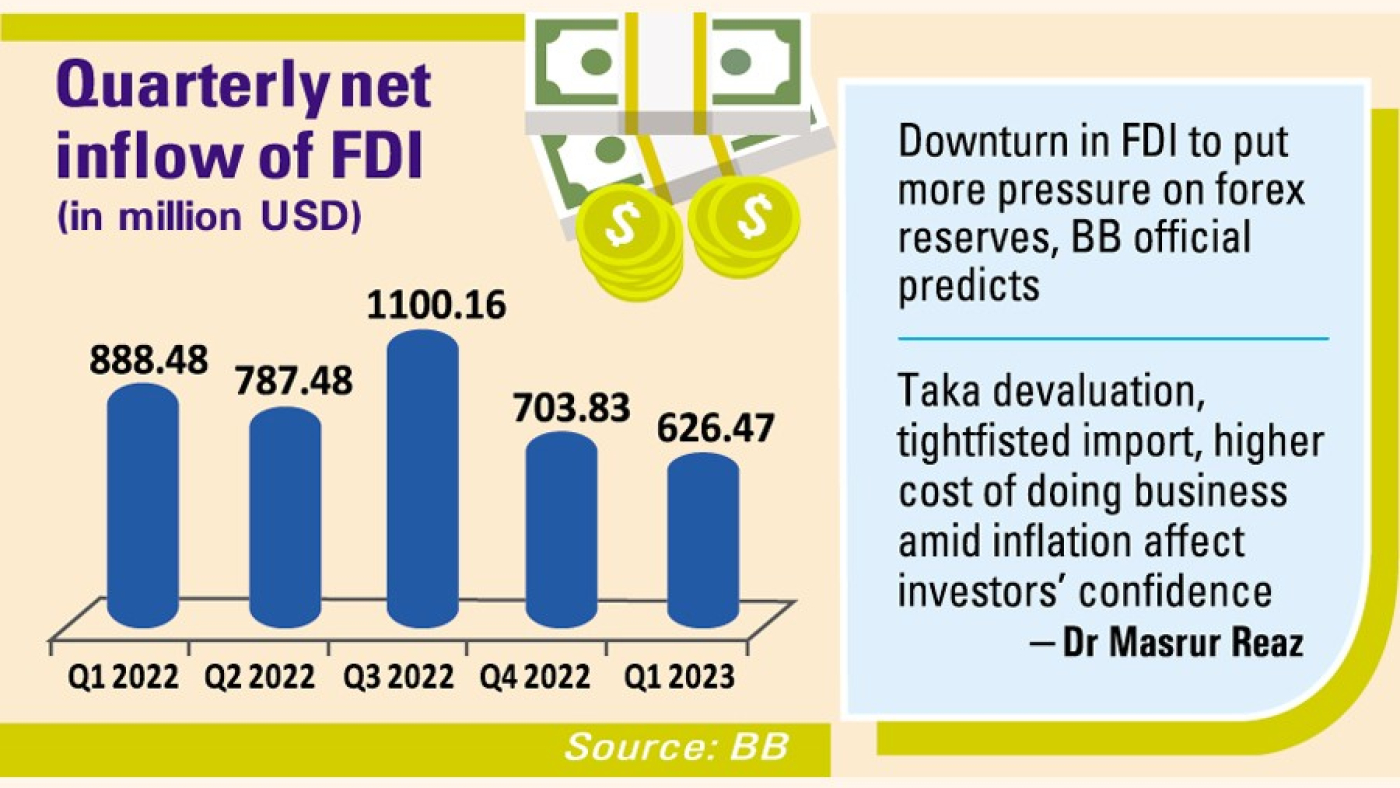

Net foreign direct investment in Bangladesh from major investor countries, the US and China, nosedived last year as rising interest rates in the global market and high volatility in exchange rates in the local market deterred overseas investors and created capital outflow pressure.

The higher outflow of foreign capital than inflow due to interest rate hike by the Federal Reserve Bank of America resulted in negative growth in equity capital investment in Bangladesh, which ultimately waned the country’s foreign exchange reserves.

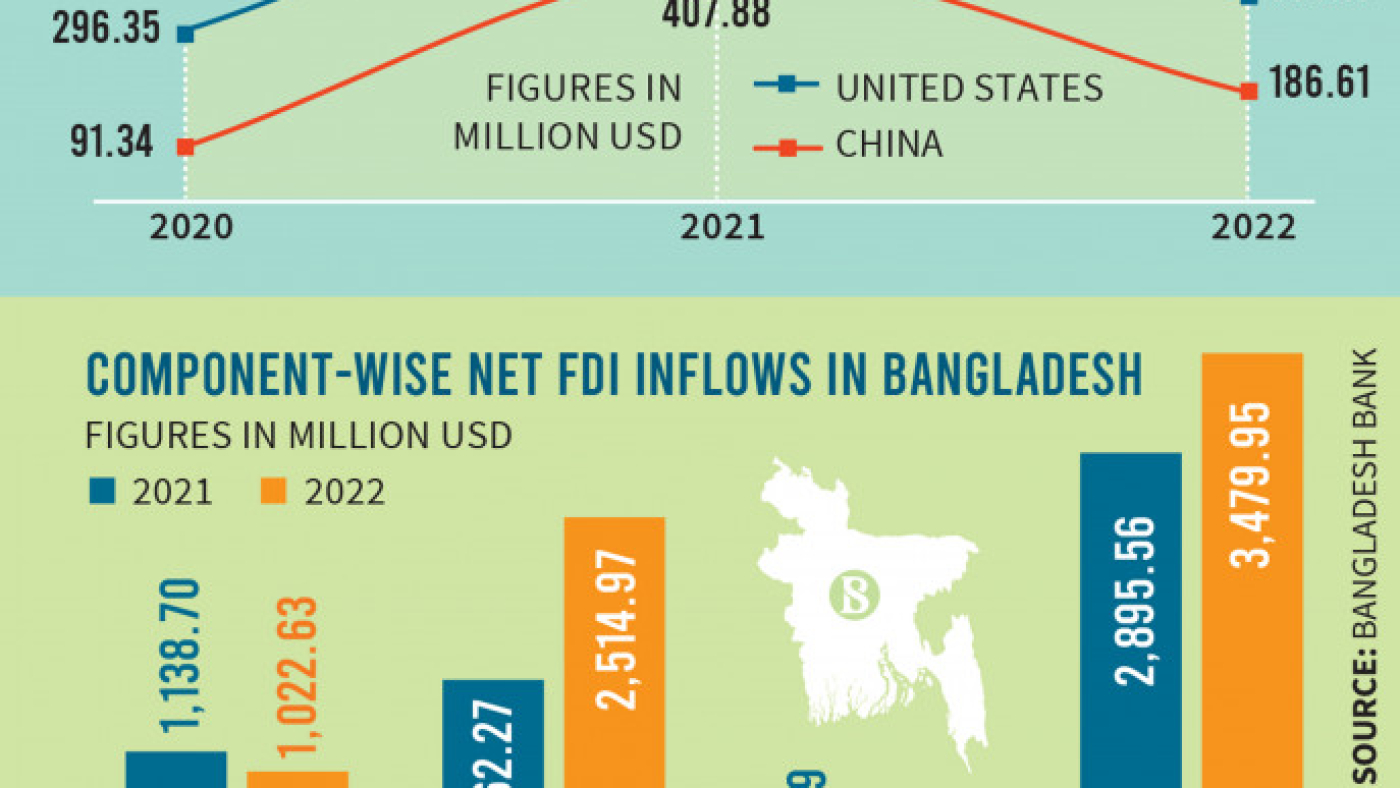

China emerged as the largest source of loans for Bangladesh in 2020 and 2021, but net FDI from the country witnessed a sharp decline of 118% last year, falling from $407.88 million in the previous year to $186.61 million in 2022, according to data from the Bangladesh Bank.

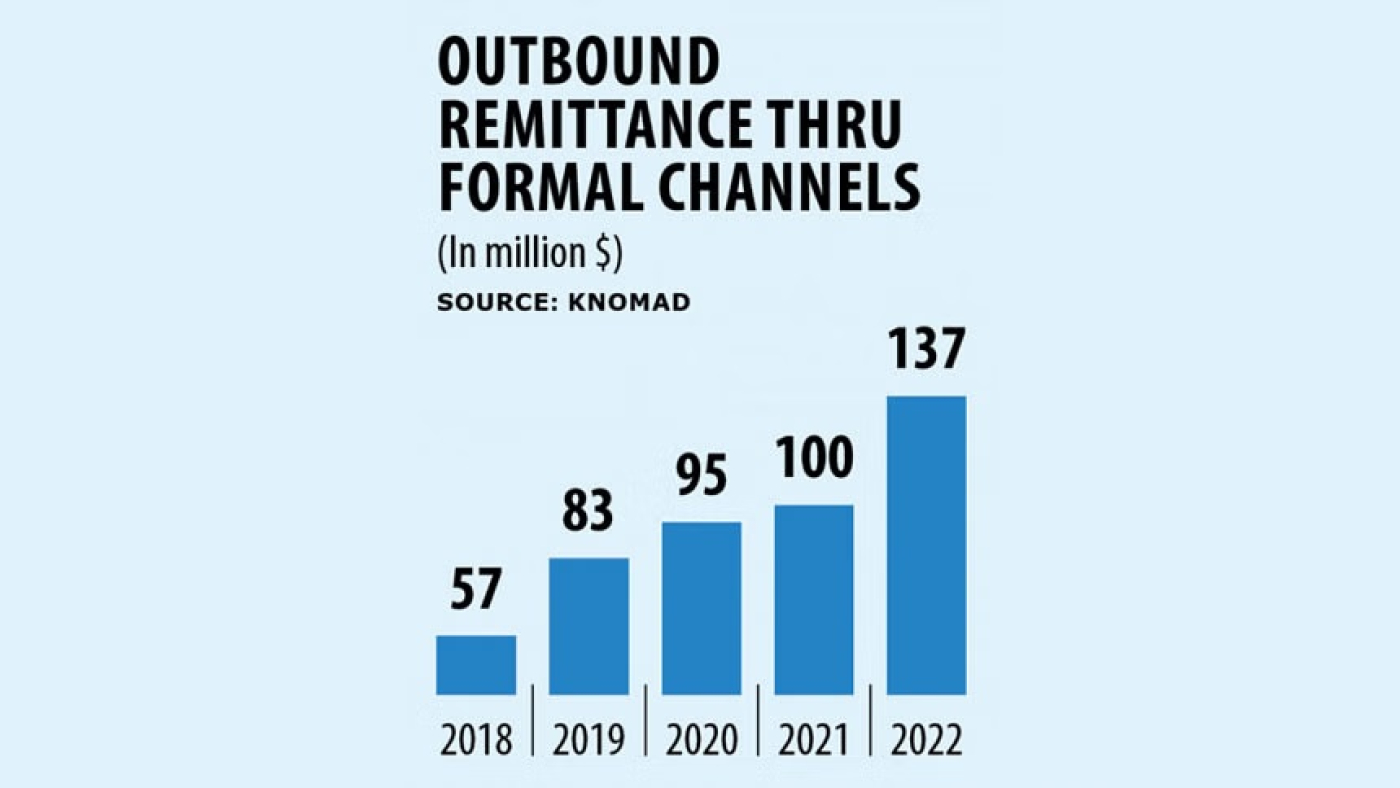

In contrast, capital outflow from Bangladesh reached $153 million last year, surpassing that of other countries and exceeding the previous year’s amount by over five times, as reported by the central bank.

The United States, previously the largest source of foreign investment, slipped from the top position due to a decrease in net foreign direct investment, making way for the UK as the leading investor in 2022. Nevertheless, the US maintained its top position in terms of equity capital investment, as indicated by Bangladesh Bank data.

Net foreign investment from the US declined by 39.57% to $354 million last year, while net equity capital investment from the country amounted to nearly $300 million.

China ranked third highest source country of equity capital investment for Bangladesh last year with $105 million, according to data from the central bank.

Additionally, loans from the US decreased by 13% to $699 million year-on-year in 2022, as per central bank data.

Mezbaul Haque, executive director and spokesperson of the Bangladesh Bank, attributed the decline in overseas capital investment to a rise in interest rates in the global market, which limited cash flow for foreign investors.

He stated that the current interest rate made new investment projects less viable when considering future return projections.

Mezbaul further noted that the exchange rate was highly volatile last year, which posed a risk for investors when making investment decisions, resulting in a decline in capital investment from overseas investors.

Regarding the significant decline in Chinese investment, he explained that it was due to the retrieval of intra-company loans. Typically, foreign companies operating in Bangladesh acquire working capital from their parent companies, but foreign investors started repatriating their loans to invest in more lucrative instruments in the global market after the rate hike by the Federal Reserve Bank, he added.

The US central bank hiked the benchmark rate to between 5% and 5.25%, the highest in 16 years, up from near zero in March 2022. The European Central Bank also raised rates following the US to curb inflation.

The rise in the fed rate created a dollar crisis in Bangladesh, compelling the central bank to devalue the Taka by more than 17% last year, taking the price of $1 to Tk109.

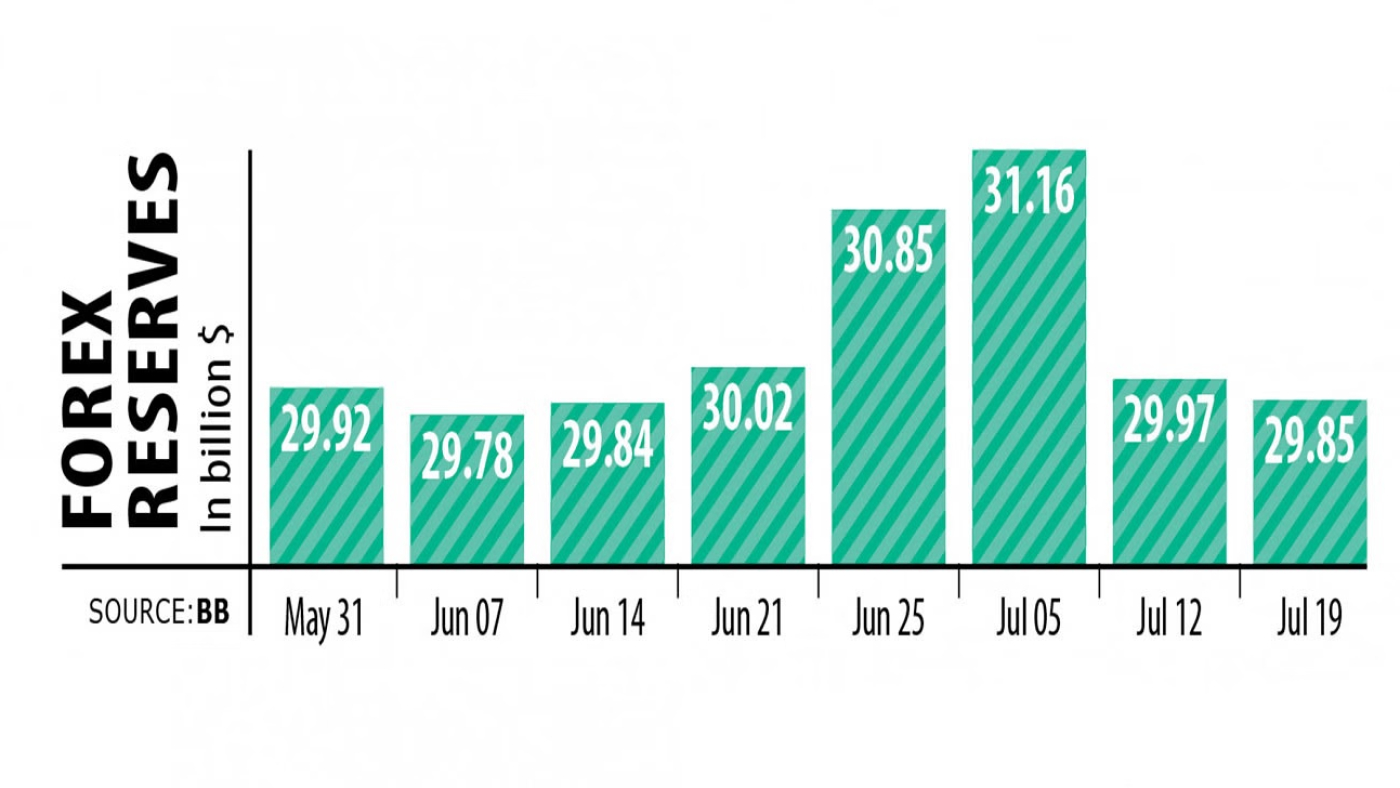

The high fluctuation in dollar rate and fall in capital investment caused faster erosion of reserve landing it to $23.56 billion on 12 July which was nearly $40 billion in July last year.

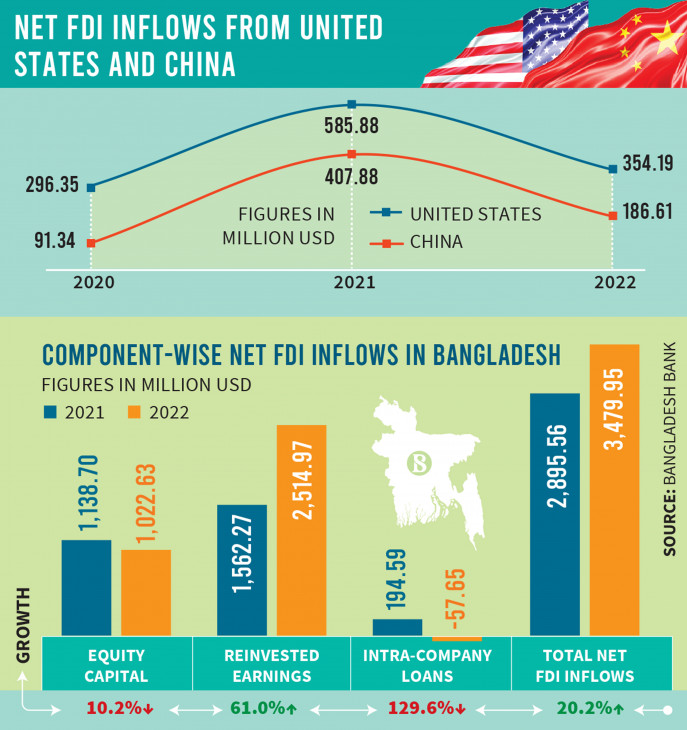

Data from the Bangladesh Bank reveal that total net equity capital investment decreased by 10% to $1 billion last year, mainly due to the decline in net investment from the US and China. The growth in net equity capital investment was 35% in 2021.

However, net foreign direct investment increased by 20% to $3.4 billion in 2022, driven by a 61% growth in reinvested earnings.

Intra-company loans, another component of net foreign direct investment, also saw a decline of 129.6% last year as foreign companies retrieved their loans to invest in other markets.

Other countries, including India and China, also experienced capital outflows last year due to rate hikes by the US Federal Reserve Bank.

Despite the sharp decline in investment from the US and China, other top investor countries such as the UK, Malaysia, and the Netherlands contributed to the overall growth in net investment in Bangladesh.

The steep fall in capital investment from China was recorded even after the government allocated an economic zone to attract Chinese investors.

Al Mamun Mridha, secretary general of the Bangladesh China Chamber of Commerce and Industry (BCCCI), explained that Chinese investors faced difficulties in setting up their investments due to movement restrictions and prolonged flight suspensions during the pandemic in 2020.

Additionally, the lack of infrastructure development in the economic zone, despite its allocation by the government a few years ago, hindered investments.

There were some complications long pending in developing the economic zone and the BCCCI sat with Bangladesh Economic Zones Authority (Beza) to resolve the issues, he said.

Mamun expressed optimism that many Chinese investors would invest in the economic zone once infrastructure development is completed.

How Chinese investment turns into loans

The investment pattern of China indicates a deepening economic partnership between the two nations through loans, which Bangladesh will be required to repay.

Recent data from the central bank reveal that China dropped to the eighth position as the largest source of FDI, down from its previous second-place position. China’s share in total net FDI decreased to 5.4% from 14%.

However, despite the decline in FDI, China maintains its position as the top creditor among the top 20 countries. Over the past two years, loan inflows from China have increased fivefold, leading to a significant influx of Chinese loans into the private sector. In the last year alone, long-term loans from China to the private sector rose by 34% to reach $2.33 billion, as per central bank data.

As a result, China’s share of the private sector’s long-term external debt surged to 30% of the total $7.89 billion in loans received last year, up from 7% in 2020.

In 2020, China was the fifth-largest creditor country with $422 million in loans, whereas the US held the second position. However, since 2021, China has become Bangladesh’s primary source of loans, with the loan inflow continuously increasing and reaching $2.46 billion this March, according to central bank data.

The high loan inflow in the private sector in both the long and short terms mostly backed by China created huge payment pressure for the Bangladesh Bank from the beginning of this year, causing a fast erosion of foreign exchange reserves.

Private sector external debt by maturity reveals that at the end of December 2022, short-term debt up to one year occupies a major share of 67.53%, and long-term debt of more than one year accounted for 32.47% in total private sector external debt of $24 billion.

The country’s banking sector has been experiencing higher outflow than inflow in foreign currency due to repayment pressure of private sector short-term foreign loans when external borrowings of banks declined substantially after Moody’s downgraded the banking system.

According to Bangladesh Bank data, the repayment amount of the private sector’s external short-term debt stood at $11.40 billion in four months from January to April of 2023, which was nearly $3 billion higher than external borrowings of $8.5 billion.