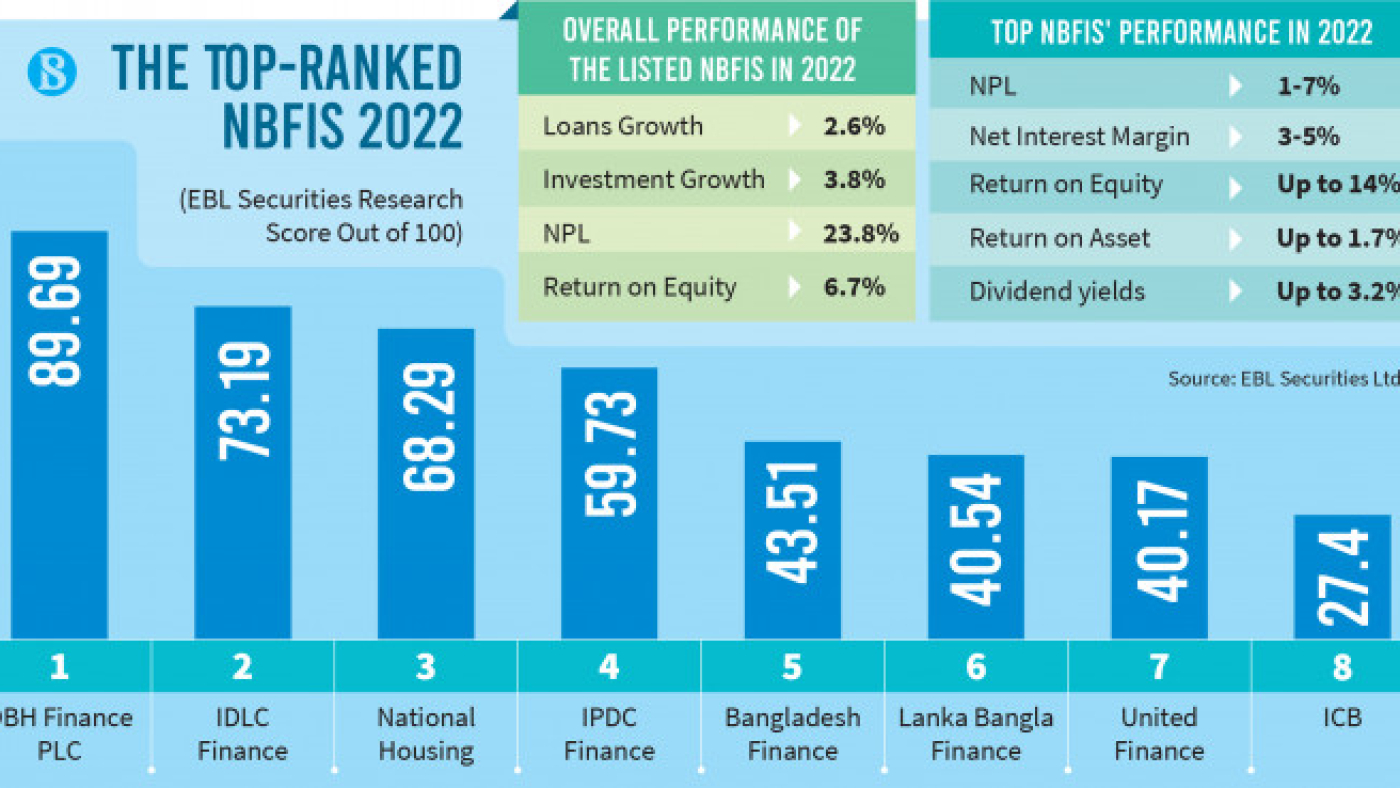

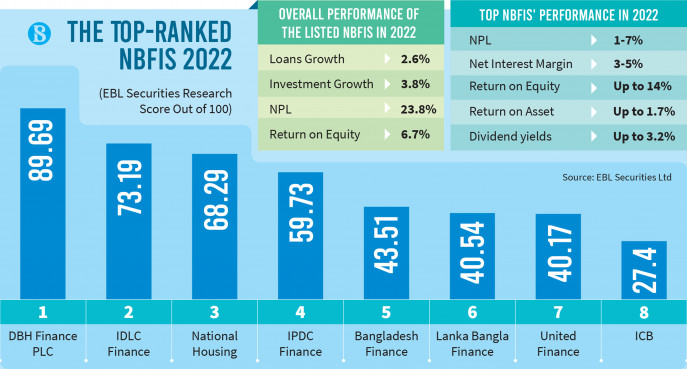

At the end of 2022, publicly traded NBFIs’ average non-performing loans (NPLs) ratio skyrocketed to nearly 24% due to some extreme figures such as 89% bad loans of scam-hit International Leasing.

The non-bank financial institution (NBFI) sector in Bangladesh has been struggling with a huge amount of non-performing loans, a liquidity crisis, and an extreme squeeze in the NBFIs’ net interest margin in recent quarters.

A significant portion of the blame can be attributed to non-compliant firms that sunk due to non-compliance and embezzlement.

However, some top-tier firms having better corporate governance, winning strategies, and the financial strengths to weather tough times, clearly stood apart from their mediocre competitors and also to show a contrasting picture of the devastated NBFIs that were struggling to pay back depositors.

For instance, at the end of the challenging year 2022, publicly traded NBFIs’ average non-performing loans (NPLs) ratio skyrocketed to nearly 24% due to some extreme figures such as 89% bad loans of scam-hit International Leasing.

On the flip side, top-tier firms managed to arrest their NPLs within a 3% to 7% range, while home loan provider Delta-Brac Housing (DBH) Finance PLC succeeded in recovering more than 99% of its loans.

With similar strong performance in several key financial indicators followed by analysts, the specialised NBFI appeared to be the strongest before analysts’ eyes.

The research arm of brokerage firm EBL Securities released its “NBFI Sector Performance and Earnings Update” report at the end of August, awarding DBH Finance PLC an impressive score of 89.69 out of 100. According to the audited financial report for 2022, DBH Finance PLC’s business competitor, National Housing Finance and Investment, secured the third position among all NBFIs with a score exceeding 68.

Rayhan Ahmed, senior research associate at EBL Securities, said, “A relatively lower default rate in housing loans contributed to the high profitability and ranking of these two specialised NBFIs, reflecting their strong financial health.”

IDLC Finance Ltd, the largest NBFI in the country, secured the second position among all NBFIs by the end of 2022, maintaining its status as a champion among full-fledged NBFIs with a diversified business portfolio, earning a score of over 73.

EBL Securities analysts considered earnings per share, cost-to-income ratio, returns on equity, return on asset, operating profit margin, net interest margin, NPL control, and dividend yields as their evaluation criteria.

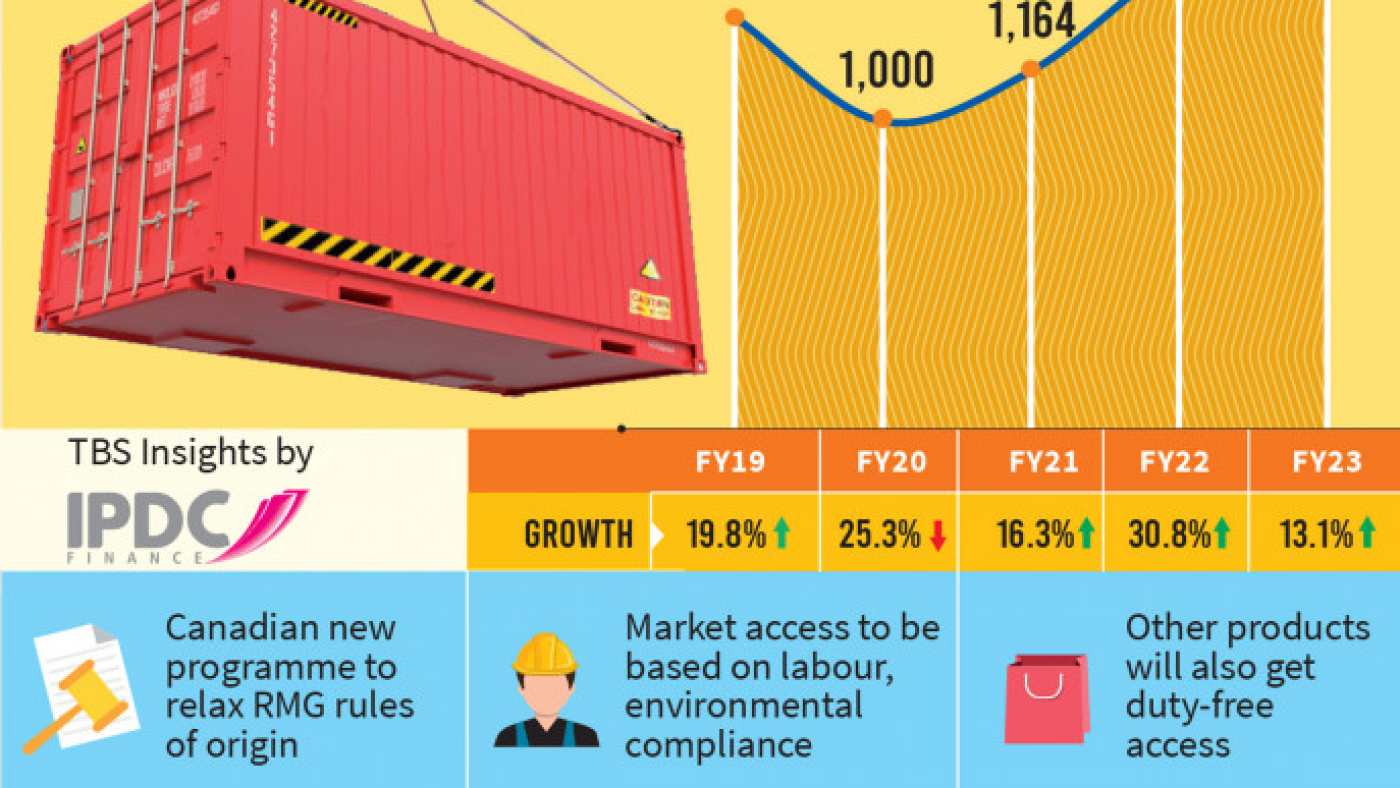

IPDC Finance, the fastest-growing NBFI that went through a significant transformation since the world’s largest non-governmental organisation BRAC acquired its major stake eight years back, stood second among the diversified NBFIs and fourth among all, securing a score of 59.73.

Bangladesh Finance, another NBFI going through a transformation in its business model and way of operations stood fifth among all as it scored 43.51.

Lanka Bangla Finance, the second largest NBFI, stood sixth as the devaluation of Taka last year hurt its financial performance to some extent by inflating its foreign currency liabilities.

United Finance with a score of 40.17 stood seventh among all NBFIs.

State-owned Investment Corporation of Bangladesh despite its 27.3% NPL managed to secure the eighth spot with a poor score of 27.4 out of 100.

In contrast, devastated firms such as International leasing or First Finance scored near to zero amid much more liabilities than assets.

In financial business, there may come short-term dents during adverse economic situations when borrowers’ payback declines or deposit becomes expensive to squeeze profit margin, said IPDC Managing Director and CEO Mominul Islam.

However, “Financial firms having strong risk management and good governance practices overcome and chase their vision,” he added.

He attributed his firm’s superior position to the socially committed business model and the priorities for sustainable growth.

National Housing MD and CEO Mohammad Shamsul Islam believes corporate governance and transparency are the biggest strengths of his firm which translates into financial strength.

Bangladesh Finance, once lagging due to investment losses, higher NPL in the dominant large corporate loans segment might not have appeared in the top ten if the ranking had been done before the pandemic.

Its MD and CEO Md Kyser Hamid thanked the transformation program it embraced during the pandemic for a stable business and efficient operations.

Hamid, also the vice chairman of the Bangladesh Leasing and Finance Companies Association, said less bank borrowing and more customer deposits, less large loans and more small loans, technology dependency for efficient, transparent operations alongside more partnership with a wide range of actors have been proved to be the winning tools in his industry.

DBH Finance PLC MD and CEO Nasimul Baten believes that the quality of loans disbursed and better liquidity is the preparation to pay back depositors at once together make the key difference and his firm in the last 18 years kept controlling the NPL within 1%.

The NBFI industry was facing an even harder time in the first six months of 2023 due to record low-interest rate spreads as deposit rates went higher and their lending rate was capped until the beginning of July, said Hamid.

NBFI industry’s net interest income, net profit, return on equity and assets and spread everything dropped in the first half of 2023.

Except for the two housing finance providers, each of the top NBFIs had a lower score at the end of June, if compared to that of six months ago.

However, the new central bank method for setting a dynamic cap for lending rate helped create a breathing space, he added.

Each of the CEOs was optimistic that with the economic hurdles over the well-governed firms would come back with higher profitability.

Echoing them, EBL Securities’ Rayhan Ahmed said the central bank’s execution of a market-based lending rate and governance enhancement initiatives could bring promising signs for a potential turnaround of the NBFI sector.

Source: The Business Standard