BSEC ordered DSE’s Chief Technology Officer Md Ziaul Karim on compulsory leave due to technical problems

The Dhaka Stock Exchange (DSE) experienced major disruptions yesterday due to a technical glitch, which sent indices into disarray, leaving investors in the dark about the market trend and heavily impacting turnover.

The daily turnover at the country’s premier bourse plummeted by 32%.

Errors stemmed from inaccurate data input from the index management department of the DSE into the trading system while adjusting the share price of Aamra Network following the issuance of rights shares, according to exchange officials.

ATM Tariquzzaman, managing director at the DSE, told The Business Standard that while there have been several technical glitches in the exchange before, this is the first instance of a glitch occurring during the adjustment of a company’s share price.

“Due to incorrect data input from the index department in the software, problems have arisen in the index calculation system. Our IT department is currently in contact with the software provider Nasdaq to resolve this issue,” he added.

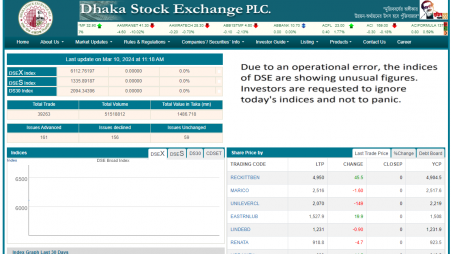

The DSE website showed at 10:10am that the benchmark index had dropped by 6,123 points or 99.99% from the previous day.

It also showed that within the first 10 minutes of the exchange’s opening, shares of 226 companies had already been traded, with 159 stocks witnessing an increase.

It’s noteworthy that DSE manually inputs information into the trading system.

“We often overlook precautions when trading proceeds smoothly, but whenever issues arise, we scramble.” Professor Mohammad Kaykobad, Computer science department at Buet

As soon as the DSE learned about the technical issue, it reset all indices to zero. Additionally, on its website, the exchange issued a notice stating its inability to display index changes due to technical errors and requesting investors not to panic.

The benchmark index showed a negative 5,971 points, or 97.68%, down at the end of the trading session.

Although the index showed unusual data throughout the trading hours, the DSE website showed that after evening, DSEX declined by 37.52 points to settle at 6075, the DS30 index fell by 10.47 points to 2083, and the DSE Shariah index fell by 10.93 points to settle at 1322.

ATM Tariquzzaman said at 7:30pm, “It has not been possible to fix it completely yet. Efforts are on to solve it in collaboration with Nasdaq. The problems will be resolved after the exchange gets ready for transactions on Monday.”

Professor Mohammad Kaykobad, from the computer science department at the Bangladesh University of Engineering and Technology, said, “We often overlook precautions when trading proceeds smoothly, but whenever issues arise, we scramble.”

“In such instances, we should maintain constant vigilance for potential glitches. A simple technical malfunction can lead to significant financial losses for investors,” Kaykobad, also a former director of the DSE, told TBS.

According to the DSE, the technical glitches are not the first. Owing to the glitches, in October 2022, the DSE halted trading for more than three hours.

BSEC ordered DSE’s Chief Technology Officer Md Ziaul Karim on compulsory leave due to technical problems.

The post of CTO has been vacant since then. General Manager Md Tariqul Islam is performing the duty of acting CTO. Not only had those glitches, but on a bullish session on July 18 July 2021, user overload triggered a standstill of the DSE trading engine that resulted in a 111-minute halt.

On 19 March 2020, the bourse had to start trading at 2pm for half an hour as it was struggling to adjust the bottom circuit breaker that suddenly changed due to the unforeseen imposition of the floor price for individual scrips in the evening.

Meanwhile, trading at the Chittagong Stock Exchange remained normal.

Steps taken

DSE has constituted a three-member inquiry committee to look into the cause of the technical glitch, which has been asked to submit a report within the next three days.

Sattique Ahmed Shah, chief finance officer of the DSE, has been made convener of the inquiry committee.

Besides, the Bangladesh Securities and Exchange Commission (BSEC) has also set up a two-member inspection team. The committee members spoke to the departments concerned and officials of DSE on Sunday.

The committee has been asked to submit its report within the next three days.

DSE suspends Aamra Networks trades

The DSE suspended the trading of shares of Aamra Networks on Sunday.

Also, the exchange cancelled all of Sunday’s executed trades for the company.

The trade suspension was for the greater interest of the capital market and to ensure proper representation of DSE indices, says the DSE on its website.

The Dhaka bourse said the trading of Aamra Networks will resume on Monday after taking corrective measures.

It also said indices were showing some unusual figures while taking corporate action for the rights entitlement of Aamra Networks in the system due to an operational error.

Source: The Business Standard