Armada Spinning Mills, Kingsway Endeavors, and Uniglobe Business Resources withdrew directorship from the bank’s board

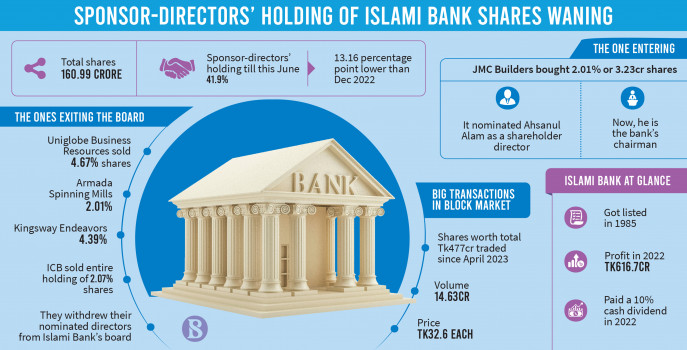

Three corporate shareholders – Armada Spinning Mills, Kingsway Endeavors, and Uniglobe Business Resources – withdrew their directorship from the Islami Bank board in June after selling off their entire holding in the country’s largest private sector lender.

It comes a month after the Investment Corporation of Bangladesh (ICB) sold its entire shareholding in the bank in May and withdrew its nominated director.

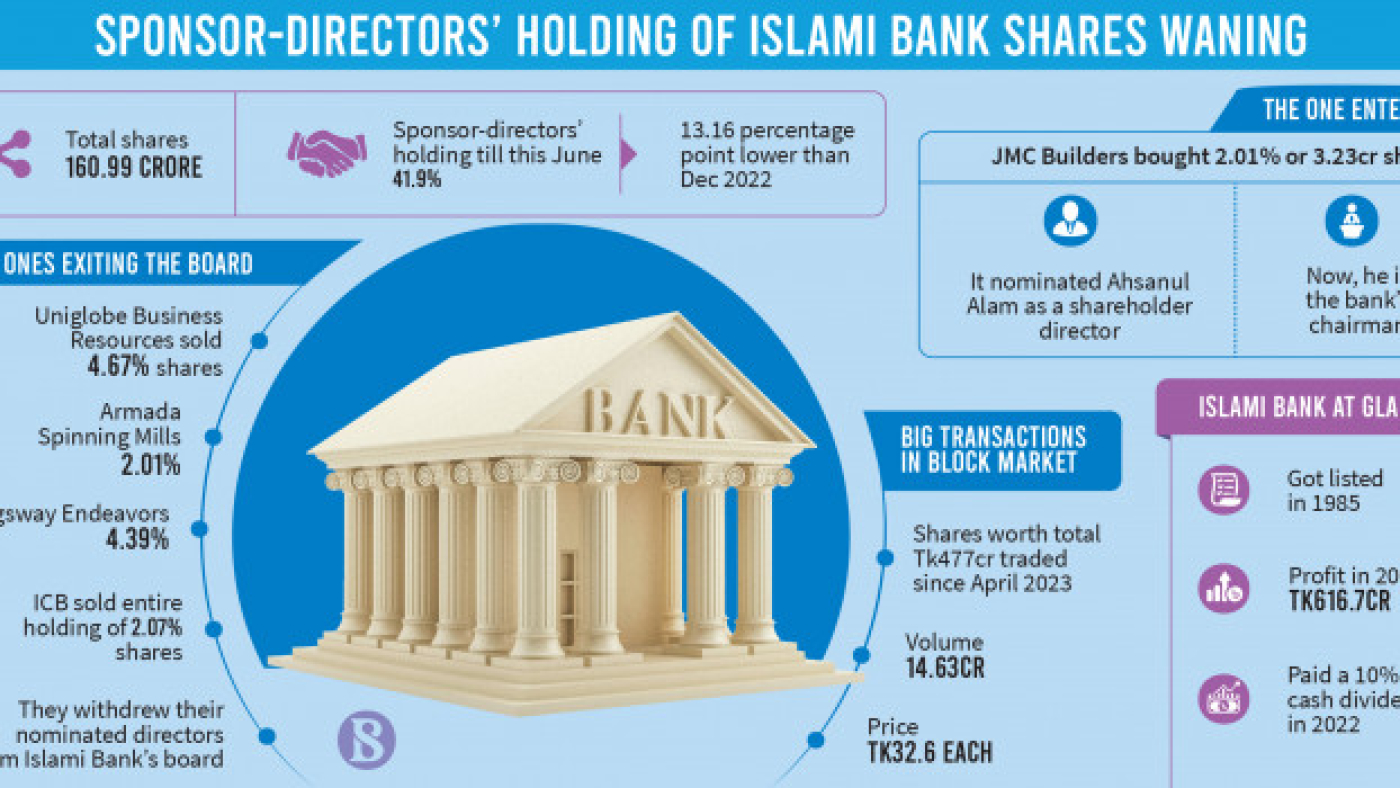

As a result, the Islami Bank’s shareholding by sponsors-directors came down to 41.90% at the end of June from 55.06% in December last year, according to a report on the monthly shareholding position for June submitted to the chief regulatory officer of the Dhaka Stock Exchange (DSE) on 5 July.

And in June, JMC Builders bought 2.01%, or 3.23 crore, of the bank’s shares. Ahsanul Alam, son of S Alam Group Chairman Saiful Alam Masood, has been appointed as a shareholder director of the bank as a nominee of JMC Builders.

Currently, he is serving Islami Bank Bangladesh Limited as its chairman.

Market insiders said the bank’s shares were traded in the block market of the DSE. And that is why there have been some big transactions in the bank’s shares in the last three months.

TBS correspondents called Mohammed Monirul Moula, managing director of Islami Bank, for his comments, but he did not pick up his phone. Later, a message was also sent to his mobile phone, but he did not respond.

Who exited the board

Since April this year, four institutions that were corporate directors on the board of the Islami Bank have exited the board as they have sold their entire holding in the bank, according to a monthly shareholding report of the bank.

The Armada Spinning Mills, which held 2.01%, or 3.24 crore shares, sent a letter to the bank on 18 June to withdraw its directorship. Professor Nazmul Islam was director on behalf of the Spinning Mills, and the bank approved the decision on 19 June at its board meeting.

Kingsway Endeavors, which held 4.39%, or 7.07 crore shares, also wrote to Islami Bank on 13 June seeking to withdraw its directorship. Salim Uddin was director on behalf of the firm, and the bank approved the decision on the same day.

Uniglobe Business Resources held 4.67%, or 7.52 crore shares, in the bank, where it sold the entire holding and withdrew the directorship.

It also sent a letter to the bank to withdraw the directorship. Major General (retd) Abdul Matin was director on behalf of the firm, and the bank approved the decision in the board meeting.

Besides, Islami Bank’s another sponsor Islamic Development Bank changed its nominee director, which was subject to the approval of the Bangladesh Bank.

Big trade in the block market

According to DSE data, since April this year, a large amount of Islami Bank’s shares have been transacted through the block market.

A total of 14.63 crore shares buy-sell, whose value is Tk477 crore. The TBS identified the seller but did not confirm the buyer.

However, the United Arab Emirates-based BTA Wealth Management, the lone buyer to be identified, bought over 2% stake—3.42 crore units of shares—in the bank at a cost of Tk111 crore as the leading private-sector lender.

On Sunday, Islami Bank’s shares traded for over Tk84 crore in the block market at Tk32.60 each.

Among the foreign sponsors, the Saudi Arabia-based Al-Rajhi Co for Industry and Trade, Islamic Development Bank, and Arabas Travel and Tourist Agency jointly hold a 22.04% stake in Islami Bank.

Among general shareholders, foreign investors own another 24.49% share of the bank till June, which was 20.23% in May.

Besides, four Middle East-based sponsors – Bahrain Islamic Bank, Islamic Development Bank, Kuwait Finance House, and Dubai Islamic Bank – sold off or reduced their holdings in the bank since 2015, stock market sources said.

Islami Bank’s profit increased by 28% year-on-year to Tk616 crore in 2022.

In that year, its earnings per share were Tk3.84, which was Tk2.99 a year ago.

The bank paid a 10% cash dividend to its shareholders for 2022.

In the January-March quarter, its profit fell by 32% year-on-year to Tk57.12 crore.