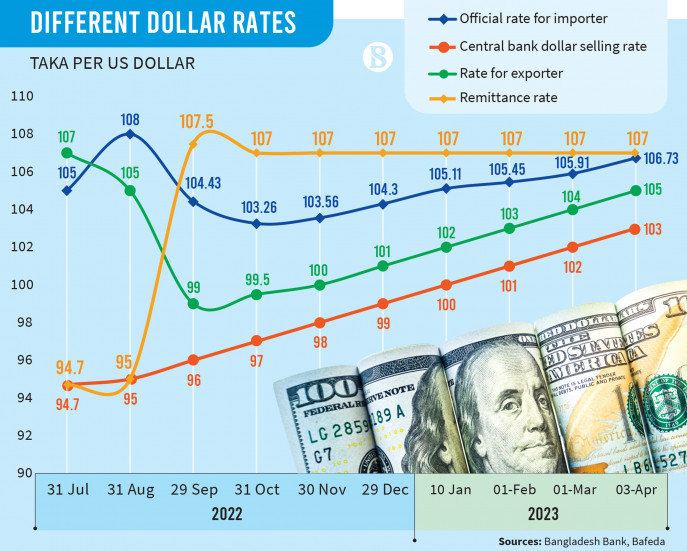

Dollars from central bank reserve now sells at Tk103, up Tk1 from the previous adjustment in March

Taka has been devalued against the US dollar yet again. The Bangladesh Bank made the adjustment on Monday to sell dollars from its reserve at Tk103, which was Tk102 until Sunday.

With the latest adjustment, the greenback price has increased 14 times since the beginning of FY23 amid depleting foreign exchange reserves.

The central bank supplied $70 million to different banks at the new rate on Monday, according to official data, while the total release of dollars from the reserve in the current fiscal year amounted to $10 billion.

The country’s foreign exchange reserves now stand at a little more than $31 billion.

Earlier, the Bangladesh Bank sold $7.62 billion in FY22 after it bought around $8 billion from banks amid low imports and high remittance inflows in the pandemic-hit FY21.

Despite the repeated increases in prices, the supply of greenback from the reserve has been on the decline as the central bank is desperate to maintain a standard amount of foreign currency reserves.

“We do not receive the amounts of dollars we are asking from the central bank. As a result, we are forced to depend on high-priced dollars from markets,” a senior official of the treasury department of a state-owned bank said.

Another official from the central bank told The Business Standard that the Bangladesh Bank wants to reduce the gap in dollar prices, which is why it has been continuously raising the rate.

Both officials wished to remain unnamed as they are not authorised to talk to the media. They also hinted that the selling price of dollars from the reserve may increase further in the next few months.

Bangladesh Bank Governor Abdur Rouf Talukder earlier said the difference between market and central bank dollar prices will be brought down in phases.

“We are already close to implementing rational rates of dollars, which means all rates will be within a 2% difference. The central bank selling rate is still lower, we will gradually make it market-based,” Bangladesh Bank Spokesperson Md Mezbaul Haque told reporters last Sunday.

Several rates of dollars exist in markets, which the Association of Bankers Bangladesh and the Bangladesh Foreign Exchange Dealers Association revise from time to time. According to its latest revision, the rate is Tk105 for export proceeds and Tk107 for remittance.

Many banks, however, do not follow the rates for collecting remittance dollars; As many as 20 banks are now offering up to Tk114 per dollar for that.

On Monday, the average rate for import payments was fixed at Tk106.73 per dollar following the authorities’ instruction. Importers, however, said they were charged up to Tk115 for a dollar. Banks traded dollars among themselves at the highest rate of Tk107, as of Sunday.