The FY24 budget has disappointed the market stakeholders

The budget proposed for the fiscal 2023-24 bears no good news for the stock market as most of the pre-budget proposals that were made by the market stakeholders were paid no heed to.

When the capital market was going through a tough time because of the liquidity crunch fuelled by high inflation, the Russia-Ukraine war, and economic uncertainty, the Bangladesh Securities and Exchange Commission (BSEC), Dhaka Stock Exchange (DSE), Chittagong Stock Exchange (CSE), Bangladesh Merchant Bankers Association (BMBA), and DSE Brokers Association (DBA) placed some proposals before the National Board of Revenue (NBR) for the stock market’s betterment.

But the budget proposed by Finance Minister AHM Mustafa Kamal on Thursday has disappointed the market stakeholders.

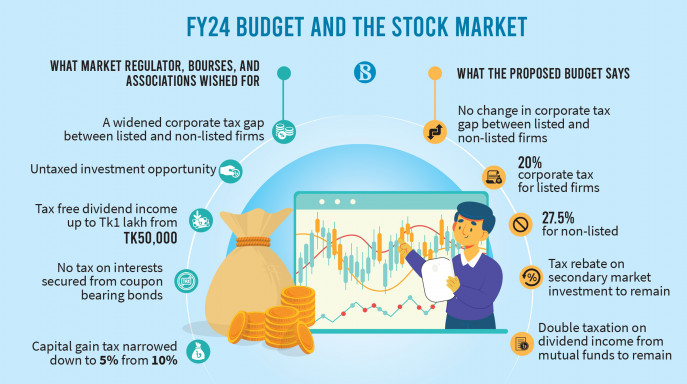

In the proposed budget, the corporate tax difference between listed and non-listed companies has remained the same as it was in the previous fiscal year.

The withdrawal of double taxation would help make the parent company more keen to provide investment support to its subsidiaries — Richard D Rozario, president of DSE Brokers Association.

At present, publicly listed companies that transfer shares worth more than 10% of their paid-up capital through initial public offerings (IPOs), will pay 20% corporate tax. And if they fail to offload 10%, they will have to pay a 22.5% corporate tax. The non-listed companies have to pay 27.5% corporate tax.

So, the listed firms are now enjoying 7.5% tax rebate opportunity than the non-listed firms.

But in the pre-budget discussions, stakeholders demanded a widened corporate tax gap – at least 10% – between the listed and non-listed firms to attract more non-listed firms to offload shares.

They also demanded the withdrawal of double taxation on dividend income of mutual funds.

The stockbrokers also called for decreasing the advance income on dividend to 15% from 20%, and tax deduction on the dividends of subsidiaries.

It also demanded untaxed black money investment opportunities for at least one year.

Capital market stakeholders proposed raising the tax-free dividend income limit to at least Tk1 lakh, from Tk50,000 at present.

Currently, zero-coupon bonds (bonds with no interest or profit distribution coupons attached) have tax-free benefits. The BSEC recommended that coupon-bearing bond yields should be given the same opportunity so that all types of bonds are popularised to create a viable bond market.

Richard D Rozario, president of DBA said, “We made some proposals in the budget highlighting the rationality of the capital market but they were not reflected. If the demands were fulfilled, the country’s capital market as well as the economy would have benefitted.”

He said the subsidiary company, after paying taxes from the received dividend, pays the parent company. Then the parent company has to pay the tax again.

“It was proposed to withdraw this double taxation and consider the single tax payment on the dividends by individual and subsidiary companies as final. If this double tax is withdrawn, the country’s economy would actually benefit, and the parent company would be keen to provide more investment support to its subsidiary,” he added.

BMBA President Sayadur Rahman said, “The pre-budget proposals made did not receive any clear guidance. But we hope to get something positive for the capital market when the proposed budget is finalised.”

However, the positive news is that the current tax rebate facility on capital market investments has not been withdrawn.

Source: The Business Standard