বাংলাদেশ বিজনেস সামিটের ওই অধিবেশনে প্রধান অতিথি হিসেবে বক্তব্য দেন কেন্দ্রীয় ব্যাংক গভর্নর। ‘দীর্ঘমেয়াদি অর্থায়ন’ শীর্ষক এই অধিবেশন সঞ্চালনা করেন বাংলাদেশ ব্যাংকের সাবেক গভর্নর আতিউর রহমান।

বঙ্গবন্ধু আন্তর্জাতিক সম্মেলন কেন্দ্রে অনুষ্ঠিত এই সম্মেলনের আয়োজন করছে দেশের ব্যবসায়ীদের শীর্ষ সংগঠন ফেডারেশন অব বাংলাদেশ চেম্বার অব কমার্স অ্যান্ড ইন্ডাস্ট্রি (এফবিসিসিআই)। এ আয়োজনে সহযোগিতা করছে বাণিজ্য মন্ত্রণালয়, পররাষ্ট্র মন্ত্রণালয় ও বাংলাদেশ বিনিয়োগ উন্নয়ন কর্তৃপক্ষ (বিডা)।

বাংলাদেশ ব্যাংকের গভর্নর আর্থিক খাতে যে সংস্কারের কথা উল্লেখ করেছেন, সরকার এরই মধ্যে আন্তর্জাতিক মুদ্রা তহবিলের সঙ্গে একটি ঋণ চুক্তি স্বাক্ষর করে সেগুলো বাস্তবায়ন করতে অঙ্গীকার করেছে।

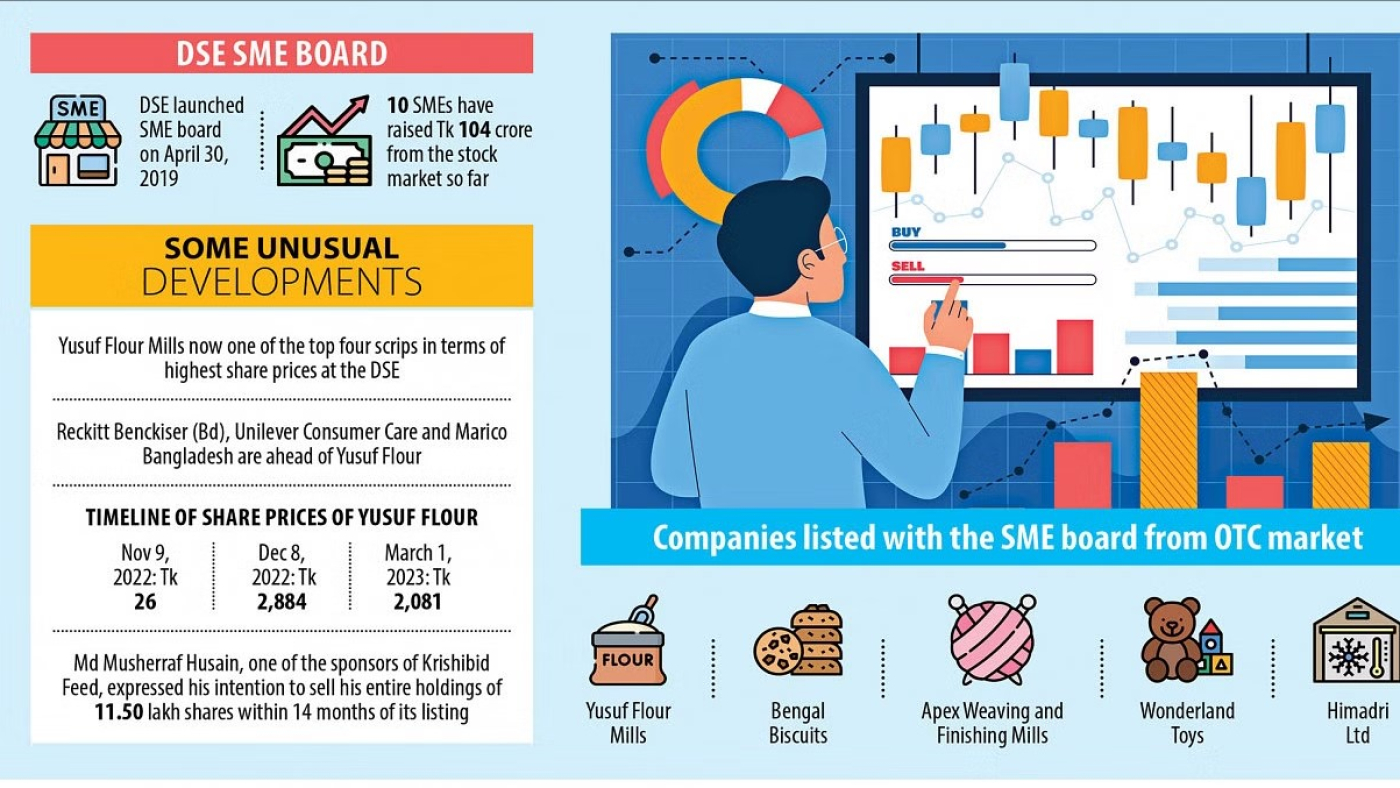

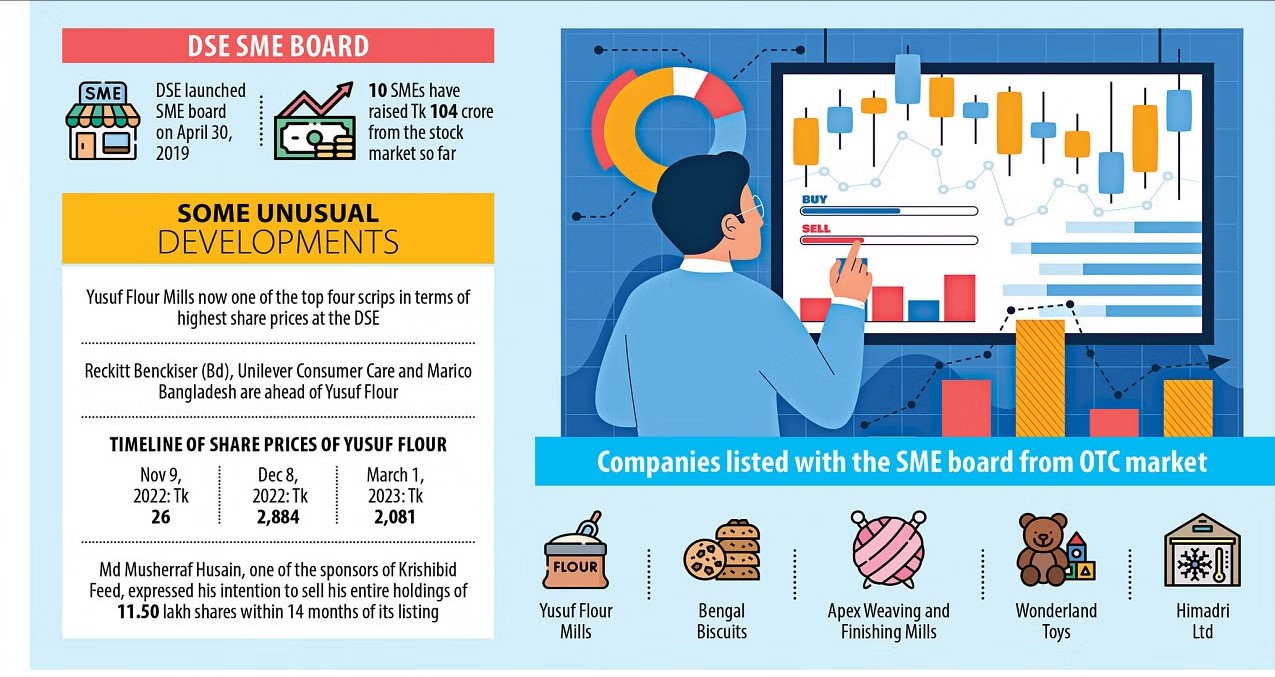

অনুষ্ঠানে আব্দুর রউফ তালুকদার আরও বলেন, মূলধন জোগান দিতে সিকিউরিটিজ এক্সচেঞ্জ কমিশনকে এগিয়ে আসতে হবে। প্রয়োজনে নিয়মকানুনগুলো আরও পর্যালোচনা করতে হবে। শেয়ারবাজার উন্নয়নে বাংলাদেশ ব্যাংক সব ধরনের নীতি সহায়তা দেবে। বাংলাদেশ ব্যাংকও দীর্ঘমেয়াদি অর্থায়নে এসএমই, কৃষি, পরিবেশবান্ধব খাতের জন্য তহবিল জোগান দিচ্ছে।

অধিবেশনে মূল প্রবন্ধে শান্তা অ্যাসেট ম্যানেজমেন্টের ভাইস চেয়ারম্যান আরিফ খান বৈশ্বিক বিভিন্ন সংস্থার পূর্বাভাস উল্লেখ করে বলেন, বাংলাদেশ ধারাবাহিকভাবে ভালো প্রবৃদ্ধি অর্জন করছে। তবে সাম্প্রতিক সময়ে বেশ কিছু চ্যালেঞ্জ এসেছে। এগুলো হলো লেনদেন ভারসাম্যে ঋণাত্মক অবস্থা, তিন মাসের আমদানি খরচের চেয়ে রিজার্ভ কমে যাওয়ার শঙ্কা, টাকার মান আরও দুর্বল হওয়া ও বাজারে পণ্যের দাম বেড়ে যাওয়া। এ জন্য সরকারের পক্ষ থেকে বেশ কিছু ব্যবস্থা নেওয়া হয়েছে।

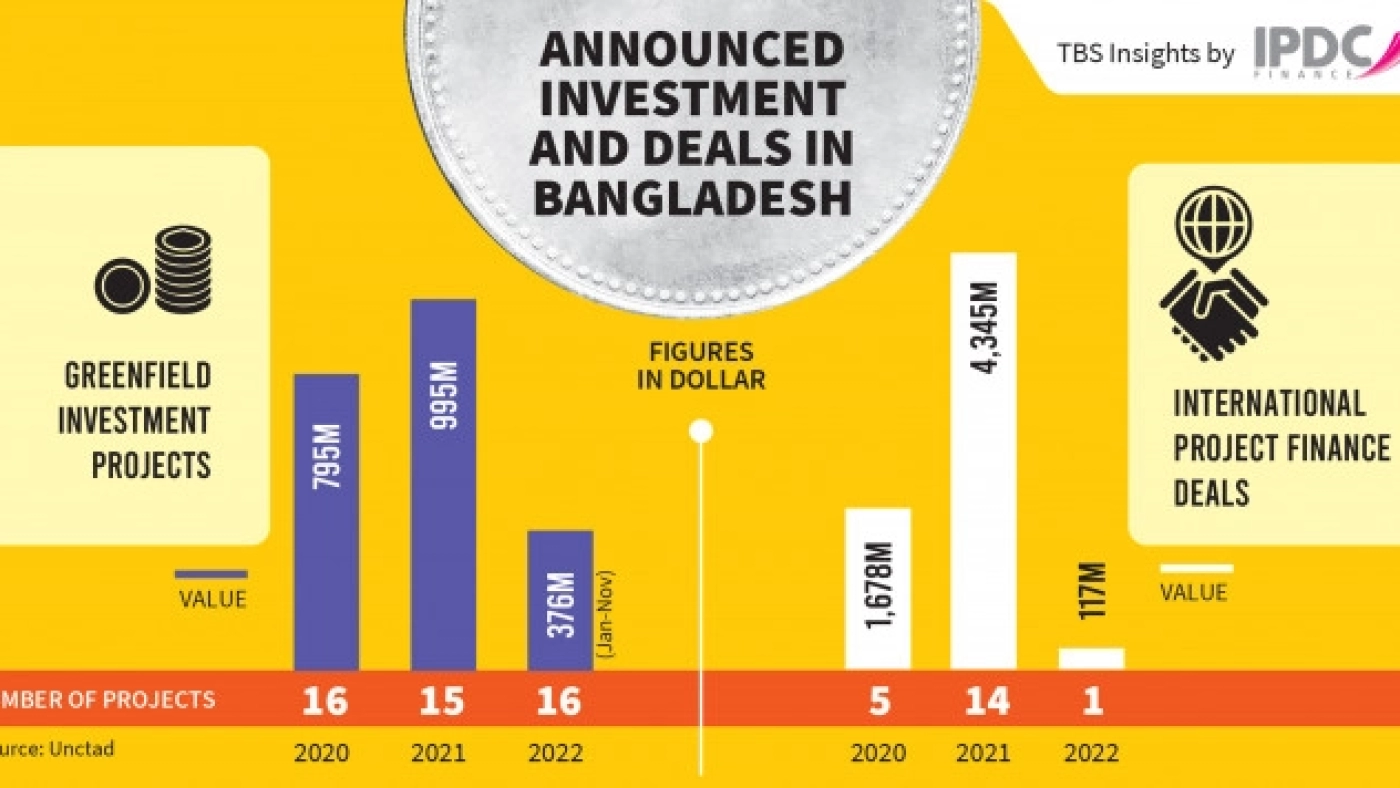

আরিফ খান বলেন, ২০৪০ সাল পর্যন্ত আমাদের যে বিনিয়োগের প্রয়োজন হবে, তাতে ১০ বিলিয়ন ডলারের ঘাটতি থাকবে। বাংলাদেশে বিনিয়োগের ৯৯ শতাংশই ব্যাংক থেকে হয়েছে। স্বল্প মেয়াদি আমানত নিয়ে দীর্ঘমেয়াদি ঋণ দিয়েছে ব্যাংক। এতে ব্যাংকগুলোর দায় ও সম্পদের মধ্যে অসামঞ্জস্য তৈরি হয়েছে। সম্পদের মান খারাপ হয়ে পড়েছে। উচ্চ খেলাপি ঋণের কারণে বিকল্প মাধ্যম দেখতে হবে। এ ক্ষেত্রে মূলধন জোগানে বড় মাধ্যম হতে পারে শেয়ারবাজার।

চট্টগ্রাম স্টক এক্সচেঞ্জের চেয়ারম্যান আসিফ ইব্রাহীম বলেন, ইতিমধ্যে শেয়ারবাজারে বেশ কিছু সংস্কার হয়েছে, যা বাজার সম্প্রসারণ ও উন্নয়নে ভূমিকা রাখছে। সরকারি বন্ড বাজারে তালিকাভুক্ত হয়েছে। এখন প্রয়োজন শেয়ারবাজারের জন্য কর কাঠামো সংস্কার করা।

ব্রুমার অ্যান্ড পার্টনার্স বাংলাদেশের প্রতিষ্ঠাতা ব্যবস্থাপনা পরিচালক খালিদ কাদীর বলেন, বাংলাদেশে অনেক পণ্য উৎপাদন হয়, সস্তা শ্রমিকও রয়েছে। তাই বাংলাদেশ এখনো বিনিয়োগের কেন্দ্র।

এইচএসবিসি বাংলাদেশের প্রধান নির্বাহী কর্মকর্তা মো. মাহবুব উর রহমান বলেন, দেশে–বিদেশি বিনিয়োগ করলে তার ফিরে যাওয়া সহজ করতে হবে। এর সঙ্গে সুদ হার, বৈদেশিক মুদ্রার বিনিময় হারসহ নানা ঝুঁকি রয়েছে।

ইস্টার্ন ব্যাংকের ব্যবস্থাপনা পরিচালক আলী রেজা ইফতেখার বলেন, খেলাপি ঋণ হলো ক্যানসারের মতো। এটা স্বল্প সময়ে না কমলে মৃত্যু নিশ্চিত। খেলাপি ঋণের কারণে সবাই টাকা হারাচ্ছে। দেশের ব্যাংকগুলোর পরিচালনা পর্ষদ ও ব্যাংকগুলোতে সুশাসনের অভাব রয়েছে। পর্ষদ ও ব্যবস্থাপনার কার কী দায়িত্ব, তা নির্ধারিত হলেও অনেকে মানছে না। এ জন্য নির্দেশিত ঋণ হচ্ছে, যা পরবর্তী সময়ে খেলাপি হয়ে পড়ছে।

বাংলাদেশ সিকিউরিটিজ অ্যান্ড এক্সচেঞ্জ কমিশনের কমিশনার শেখ শামসুদ্দিন আহমেদ বলেন, ‘শেয়ারবাজারকে আরও গতিশীল করতে আমরা অনলাইনের মাধ্যমে আবেদন নিয়ে তা নিষ্পত্তির চেষ্টা করছি। মূল্যস্ফীতি, বিনিময় হার ও বৈদেশিক মুদ্রার রিজার্ভ নিয়ে একটা চ্যালেঞ্জ তৈরি হয়েছে। এর অনেকগুলোর আমদানি করা সমস্যা। আমরা চেষ্টা করছি এ থেকে বের হয়ে আসার।’

এই সেশনে আরও বক্তব্য দেন সৌদি এক্সিম ব্যাংকের পরিচালক ইয়াহিয়া আল হার্থী, বহুজাতিক নিউ ডেভেলপমেন্ট ব্যাংকের মহাপরিচালক ডিকে পান্ডায়েন প্রমুখ।

সূত্রঃ প্রথম আলো