The Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) rose on Sunday, coinciding with the reappointment

Bangladesh Securities and Exchange Commission (BSEC) Chairman Shibli Rubayat-Ul Islam said the capital market will operate at its own pace, promising strict measures to make the market stable and vibrant.

Apart from ensuring strict governance in the market, Shibli, a banking and insurance professor at Dhaka University, expressed a commitment to taking strict action against those who engage in foul play.

During an interview with The Business Standard over the phone after his reappointment for another four years, he also outlined various plans.

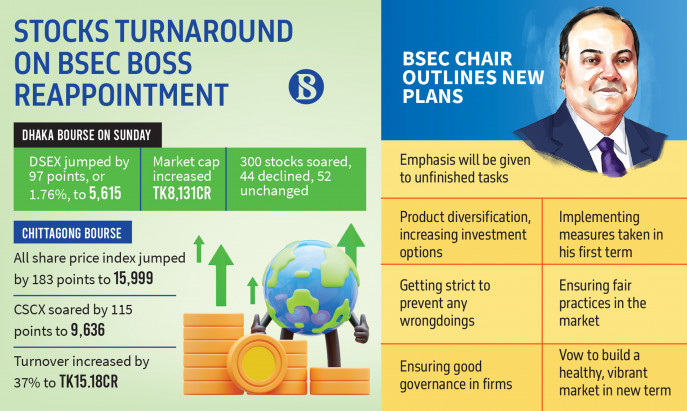

Meanwhile, the Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) rose on Sunday, coinciding with the reappointment.

DSEX, the benchmark index of the DSE, jumped by 97 points, while turnover soared to Tk613.95 crore. In addition, most stocks surged, and their market capitalisation also increased significantly.

Before this, the capital market was experiencing a continuous decline, and shares of companies were also falling, prompting investors to form a human chain in Motijheel.

The Financial Institutions Division published a gazette on Sunday appointing Shibli for a second term, about 15 days before the expiry of his first four-year tenure. Earlier, he served Sadharan Bima Corporation as its chairman.

The market is now awaiting to see whether the existing commissioners – two of whom will have their tenure expire in May, and one in June – will be reappointed or if new faces will be brought in to replace them. The tenure of the fourth commissioner will end in the middle of next year.

During his first term, which began in 2020, there were allegations against the commission that it did not take action against manipulators who were behind unusual jumps in junk shares. Additionally, the market did not receive fundamentally sound initial public offerings.

Shibli said, “A group of unscrupulous participants manipulates the capital market. They influence the market at their will, both positively and negatively, leaving ordinary investors to suffer. During the last four years, we have identified unscrupulous market participants. The commission is working on the matter, action will be taken against them.”

“Not only that, the capital market will continue at its own pace. If anyone tries to manipulate, they won’t be spared,” he vowed.

Stating it is his last term, he said, “Now there is no issue of re-renewal. So the main focus will be to build a healthy and vibrant capital market.”

After assuming responsibility for the first phase, “I could not work on the market due to the Covid epidemic, the Russia-Ukraine war, and foreign exchange volatility. Whenever I have undertaken any new initiative, I have not been able to stabilise the capital market due to external factors.”

He said, despite the external factors, the commission has emphasised product diversification instead of only equity dependence.

He mentioned the introduction of trading in bonds, government Treasury bills, and bonds in the secondary market. The commodity exchange market and the real estate investment trust (REIT) are awaiting launch.

Regarding the establishment of governance in listed companies, he said, “Investors’ interests cannot be protected if there is no good governance in companies. Keeping it in view, independent directors have already been appointed in several companies.

He said the commission will protect the interests of investors, and more initiatives will be taken to build investor confidence.

Stocks break a three-day losing streak

Stocks ended a three-day losing streak on Sunday. Stocks opened on a positive note, but ten minutes later, DSEX turned red and continued until 10:30am.

When the circular announcing Shibli’s reappointment was published, stocks began to rebound and ended with a significant jump in indices and a slight increase in turnover.

EBL Securities, in a daily commentary, said the benchmark index of the DSE settled in green territory, breaking a three-day losing streak, as opportunistic investors took positions in certain scrips, particularly large-cap scrips, which seemed lucrative following the substantial corrections.

The market experienced dominance of the buyers since the beginning of the session, where the news of the confirmation of the reappointment of the BSEC chairman worked as a catalyst, and such dominance of the buyers persisted throughout the session, allowing the bull to regain control after three consecutive periods of losses, reads the commentary.

However, the news of the proposal to impose a capital gain tax in the next fiscal year may pose concerns about sustaining this positive momentum in the forthcoming sessions.

The port city bourse, CSE, also settled on green terrain.

The selected indices (CSCX) and All Share Price Index (CASPI) increased by 114.5 and 183.8 points, respectively.

Source: The Business Standard