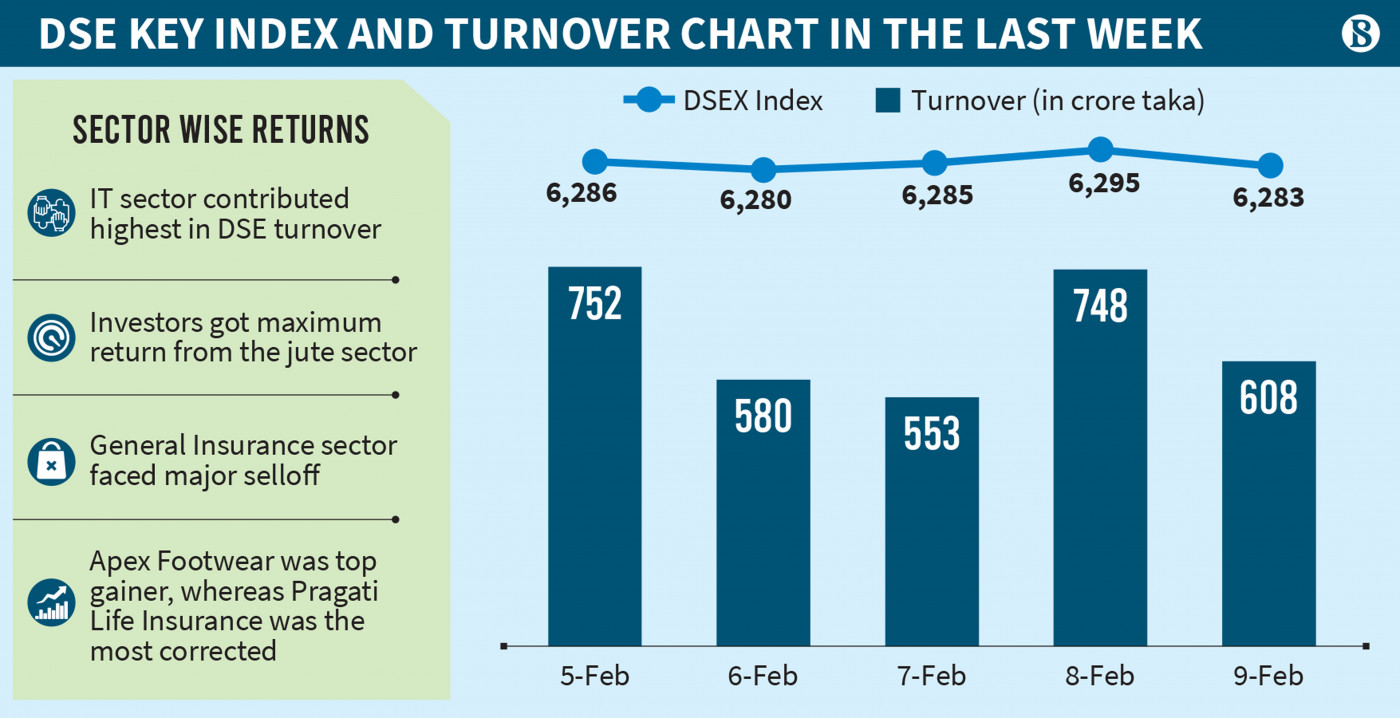

Meanwhile, the daily transaction increased to over Tk450 crore, which fell below Tk300 crore a day during the decline last week.

DSEX, the broad-based index of the Dhaka Stock Exchange (DSE), from its recent bottom of 6,175 on Monday morning, hit 6,234 in the middle of Wednesday session. But adamant sellers dragged the index down to even lower than the previous close.

“The market saw mixed reactions as the session began with an upbeat momentum, but the morning optimism faded as risk-averse investors booked profits, enticed by the recent price appreciation of selective issues,” said EBL Securities in its daily market commentary.

DSEX finally closed at 6,214 which was 0.04% lower, and out of the total DSE scrips, 68 advanced and 80 declined.

“However, opportunist investors continued to take positions in beaten down issues with anticipation of quick gains since they expect positive momentum in the market, as the floor price is likely to be intact for the foreseeable future,” added the brokerage firm in its commentary.

On the sectoral front, IT contributed the maximum 16.2% of the DSE turnover, followed by life insurance and food.

As the late hour selloff wiped out the early hour intraday gains, most of the sector displayed mixed returns at the end.

General insurance registered the highest gain of 1.5%, followed by life insurance and tannery.

Paper with 2.4% correction led the losers, followed by travel and jute sectors.

Source: TBS News