The volatile foreign exchange market turns out to be a blessing for remitters, but a challenging impediment for importers and eventually consumers.

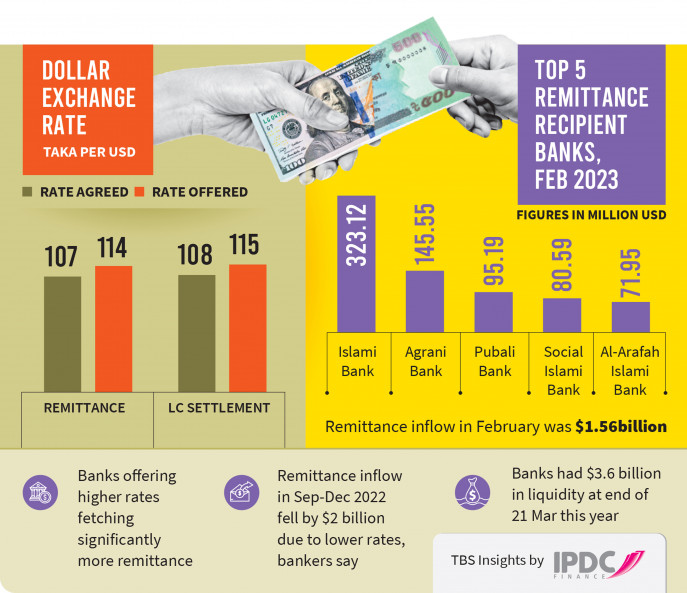

According to bankers, remitters are receiving as much as Tk114 for a dollar along with a 2.5% cash incentive from the government.

This rate is much higher than the Tk107, agreed upon by the Bangladesh Foreign Exchange Dealers Association (Bafeda) and the Association of Bankers, Bangladesh (ABB) in September last year.

Out of the country’s 61 banks, at least 20 are offering higher rates for a dollar than the agreed rate in order to meet the demand for the greenback.

But they are not showing their actual offered rates in balance sheets, a number of top bankers and treasury officials, who chose to remain anonymous, told The Business Standard.

The banks which are not offering higher rates are receiving fewer remittances.

“You can see it in banks’ monthly inward remittance flow. A bank that channelled $2 million in February last year, fetched a whopping $45 million in February this year mainly because of offering higher rates,” the head of the treasury department of a private bank told The Business Standard (TBS).

“Nothing significant happened in these banks over the last year which will increase their remittance flow more than 20 times. Higher rates are behind the surge, which is destabilising the forex market,” he added.

Bangladesh Bank data shows all the banks of the country together brought in remittances of $1.56 billion in February, up 4.47% year-on-year.

However, the bank-wise picture of the year-on-year growth is widely uneven. Some banks have exceeded 100% year-on-year growth and a couple of them showed a growth of over 1,000%, according to central bank data.

On the other hand, some banks saw a significant decrease in remittance income compared to the same period last year, as they declined to offer a higher exchange rate for the dollar.

Earlier, the ABB and Bafeda in a meeting on 11 September last year fixed Tk108 per dollar of remittances. The initiative was taken after the rate went up to Tk114-115 with each bank offering different rates. To control it, a fixed rate was agreed upon under the direct supervision of the central bank. Later, the rate was reduced to Tk107 in two phases. This was followed by a drop in monthly remittance inflow by around $500 million.

However, in January this year, some banks began increasing their remittance exchange rates. Bafeda and ABB in a joint meeting on 18 January warned banks not to offer more than they agreed in September. Letters were also sent to the managing directors of all banks. In response, some banks stopped bringing remittances at higher rates, but others continued to offer higher rates.

The number of banks, offering high rates, has increased in March with the rest planning to follow suit. To address this issue, a meeting of the executive committee of Bafeda was held last Friday.

How are banks paying high rates for remittance?

Banks are resorting to various strategies for paying higher rates for dollar against remittance, said senior officials of at least seven banks.

“For instance, some banks deliver the excess amount, resulting from paying above the rate of Tk107 per dollar, to exchange houses separately,” a deputy managing director of a private bank told TBS.

According to this strategy, the bank first comes to an agreement with the exchange house to buy dollars at a higher price than the fixed rate. The exchange house keeps the rate at Tk107 in the ledger while delivering the dollars sought by the bank, even though the bank agreed to the rate of Tk112-114, he said.

The bank then pays the remaining amount (calculated on the difference between Tk107 and Tk112-14 per dollar) to the exchange house in cash or through a bank transaction. At present, a large proportion of those buying remittances at higher rates follow this method, the bank official said.

Many banks are showing this extra payment as “other expenses” in the balance sheet but in reality, channelling remittances at higher rates. This is how banks are able to show a rate of Tk107 per dollar in reporting to the central bank, the official added.

An official of the treasury department of another bank that is bringing remittances at a high rate told TBS that it is not possible to fetch remittances at Tk107 in the current market and by forcing a rate will throw the market further into trouble.

Between September and December last year, monthly inflow of remittances was around $1.5 billion, down from $2 billion in previous months’ average, due to lower exchange rates. Remittances rose again to around $2 billion in January due to higher rate, he said.

“Besides, according to the conditions of the IMF, our foreign exchange reserves must be increased by about $3 billion by next June to get the next instalment of the $4.7 billion loan. All in all, keeping the remittance dollar rate fixed at Tk107 will reduce our foreign currency flow,” the treasury official added.

How are banks charging up to Tk115 for settling LCs?

Several importers told TBS that many banks are charging up to Tk113-115 for opening import letters of credit (LCs). But, as per the rules, there is no scope to charge a rate above Tk108.

Banks on the other hand are saying that they have to charge more as they are buying at high rates.

Even though banks are charging higher rates for LCs, they are not showing it on their logbooks and resorting to various techniques to conceal it.

Some banks are creating fake loans against the customers to adjust the additional money off the high LC dollar rate, said the treasury official, adding that in this way, 9% interest is charged against fake loans to the customer who settled the LC. This loan money is deposited in the current account of the bank.

How are exporters hiking the dollar rate strategically?

Biswajit Saha, Director of Corporate and Regulatory Affairs at City Group, said, “We are not even getting a dollar for Tk 113-114. Almost all banks are offering a rate of Tk115-116.

“We are obligated to make payments, so we are forced to buy dollars at a higher price,” he told The Business Standard.

A businessman wanted to open an LC to import fruits including apple, grape, and orange from Bhutan. Being a sight LC, the cost of these products was to be paid within 15 days of the opening of the LC. However, the businessman was not getting dollars from the banks at the Bafeda-fixed rate. Later, the importer opened the LC with a private bank on the assurance that the “dollars equivalent to the payment would be brought from an apparel exporter”. This entire process of payment has been done in accordance with the central bank policy, but technically.

A senior officer of the treasury department of the concerned bank involved in the process told TBS, “In this process, the fruit importer himself managed the RMG exporter offering to pay Tk114 per dollar. Later the exporter talked to his bank to encash the proceeds with the condition that the dollars will be sold to another bank. The bank agreed to it as he is a big exporter. The bank then encashed $1 million at the Bafeda-fixed rate of Tk104 and sold it to the importer’s bank at the rate of Tk105. The importer’s bank then sold the dollar to the fruit importer at the rate of Tk106.”

As per the initial agreement between the importer and the exporter, the importer paid Tk80 lakh separately to the exporter an extra Tk8 per dollar, the official said.

In this process, several major exporters are increasing the dollar rate of export proceeds. But small exporters are not able to take advantage of this. They are forced to encash the dollar at the rate of Tk104 fixed by Bafeda.

Who will take action against banks?

It is not yet clear which authoritative body is responsible for taking action against banks that are providing higher rates on remittance.

ABB and Bafeda have not issued any direct statement in this regard. But the organisations wrote to the bank MDs at different times, saying all authorised dealer (AD) banks must comply with the decisions taken in the joint meeting of Bafeda and ABB. Any violation of the above by any bank will be viewed and dealt with strictly by the regulator.

Several office bearers of Bafeda, wishing not to be named, told TBS that Bafeda does not have the authority to take action against any bank. Only the Bangladesh Bank can take measures in this regard.

A committee member, who attended the meeting on Friday, said that although all banks are following the agreed exchange rate for export proceeds, some banks are giving more than the specified rate for remittances.

“We have been hearing such complaints for a long time. As some banks are breaching agreed rates, the central bank has been officially informed of the issue, and it will take appropriate measures,” he said.

On the other hand, the central bank says that ABB and Bafeda will take action against the respective banks if the fixed exchange rate of dollar is not followed.

Bangladesh Bank Spokesperson and Executive Director Md Mezbaul Haque told TBS that banks had $3.6 billion at the end of Tuesday (21 March).

“If there is enough supply of dollars, then why would the banks buy dollars at a higher rate? The central bank did not fix this rate, ABB and Bafeda did. Therefore, if any action is taken in this regard, they have to take it,” Mezbaul Haque added.