- Economists identify cheap credit, market manipulation by vested interests, weak monitoring, issues in banking sector behind food inflation soaring to 12.54%

- Data indicates an ample supply of locally produced food grains and vegetables, dispelling concerns of shortages, said Dr Fahmida, Executive Director of CPD

- Bangladesh did not use interest rate as a tool to control the money supply to contain inflation, said Dr Fahmida

- Authorities are not allowing the markets to function as they should, considering the reality on the ground, said Mustafa K Mujeri

- Consumers are spending less as their buying capacity did not increase in line with the inflationary pressure, Mostafa Kamal, chairman of MGI

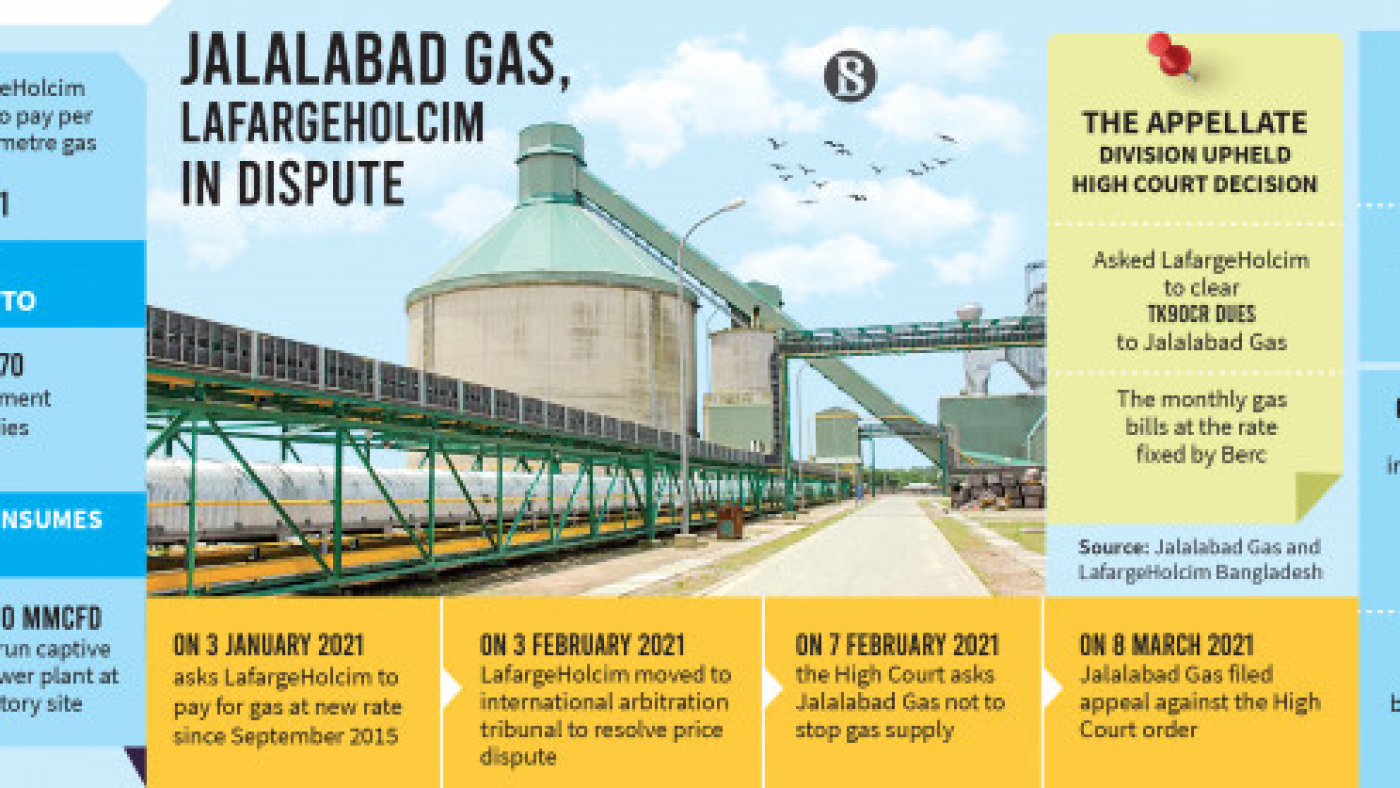

- Sri Lanka managed to reduce it to 4% in August from over 64% a year ago

- Bangladesh witnessed 14.11% inflation FY11

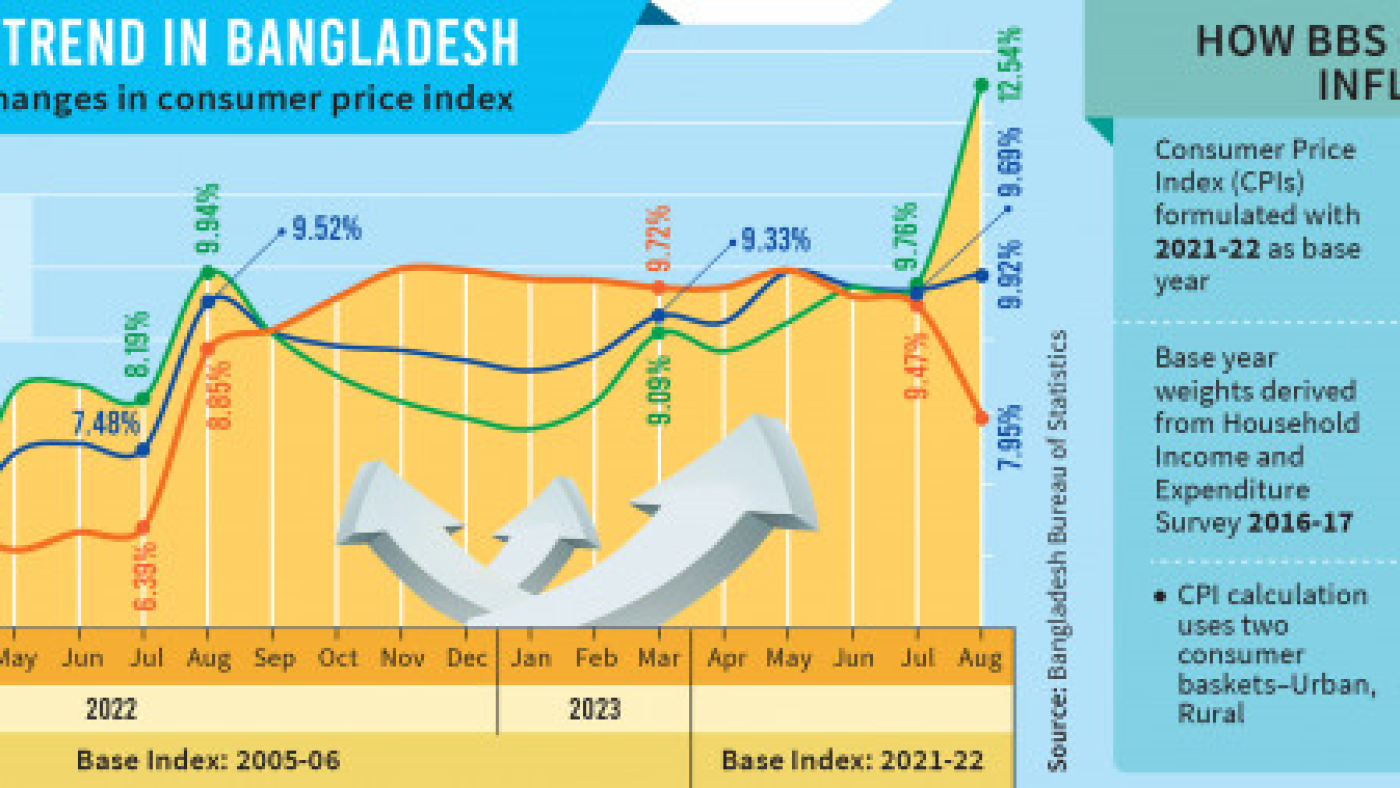

While global prices for staple foodstuffs hit a two-year low in August, Bangladesh experienced a staggering 12.54% food inflation that month, the highest in 13 years, a situation that is significantly impacting the cost of living, particularly for the low-income groups.

The last time Bangladesh witnessed inflation higher than August was in FY2010-11 when it reached 14.11%.

As for the overall inflation rate, released on Sunday by the Bangladesh Bureau of Statistics, increasing slightly to 9.92% from 9.69% in July, it indicates that prices for a broader basket of goods and services, not just food, have also experienced an upward trend.

Economists attribute this persistently high inflation to internal factors, describing it as largely man-made. These factors include availability of cheap credit, market manipulation by vested interest groups, weak monitoring mechanisms, deteriorating macroeconomic fundamentals, and issues within the banking sector and money market.

Read more:

With central banks’ job half done, global inflation talk is shifting

Sri Lanka has managed to bring inflation down tenfold. Why are we still struggling with ours?

Dr Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), said while global commodity prices, including essential items, are declining, Bangladesh is experiencing the opposite trend. “This is no longer imported inflation as the country has moved away from that phase,” she said.

Government data also indicates an ample supply of locally produced food grains and vegetables, dispelling concerns of shortages, said Dr Fahmida.

She questioned why food inflation is on the rise in Bangladesh, especially when many countries including Sri Lanka, India, the US, and the EU were able to bring down their inflation rates from the peak levels in the middle of last year.

For example, Sri Lanka has managed to reduce it to 4% in August from over 64% a year ago. Similarly, countries like India, the US, and the EU have successfully halved their inflation rates from peak levels.

According to Dr Fahmida, there are likely two reasons for this situation: either anomalies in local production data, or artificially created supply shortages driving persistent high inflation.

She cited examples of how vested interest groups have artificially increased prices of items like green chilies, eggs, onions, and potatoes by manipulating supply in recent months.

“This high inflation is not solely due to supply crisis or imported prices; rather, it stems from market mismanagement and manipulation,” said Dr Fahmida.

Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development and a former chief economist of the Bangladesh Bank, pointed out that while the price spike in the world market has subsided, consumers in Bangladesh are not reaping the benefits due to internal economic instability.

Mujeri said all markets, whether it’s commodities, foreign exchange, or the money market, are not being effectively managed to address the current economic situation.

He identified exchange rates as a critical factor and expressed that the central bank’s attempts to manage them have been ineffective.

“Misalignment of exchange rates by the Bangladesh Bank is inadvertently promoting remittance through informal channels like Hundi,” he said, citing an example.

He noted that the relevant authorities are not allowing the markets to function as they should, considering the reality on the ground. “This, in turn, allows vested interest groups to manipulate commodity prices in their favour,” Mujeri told The Business Standard.

No shortage in markets: MGI chairman Mostafa Kamal

There is no shortage of commodities in the Bangladesh markets, said Mostafa Kamal, chairman of Meghna Group of Industries (MGI), one of top food commodity importers and marketers in the country.

“Consumers are spending less as their buying capacity did not increase in line with the inflationary pressure,” he told TBS.

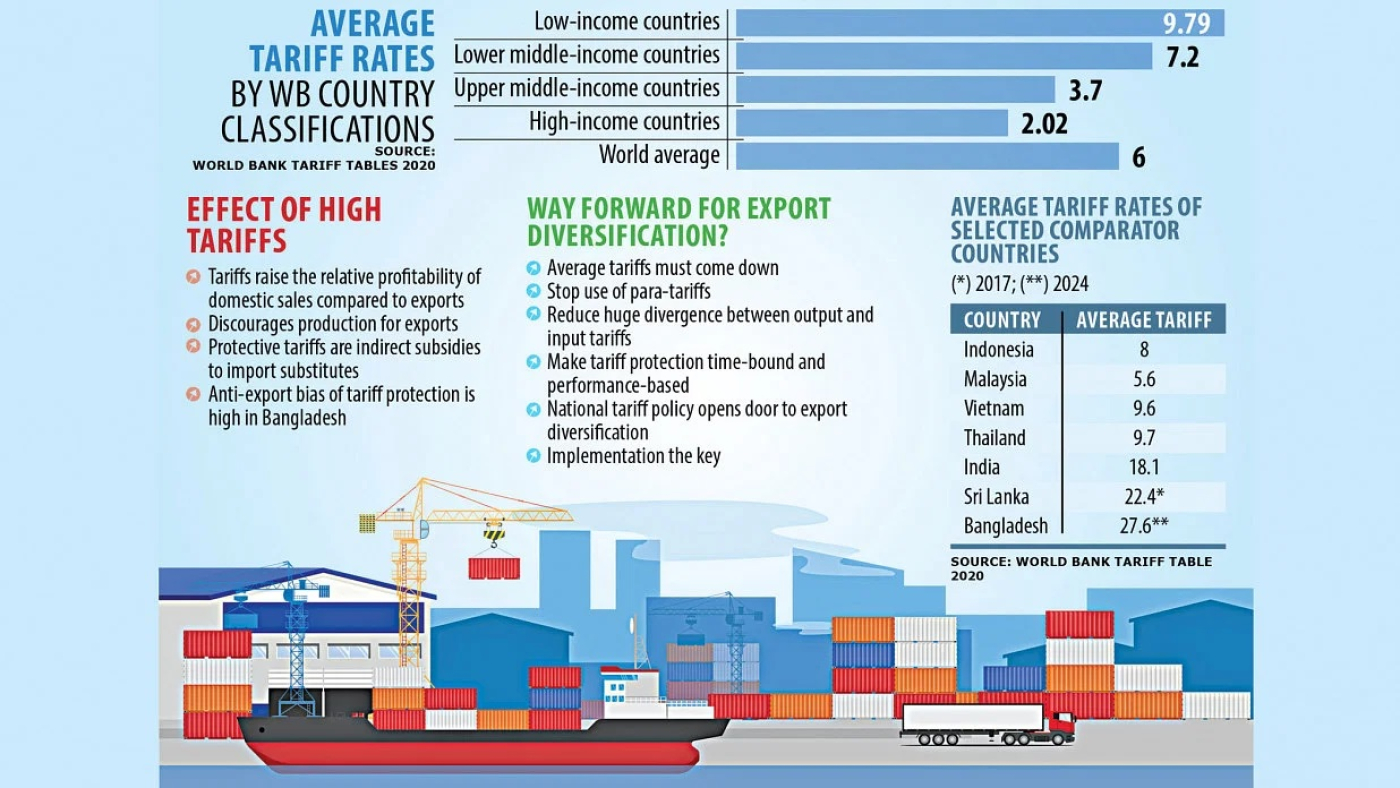

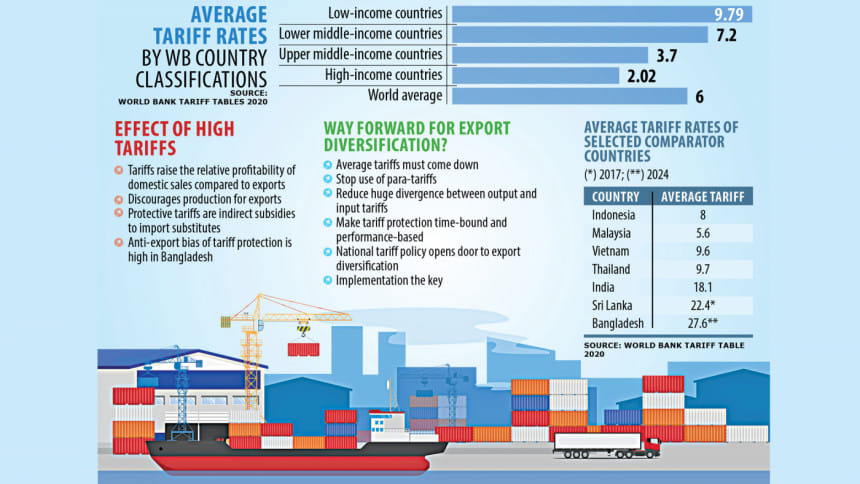

Kamal said local consumers are not getting the price declining benefits of commodities in the global markets because of the exchange rate depreciation – by over 30% in the last one and a half years and import duty hike.

Highlighting Bangladesh’s heavy dependence on imports, Kamal stressed that the country relies significantly on the US dollar, which is not yet readily available in the local market.

What is the way out?

Dr Fahmida said around 70 countries across the world have so far used the interest rate as a tool to control the money supply to contain inflation. But Bangladesh was an exception as it did not try to use this tool, which is the primary measure to manage the inflation.

For example, she said Sri Lanka, which was a failing economy a year ago, has turned around a lot by applying some policy tools, such as raising interest rates and tightening public expenditure. Same goes to India, she added.

“But Bangladesh was very rigid in using these tools as many of our policies are influenced by vested interest,” said Dr Fahmida, adding that Bangladesh continued to supply money at a cheaper interest rate, which was capped at 9% for over three years.

According to Dr Mustafa K Mujeri, the government and the policymakers have to work diligently to improve the macroeconomic fundamentals. When it was needed to raise the interest rate, to tighten money supply, Bangladesh had made credit cheaper than before to support the vested interest groups, who also own and run many banks.

“It is high time we must look into the economic fundamentals. Strong decision is needed to do so, but see lack of willingness,” he noted.

Latest inflation data

Bangladesh’s food inflation soared to 12.54% in August, pushing up overall inflation.

Average inflation increased by 23 basis points to 9.92% in August, inching close to a decade-high of 9.94% which was registered in May. The country has been experiencing an inflation rate exceeding 9% since last March.

Non-food inflation, on the other hand, dipped to 7.95% in August, down from 9.57% in May.

Global situation

The Food and Agriculture Organization (FAO) of the United Nations reported on 8 September that prices for staple foodstuffs reached a two-year low in August.

The FAO’s Food Price Index has not been at this level since March 2021 and has dropped by as much as 24% compared to its all-time high in March 2022, which occurred following Russia’s full-scale invasion of Ukraine.

In a statement, the FAO said, “the drop reflected declines in the price indices for dairy products, vegetable oils, meat and cereals.”

Impacts of inflation

Higher food inflation means that consumers are likely to spend more on essential food items, which can strain household budgets and reduce the purchasing power of individuals, leading to a higher cost of living.

Also, rising food prices can lead to a reduced standard of living as people allocate more of their income to food expenses.