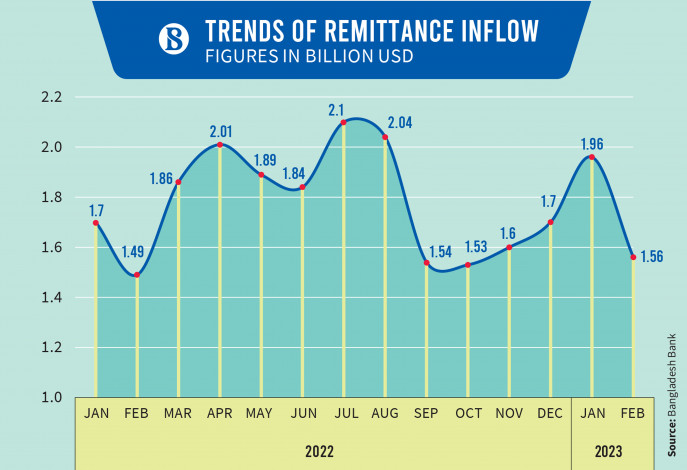

However, remittance in February this year is about 4.46% higher than the same time last year

Remittance inflows into Bangladesh dropped by about 20.29% to $1.56 billion month-on-month in February, which bankers attribute to a weaker dollar exchange rate for expatriates’ incomes.

According to central bank data released on Wednesday, Bangladesh received $1.96 billion from its expatriates in January.

According to bankers, expatriate Bangladeshis choose hundi – an informal cross-border money-transfer method – over the official banking system because it offers a lower exchange rate than the open market. Besides, February was three days shorter than January.

They expect the remittance inflows will pick up in March as expatriates send a large amount of remittances to cover household expenses back at their home before fasting begins later this month.

Still, February’s remittances were about 4.46% higher than $1.49 billion in the same month of 2022.

The total remittance inflow in the first eight months of the current financial year is $14.01 billion, up from $13.43 billion during the same period of the last financial year.

According to central bank data, in February $275 million came through state-owned banks, $38 million through specialised banks, $124 million through private banks, and only $6 million through foreign banks operating in Bangladesh.

In February, seven banks – BDBL, Rajshahi Agricultural Development Bank, Bengal Commercial Bank, Community Bank, Habib Bank, the National Bank of Pakistan, and the State Bank of India – could not collect any remittance.

In July and August, remittance inflows were $2 billion on average. It, however, fell to $1.5 billion in the next three months after the central bank authorised the Association of Bankers, Bangladesh and the Bangladesh Foreign Exchange Dealers’ Association to set dollar rates for export-import transactions in the private sector and remittance earnings.

However, the government and the central bank have taken several initiatives to increase the flow of remittances. At present, the dollar rate for remittances coming through the banking channel is Tk107. Also, expatriates are getting an incentive of 2.5% per dollar.

Besides, there are instructions not to charge remittance fees for all the banks that have exchange houses abroad.

Besides, in a recent instruction, the central bank said remitters would not have to make any declaration to send remittances up to $20,000. According to the Guidelines for Foreign Exchange Transactions 2018, a declaration is not required for inward remittances up to $10,000 or its equivalent.

According to the treasury heads of several banks, one of the reasons for the decrease in remittances is that the rates are lower compared to the open market. Currently, the dollar rate in the open market is Tk112-14.

An official of the related department of the Bangladesh Bank said, “I can say from my long experience that remittance inflows drop a month before Ramadan. Because expatriates send more remittances in the week before Ramadan begins to cover family expenses during fasting. Remittances will increase this month.”

Data from the Bureau of Manpower, Employment, and Training shows that in 2022, about 11.35 lakh new people went abroad for overseas employment, compared to six lakh in the previous year.