Sector insiders blame the central bank’s liberal policy that empowers bank owners to waive loan interests on nominal down payments

Default loan rescheduling and loan interest waivers have increased at an unusual rate in the banking sector, according to the latest Bangladesh Bank data.

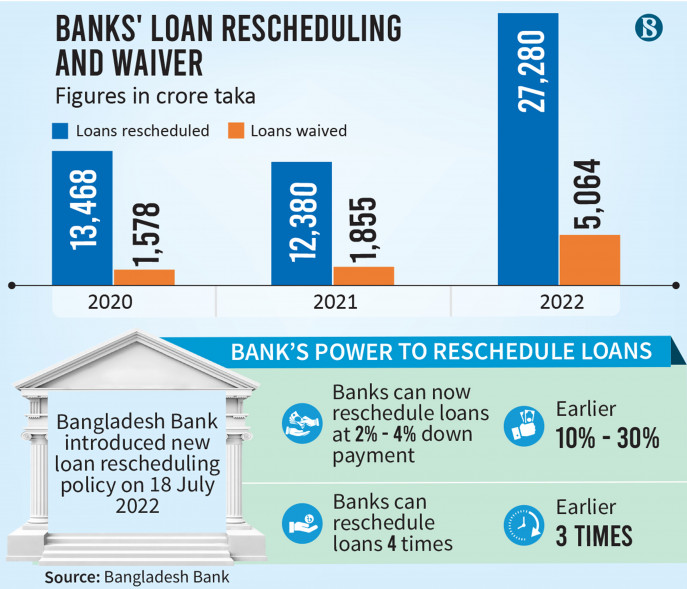

Lenders waived off some Tk5,064 crore while rescheduling loans throughout 2022. It is Tk3,209 crore higher than that of the previous year.

For such a situation, sector insiders blamed the liberal policy of the central bank which empowered bank owners to waive loan interests on nominal down payments.

Besides, the desperate attitude of banks to recover outstanding loans which got stuck thanks to pandemic-induced relaxed policies also contributed to the surge in waived-off interests.

“All the benefits of loan rescheduling and waiver are received by some large borrowers, who are mostly wilful defaulters,” Salehuddin Ahmed, former central bank governor, told The Business Standard.

“Currently the banking sector is very unfortunate. The central bank is not taking proper actions, banks are tactfully making their balance sheet look good. No one is giving due importance to protecting the interests of the depositors.”

“The central bank should play a stronger role to curb such irregularities in the banking sector. For example, strict measures should be taken if any customer defaults. At the same time, new loans should be scrutinised properly,” he added.

According to the Bangladesh Bank, banks waived off Tk1,194 crore in loan interest in 2018 as the figure jumped to Tk2,293 crore next year. It dropped slightly to Tk1,578 crore in 2020 and spiralled again to Tk1,855 crore in 2021.

Besides, banks rescheduled loans of Tk27,279 crore in 2022, almost two times more than Tk12,380 crore in 2021. It was Tk13,468 crores in 2020.

Thanks to the latest interest waivers, the amount of defaulted loans of banks fell to Tk1.20 lakh crore at the end of December 2022 from Tk1.32 lakh crore in January of that year, Bangladesh Bank data said.

“It would have been good if banks had waived interest on bad loans [to small borrowers]. The benefit of the interest waiver is gone to large groups, unfortunately,” a central bank official, wishing to remain unnamed, told The Business Standard.

Last year, a Chattogram-based group got large amounts of interest waiver from National Bank and a state-owned bank, he added.

Regarding defaulted loans, former governor Salehuddin Ahmed said, “This is not the actual amount of defaulted loans in the banking sector. The figure has been hidden in various ways.”

“International rating agencies are marking our banking sector negatively, which is bad for the overall economy. Our imports will suffer and interest rates on foreign loans will increase, as a consequence. Mass people will be the ultimate sufferer,” he added.

“Now, many banks are in a liquidity crisis. At the same time, their defaulted loans are increasing. Such banks are set to see more difficulties soon,” a private bank managing director, asked not to be named, told TBS.

“Banks have been stuck with defaulted loans of customers for a long time. Hence, they are trying to recover their money even though they need to waive some amounts, which is why interest waivers have been on the rise,” he added.

The Bangladesh Bank, in a circular in July last year, empowered boards of banks for rescheduling new loans on 2.5-4.5% deposits. Prior to that, the central bank’s approval was required to regularise the loans and 10-30% deposits were mandatory. Besides, the time limit for repayments was extended up to eight years, from the previous two years.

Source: The Business Standard