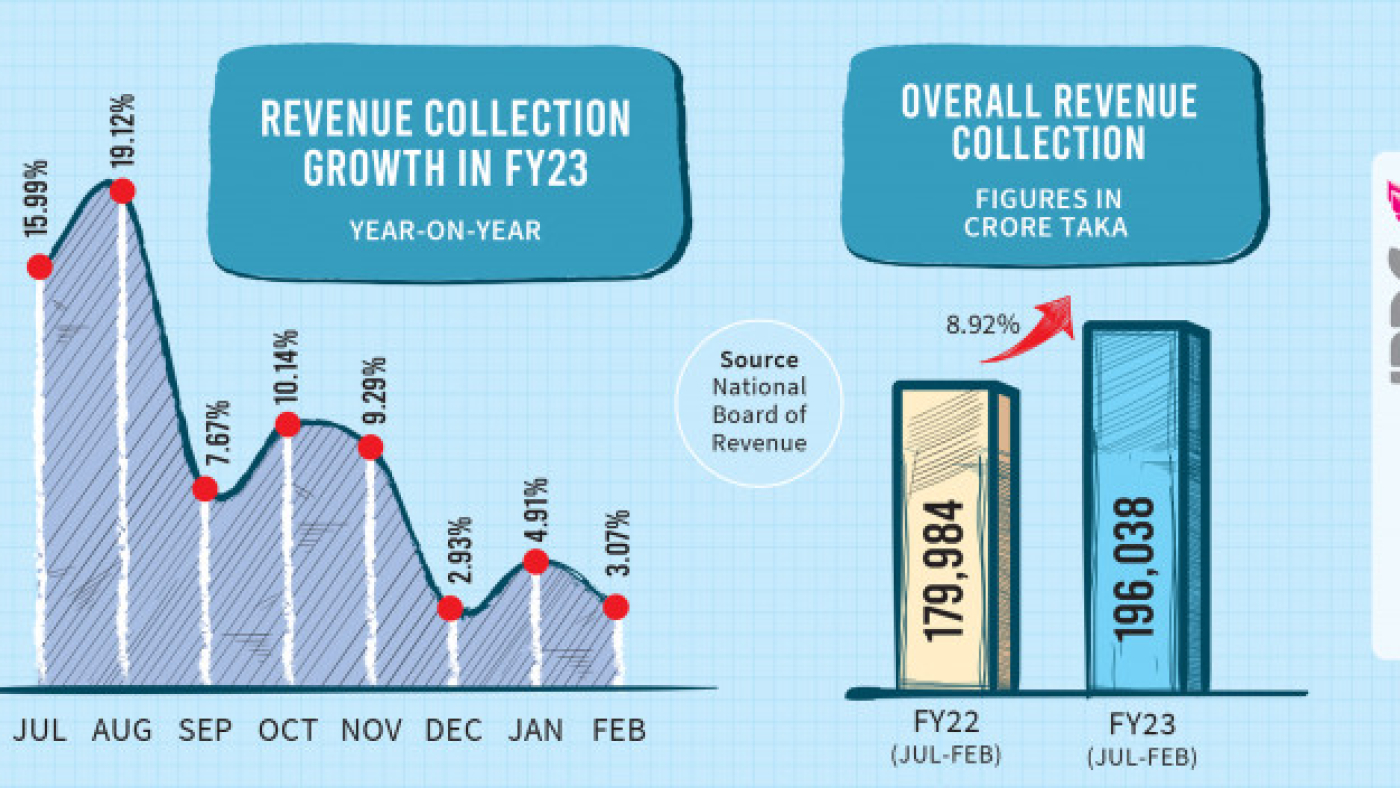

Revenue growth has nosedived and fallen far behind the target in the eight months of the current fiscal year up to February, raising concerns over financing the deficit and development projects with prospects of more domestic resource mobilisation in the rest of the year remaining bleak.

The downward trend in revenue collection that began in November last year continues with collection growth falling as low as 3.07% this February, sliding by more than a percentage point from 4.91% in January.

According to the National Board of Revenue (NBR) sources, Tk23,727 crore in revenue – income tax, value-added tax (VAT) and customs tax – was collected in February this year, which was Tk23,020 crore in February of FY22.

This persistent declining tendency raised questions among economists about the various initiatives taken by the government to reduce imports, as well as the capacity of the NBR as the central revenue-collecting authority.

At a pre-budget meeting on Sunday, leading economists suggested reforms to the taxation system to increase the country’s tax-to-GDP ratio, which is the lowest in South Asia.

M Saiduzzaman, former finance minister, stressed that increasing the tax-GDP ratio should be given the highest priority in the next budget to solve major problems of the economy.

Revenue collection in eight months till February of the current fiscal year runs short of target by about Tk23,000 crore.

The revenue deficit would mean more government borrowing from the stressed banking system to bankroll the annual development programme (ADP) outlay and more spending in interest payment, economists have warned.

The government has already cut the ADP allocation by 7.5% to Tk227,566 crore, slashing the foreign aid component. But local component remained the same as Tk153,066 crore, meaning that the revenue authority will be under pressure to gear up its efforts to collect more tax revenue to meet the resource gap and comply with the IMF’s condition to raise tax-GDP ratio.

Otherwise, higher bank loans will be the only option for the government as foreign aid flow has dwindled due to limited implementation capacity.

Net borrowing of the government from the banking system stood at Tk41,392 crore in eight months till February, against the target set at over Tk1 lakh crore for the whole fiscal year.

The possibility of changes in the government’s current approach to control imports in the coming months is low. Hence, there is no scope for the revenue collection to increase in the remaining months of this fiscal year, rather this growth may decrease a bit more, economists said.

Dr Muhammad Abdur Mazid, the former chairman of NBR, believes that the country’s macroeconomic stability may be threatened and development activities may decrease as the shortfall in revenue collection in the eight months (July-February) of FY23 is about Tk23,000 crore of the target.

He told The Business Standard (TBS), “Due to low revenue collection, bank loans will increase and the International Monetary Fund’s (IMF) conditions [for the $4.7 billion credit] will also not be met, which may make it difficult to get the next instalment of the loan from the agency.”

However, a review of the revenue collection figures from July to February of FY 23 shows that the growth in NBR’s revenue collection during the period is close to 9%, which was almost double in the same period of last fiscal year. Revenue earnings had a negative growth of 2% in the 2019-20 fiscal year that met pandemic-induced lockdowns, but recovered in the next two fiscal years posting an average 16% annual growth.

“The written-unwritten restrictions on imports were imposed mainly due to the dollar crisis, resulting in a significantly lower collection of import duties. If the situation continues, the current revenue growth may decrease further in the future,” Muntaseer Kamal, a research fellow of the Center for Policy Dialogue (CPD), told TBS, adding that this situation can be called the slowdown of the economy.

Bangladesh’s revenue contribution to GDP (tax to GDP ratio) is very low if compared globally. There are several conditions attached to the $4.7 billion loan from the IMF and one of which is to increase the tax-to-GDP ratio by 0.5% in the next 2023-24 fiscal year.

“But it will be difficult to meet the conditions like reducing tax expenditure and increasing the tax-to-GDP ratio,” Muntaseer Kamal added.

The government has taken several steps to discourage imports since April last year as the strong US dollar raised global commodity prices when the Russia-Ukraine war broke out. These import restrictions were not eased yet but rather increased in some cases. As a result, imports are continuously decreasing.

According to the latest Bangladesh Bank data, imports fell by 5.7% from July to January of FY 23, which affected the revenue collection. In January, there was a negative growth in import duty collection.

NBR sources said, among the three sectors of revenue collection, the growth in import duty was the lowest at a little over 4% in the first eight months of the current fiscal year. The growth in VAT and income tax collection has been 15% and 6.29%, respectively.

Former NBR chairman Dr Muhammad Abdul Mazid said he believes that the main reason for this growth in VAT collection is the high price of imported goods.

NBR takes initiatives to boost revenue collection

NBR Chairman Abu Hena Md Rahmatul Muneem held a meeting with field-level senior officials on Sunday to find ways to increase revenue collection.

In the meeting, field-level officials explained some of the reasons behind the slow growth in revenue collection.

On condition of anonymity, a senior NBR official, who was present at the meeting, told TBS, “It has been challenging to increase revenue collection due to low imports. However, directives have been given to realise large sums owed to the Bangladesh Petroleum Corporation (BPC), Petrobangla and other organisations.

“We were also instructed to dispose of cases quickly to increase revenue collection,” he added.

পুঁজিবাজারের অব্যাহত মন্দা উত্তরণে নানা রকম উদ্যোগ নিচ্ছে নিয়ন্ত্রক সংস্থা বাংলাদেশ সিকিউরিটিজ অ্যান্ড এক্সচেঞ্জ কমিশন (বিএসইসি)। এরই অংশ হিসেবে সংস্থাটি শেয়ারবাজারে মধ্যস্থকারী প্রতিষ্ঠানগুলোর প্রভিশনের মেয়াদ দুই বছর বাড়ানোর সিদ্ধান্ত নিয়েছে। কয়েকটি প্রতিষ্ঠানের আবেদনের প্রেক্ষিতে এবার মেয়াদ বাড়িয়ে ২০২৫ সালের ডিসেম্বর পর্যন্ত করা হয়েছে।

পুঁজিবাজারের অব্যাহত মন্দা উত্তরণে নানা রকম উদ্যোগ নিচ্ছে নিয়ন্ত্রক সংস্থা বাংলাদেশ সিকিউরিটিজ অ্যান্ড এক্সচেঞ্জ কমিশন (বিএসইসি)। এরই অংশ হিসেবে সংস্থাটি শেয়ারবাজারে মধ্যস্থকারী প্রতিষ্ঠানগুলোর প্রভিশনের মেয়াদ দুই বছর বাড়ানোর সিদ্ধান্ত নিয়েছে। কয়েকটি প্রতিষ্ঠানের আবেদনের প্রেক্ষিতে এবার মেয়াদ বাড়িয়ে ২০২৫ সালের ডিসেম্বর পর্যন্ত করা হয়েছে।