Risk-free interest surged above 11%, investors were deprived of gains from healthier stocks for a long time and excessive and unpredictable regulatory interventions perplexed people – all these played a role in the free fall of Dhaka stocks for more than five weeks.

Over Tk86,000 crore in market capitalisation – the total value of all the listed securities on a bourse – has been eroded during the last 24 sessions since 12 February when investors started to shy away from risk-taking in stocks due to a rare regulatory indecision regarding how they would treat shares of sick companies selling like hotcakes.

Since 1 January, the DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), fell by 7% to 5,814 points during the closing bell on Tuesday – the lowest since 24 May 2021.

Only in three of the past 24 trading sessions did the index see some green, when some optimistic investors tried to grab the emerging opportunity to buy oversold shares, only to surrender to desperate sellers on the very next day.

Many experts and analysts initially perceived the fall as a usual correction after the withdrawal of floor price restrictions that began in January. However, the 660-point drop in less than six weeks has already shaken them, especially those who were heavily exposed to stocks.

Analysts, adhering to the universal theory that suggests the stock market tends to weaken when interest rates continue to rise, stated that large-cap stocks, particularly those that were stuck at their lower limits for one and a half years despite declining earnings, might have been under some stress until there is a rebound in fund flow and corporate earnings.

However, the frequent occurrence of junk stock mega fests on the bourses, facilitated by the regulator’s decision to keep most large and mid-cap stocks hibernating for extended periods, has pushed clean investors into a tight corner.

Stockbrokers, seeking anonymity, revealed that the market’s collective psyche was abnormally affected by excessive manipulation, leading many short-term traders to lose money chasing them at the end of managed rallies. Clean investors, who prioritise adherence to investment principles, have consequently shied away.

Sick companies, grappling with ongoing production challenges, outstanding bills, and loan payments, while their auditors continuously raise red flags for investors, have surprisingly led the gainers for more than a year.

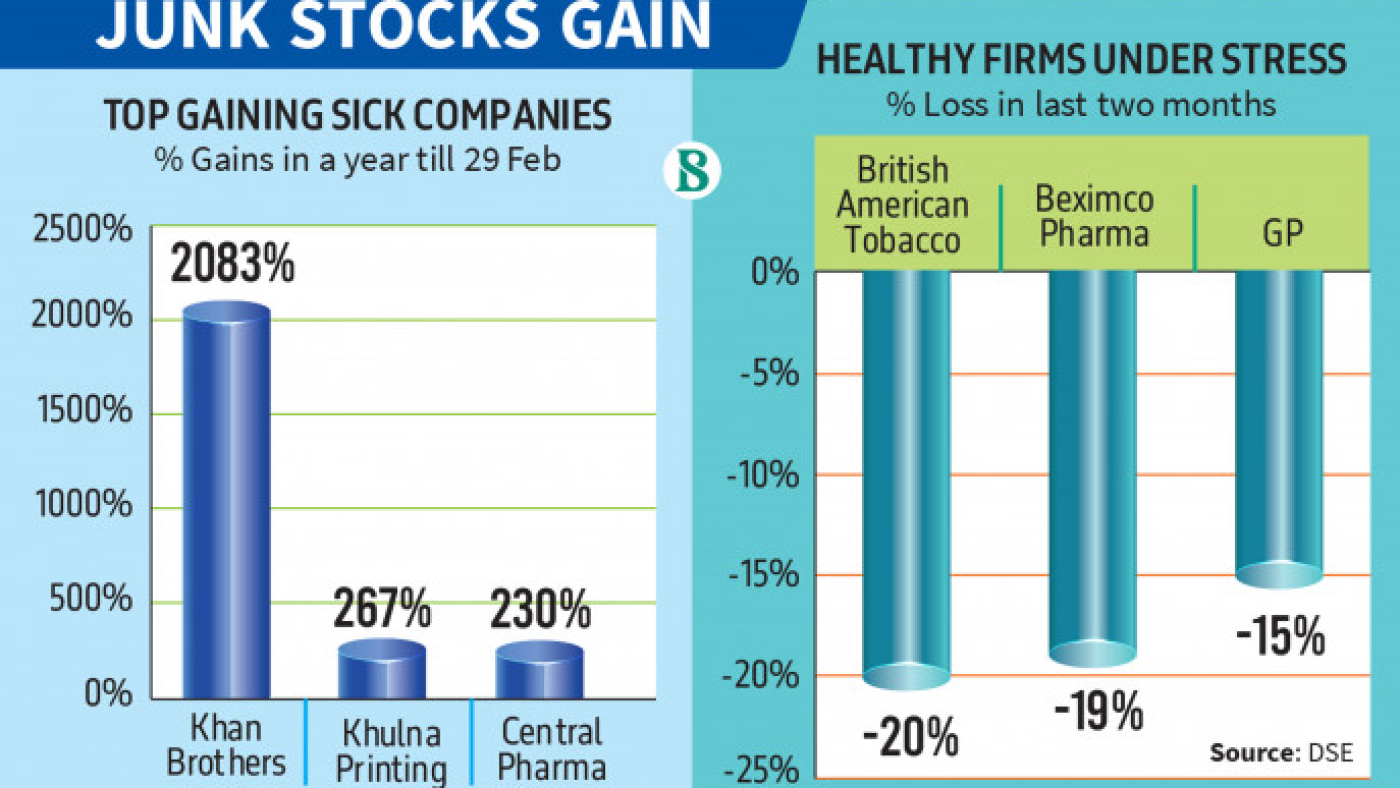

For instance, lossmaking Khan Brother PP Woven Bag Industries saw its shares surge more than 20 times in value over the course of a year until the end of February 2024.

Another example is Khulna Printing and Packaging, which has been out of operations for an extended period and was founded by an absconded loan defaulter. Despite this, its shares surged by 267% in a year.

Similarly, Central Pharmaceuticals, which encountered significant disputes with the revenue authority and subsequently became sick, witnessed its shares generate a remarkable 230% return.

Meanwhile, blue-chip firms like Square Pharmaceuticals and Brac Bank generate meagre positive returns if their dividends and a single digit capital gain are calculated together. On the other hand, Grameenphone and British American Tobacco caused 15-20% capital erosion in a couple of weeks.

Rumour about regulatory factors at their peak

Seeing rare market interference like the floor price, regulators suddenly changing their minds in so many things related to market behaviour, and an apparent indemnity to manipulators who act with insiders made impatient investors excessively rumour-seeking as they believed in what they saw, said a senior stock broker.

For instance, the process of coming out of pandemic time relaxation by sending weaker firms in the Z category has been a chaotic blunder to the investors, as the regulatory officials gave contradictory messages several times alongside acting out of indecisions that even hurt junk lovers’ sentiment, said another brokerage official who serves thousands of retail and a few institutional investors.

Rumours like “regulatory officials got divided in quarters, when the floor from which stocks to be lifted, or which new circular the regulators to throw to change market courses” are price sensitive to investors, and the factors should not have been so important here, he added.

The Bangladesh Securities and Exchange Commission (BSEC), blaming rumours for the market fall, recently said in a press statement that there is no division among market regulators and bourses and spreading rumour on social media would be a punishable offence.

Social media user investors nowadays are refraining from sharing their market predictions, which is illegal according to local securities laws. However, their frustration is rising as the free fall continues, and this sentiment is going viral on social media platforms, with almost everyone counting losses.

Brokers’ seven points for a better market

The DSE Brokers Association (DBA) held a meeting among the top brokers on Tuesday and stated in a press release that they believe the fall is a natural consequence of the withdrawal of floor price restrictions.

They anticipate that the market should soon take the right course, attracting investors to lucrative stocks at cheaper prices.

They urged policymakers and regulators not to consider any radical market interference, such as reinstating floor price restrictions.

Their major demands, according to the statement quoting DBA President Md Saiful Islam, included listing more of the well-performing companies to increase the supply of quality stocks, strengthening the mutual fund sector, ensuring reforms in the stock categorisation system and margin loan regulations, and ensuring compliance in listing and operating listed firms.