Power Grid Company of Bangladesh has finally decided to issue shares against the share money deposit it has been taking from the government for years to finance various projects.

Share money deposit is basically the amount paid for shares that have not been issued yet.

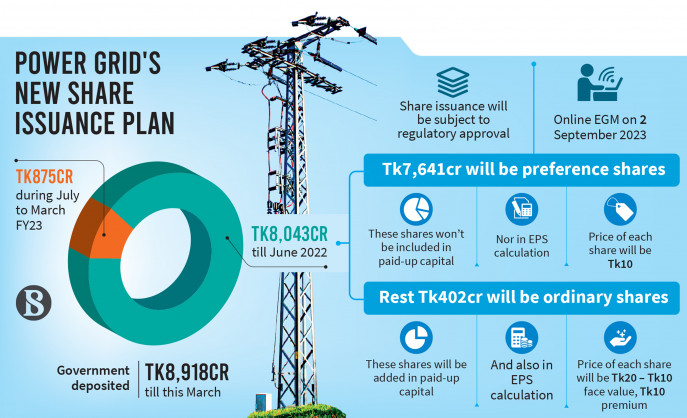

Till this March, the total share money deposit of the state-owned power producer stood at Tk8,918 crore – the highest for any listed firm.

Of the amount, Tk8,043 crore piled up till June last year. Power Grid wants to issue both ordinary and preference shares against this amount in favour of the secretary of the power division.

The remaining Tk875 crore came during the July to March period of the fiscal 2022-23.

The issuance of both types of shares is subject to approval by the Bangladesh Securities and Exchange Commission (BSEC) and also the shareholders. For shareholders’ approval, the company has scheduled an extraordinary general meeting (EGM) on 2 September 2023.

Also, the company said in a stock exchange filing that it wants to increase its authorised capital to Tk15,000 crore, which is now Tk10,000 crore.

Why issue both types of shares

Power Grid’s Company Secretary Md Jahangir Azad told The Business Standard, “To finance various projects, we have taken money from the government for many years as share money deposits.”

“But issuing only ordinary shares against the whole amount would increase the number of shares, and in turn, impact the earnings per share (EPS).”

Currently, Power Grid’s paid-up capital is Tk71.27 crore which would also increase if only ordinary shares were issued.

Therefore, so that the EPS is not heavily impacted, a large number – 764.1 crore – preference shares, and only 20.1 crore fresh ordinary shares will be issued.

This will benefit both the company and its shareholders, said the company secretary.

The ordinary share equation

The company’s board has decided to issue 20.1 crore new ordinary shares at Tk20 per share. Of the share price, Tk10 will be the face value and Tk10 premium. Therefore, the total value of the shares will be Tk402 crore.

These shares will be added in the company’s paid-up capital, and in the calculation of EPS.

At the DSE, Power Grid shares closed at Tk52.4 apiece – much higher than what will be offered – on Wednesday.

About this, Md Jahangir Azad said this money has been taken from the government for many years, and back then, the share price was low.

“Thus, general shareholders won’t be harmed even though the shares are offered at a price less than the current market price,” he added.

The preference shares

A large portion – Tk7,641 crore – of the Tk8,043 crore will come from issuing 764.1 crore preference shares at a face value of Tk10 each.

The nature of these shares will be irredeemable and non-cumulative.

Company officials said issuance of such shares will be more flexible than the ordinary shares.

Because the proposed conditions imply that if Power Grid posts higher profits, the government will get dividends against preference shares. On the other hand, if the firm turns a loss, then there will be no dividend.

As the shares are irredeemable, they will not raise the firm’s paid-up capital, and because of their non-cumulative nature, the company will not have to pay the government any previous year’s unpaid preference share dividends.

Unlike ordinary shareholders, preference shareholders are not the owners of the company. But they enjoy a priority over ordinary shareholders in getting dividends and redemption rights in case of bankruptcy.

Source: The Business Standard