In a disclosure on the Dhaka bourse, the housing sector financer said the bond will facilitate the disbursement of loans at affordable interest rates to the housing sector

DBH Finance PLC, the pioneering and largest financial institution supporting housing schemes in the country, has opted to raise Tk550 crore by issuing bonds to facilitate affordable housing for middle-income individuals.

The non-bank financial institution (NBFI) plans to lend the fund to middle-income individuals, specifically those with a monthly income below Tk1 lakh, for purchasing flats or houses.

Officials at the NBFI have mentioned that, due to the rise in interest rates on deposits, interest rates on loans in the housing sector are also increasing.

Consequently, DBH Finance is considering raising capital through a fixed-rate bond issue to ensure that lending interest rates do not need to increase significantly, they added.

Currently, DBH Finance is taking deposits at 8.25% and disbursing loans at rates ranging from 10.5% to a maximum of 10.9%, depending on the customer.

In its annual report for 2022, the NBFI said the real estate sector is not in a comfortable position at the moment as the price of land is increasing and developers will not be allowed to construct buildings over a third of the land due to the new rules introduced in Dhaka city.

The bond, once approved and mobilised, will be used for affordable housing clients, i.e. for the middle-income group and lower-middle-income group clients for their housing needs [Nasimul Baten MD & CEO, DBH Finance]

However, the demand for flats has not declined, and sales of secondary flats have also increased due to lower prices and the availability of utility connections.

The report said, due to the ongoing Russia-Ukraine war, the strain on foreign currency reserves, the dollar shortage, runaway inflation, higher construction costs, and the implementation of the new Detailed Area Plan, the real estate sector has been facing a range of challenges since 2022.

This has created an unstable situation of raw material prices both in domestic and international markets, resulting in realtors slowing down on taking up new projects.

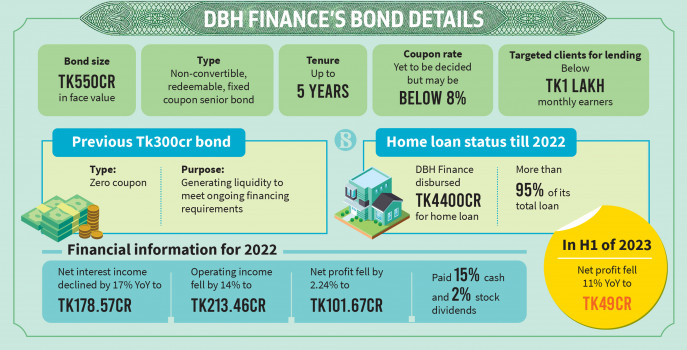

In a Dhaka Stock Exchange filing on Monday, DBH Finance said its board has approved a proposal for the issuance of a non-convertible redeemable fixed coupon senior bond worth Tk550 crore to provide affordable housing finance.

The bond will be issued only through private placement, and its issuance is subject to the approval of regulatory authorities.

The tenure of the bond is up to five years from the issue date. The coupon rate has yet to be decided as it is now in negotiation.

In 2021, DBH Finance secured approval from the Bangladesh Securities and Exchange Commission (BSEC) for issuing a non-convertible zero-coupon bond worth Tk300 crore for housing financing.

The purpose of the bond was to generate liquidity to meet ongoing financing requirements.

In November last year, the NBFI signed an agreement with the IFC to strengthen its Affordable Housing Finance Business.

According to the company, in collaboration with IFC, DBH aims to strengthen its affordable housing loan product by establishing a value proposition for the affordable housing segment and effectively targeting the lower-middle income segment.

Nasimul Baten, managing director and CEO of DBH Finance told The Business Standard, “It is still at a nascent stage. We just got the board approval, now it is subject to regulatory approvals. The bond, once approved and mobilized, will be used for affordable housing clients, i.e. for the middle-income group and lower-middle-income group clients for their housing needs.”

Company Secretary Jashim Uddin told TBS, “It has been decided to issue this bond to target customers with monthly income below Tk1 lakh to provide loans for affordable housing.”

“Currently, the deposit interest rate has increased, due to which the lending rate is also increasing. However, the board has decided to raise funds through bond issues to reduce the additional interest burden for new customers,” he added.

He said bonds usually have fixed interest rates, and interest rates are low. As with deposits, rate hikes are also less likely. So if the funds obtained through bonds are available, loans can be given at lower rates, so that the pressure on the customer does not increase.

“The demand for loans in the housing sector is a little less now. While in previous years at least Tk120 crore was disbursed every year, now it is Tk100 crore or less,” Jashim Uddin added.

DBH has been a major player in the housing finance sector in Bangladesh since 1997 and remains one of the leading non-bank financial institutions.

Since launching operations in 1996, DBH Finance has registered commendable growth in creating home ownership in Dhaka and other major cities of the country.

At the same time, it has been playing an active role in promoting the real estate sector to a large cross-section of prospective clients who have yet to fulfill their dream of owning a home.

The NBFI was listed on the stock exchanges in 2008.

In 2022, DBH Finance witnessed a decline in net interest income and operating income. Also, it posted a decline in net profit.

Its net interest income fell by 17% and operating income by 14% to Tk178 crore and Tk213 crore, respectively.

Its net profit declined to Tk101 crore, down from Tk104 crore in 2021.

In the first half of 2023, the NBFI witnessed a fall in profit to Tk49 crore, which was Tk54 crore at the same time as the previous year.

Source: The Business Standard