Tanvir Islam, a banker, has invested Tk 17 lakh in the stock market since he started trading on the Dhaka Stock Exchange (DSE) a decade ago.

Besides, he borrowed Tk 5 lakh from a merchant bank and invested the fund in four well-performing stocks.

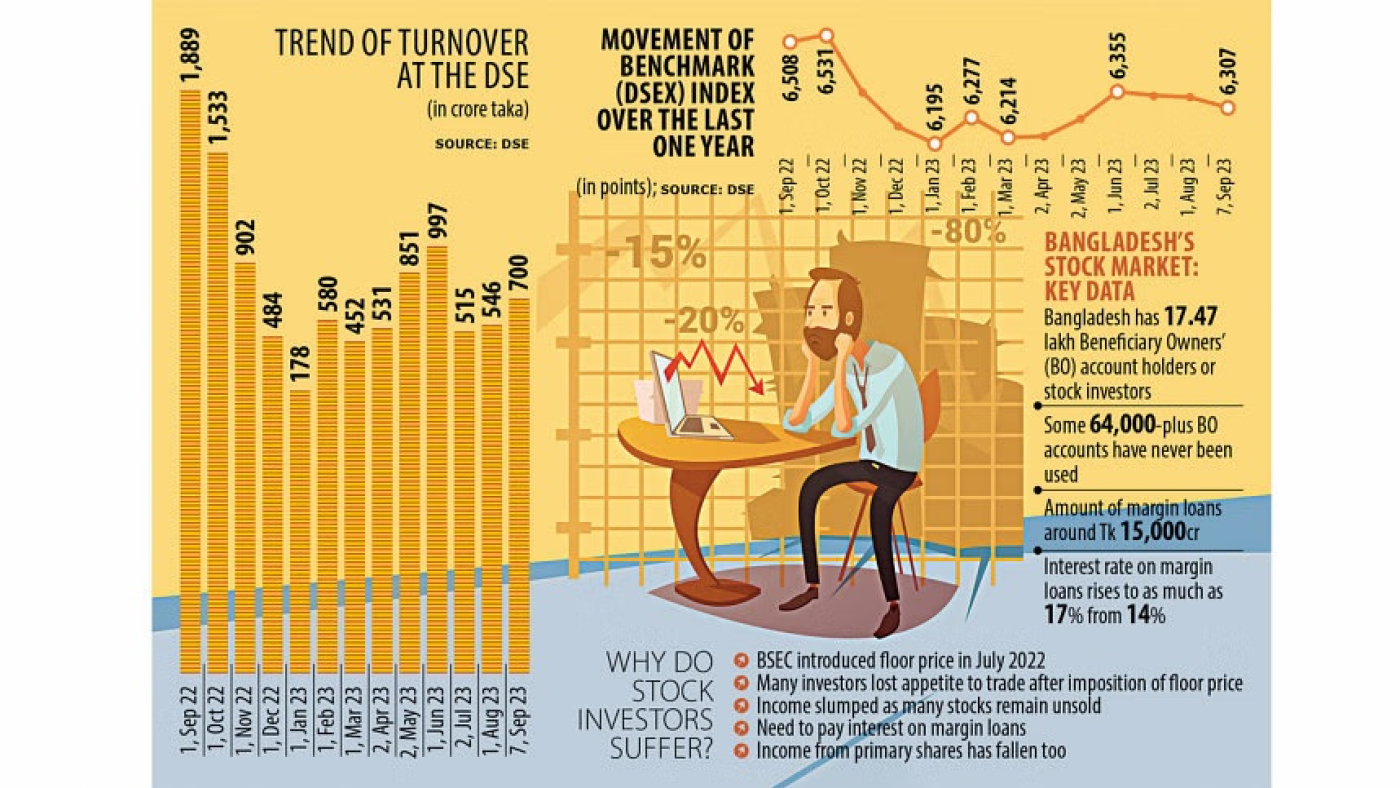

But he has not been able to trade any of his securities due to a thin presence of investors in the last one year, largely driven by a floor price. This means he has not been able to make any profit from the investments.

The merchant bank, however, is charging him interest on the loan.

In another blow, investors like Islam will see the interest rate go up by 2 to 3 percentage points from this month amid the high-interest rate regime in the banking sector after the central bank moved away from the 9 percent interest rate cap.

“I have to pay the additional interest from the pocket,” Islam said.

Islam is one of thousands of stock investors who have injected funds into the market by borrowing funds and they are now in troubled waters as they are being forced to pay interest from their pockets since their investment is bringing about little yields.

The Bangladesh Securities and Exchange Commission (BSEC) introduced the floor price in July last year to halt the freefall of the indexes amid global economic uncertainties brought on by the war between Russia and Ukraine.

The exact volume of margin loans in the stock market is hard to come by. A number of officials of the DSE and the BSEC put the figure at Tk 15,000 crore.

The interest rate on margin loans was 12 to 14 percent a couple months ago and it now stands at 15 to 17 percent. The rate is slightly lower for high-net-worth investors, according to a number of brokers and merchant bankers.

“Most of the market intermediaries and investors who are not involved in any price manipulation are now in a painful situation as their investments have remained stuck,” said Md Moniruzzaman, managing director of Prime Bank Securities.

“The investors who have taken margin loans are facing serious problems since their debt is rising whereas they are not being able to generate any income.”

He requested the BSEC to lift the floor price gradually so that the market could absorb the shock that may stem from the withdrawal of the artificial support measure rarely seen in other markets.

Al-Amin, an associate professor of the accounting and information systems department at the University of Dhaka, said margin loans are generally used to buy sound stocks but most of the good securities are stuck at the floor price.

“Under the circumstances, the rising interest rate will add to investors’ woes,” he said, adding that intermediaries normally cut interest rates during challenging times in a bid to give relief to investors.

Prof Al-Amin said he does not support any artificial mechanism and urged the regulator to lift the floor price gradually.

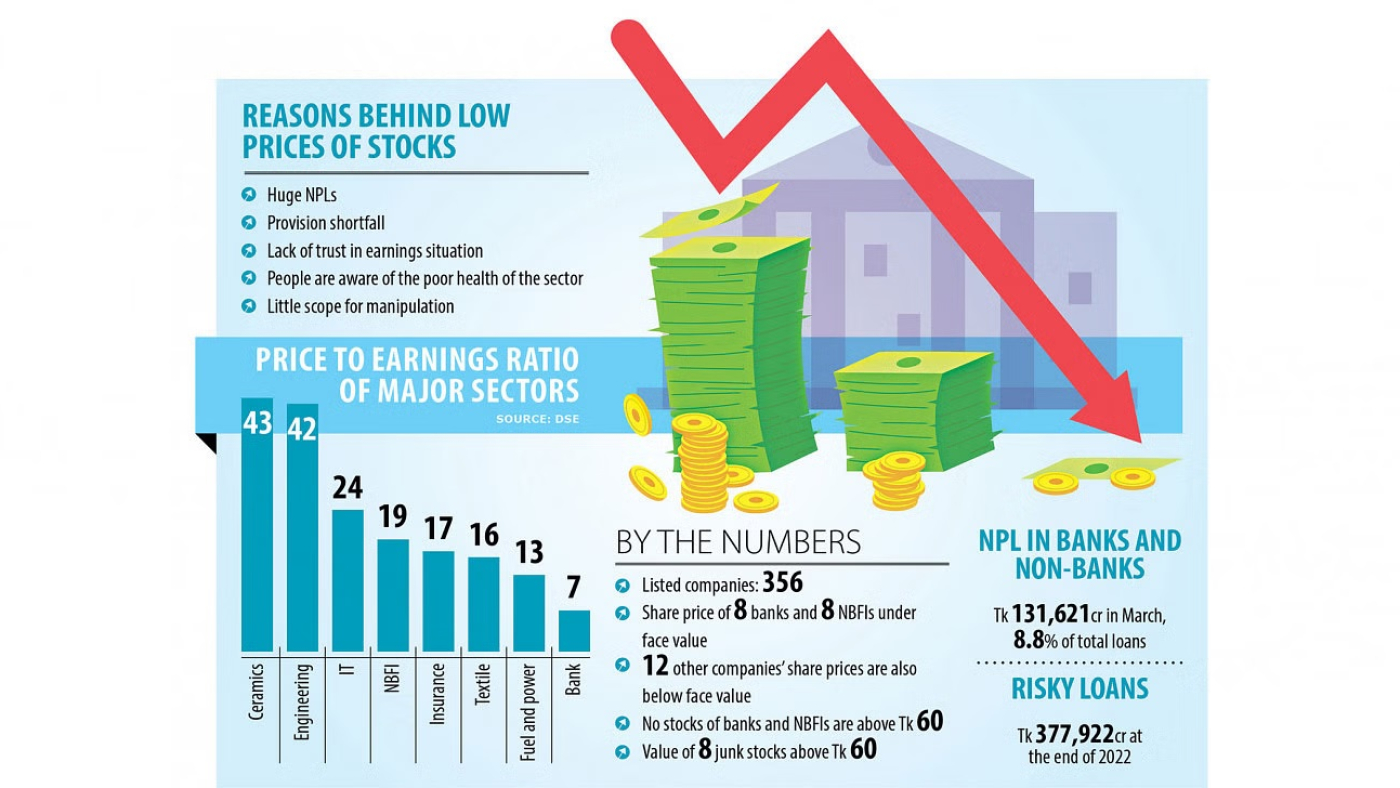

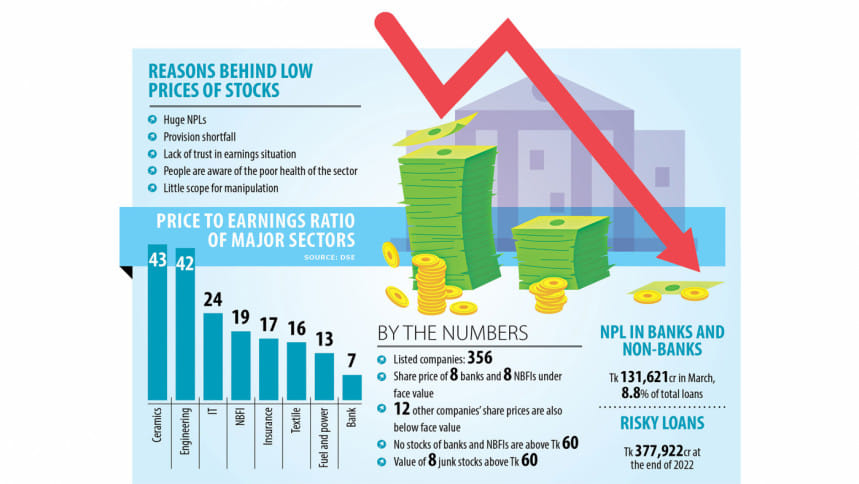

Though good companies are struggling to attract buyers, low-paid-up capital-based firms and junk stocks are witnessing an increased level of trading activity.

“The BSEC should eliminate price manipulation so that people’s confidence in the market gets a boost,” Prof Al-Amin said.

The current situation is hurting brokerage firms and merchant banks as well.

“Banks are not interested in extending any funds to brokerage firms or merchant banks that could be used as margin loans even if the rate is higher,” said Md Sayadur Rahman, president of the Bangladesh Merchant Bankers Association.

“As banks have increased the interest rate, intermediaries have had no other way but to raise the interest rate on margin loans.”

He suggested investors not invest by taking margin loans as it is an equity market.

Source: The Daily Star