It will enter the capital market with a face value of Tk10 per share

NRB Bank is set for its trading debut on the country’s stock market on Tuesday, with investors anticipating significant returns from the very first day.

The fourth-generation bank, with the majority of its shares owned by non-resident Bangladeshis, will enter the capital market with a face value of Tk10 per share.

The managing director at a brokerage firm told The Business Standard that the private sector lender witnessed a remarkable response to its initial public offering (IPO) subscription, with the subscription amounting to 3.91 times higher than the allocated shares.

He also noted that investors have received favourable returns from recent IPO shares like Best Holdings and Sikder Insurance. As a result, investors are expecting promising returns from NRB Bank shares as well.

General investors were allotted 255 primary shares in NRB Bank, while non-resident Bangladeshis received 209 shares against a Tk10,000 deposit.

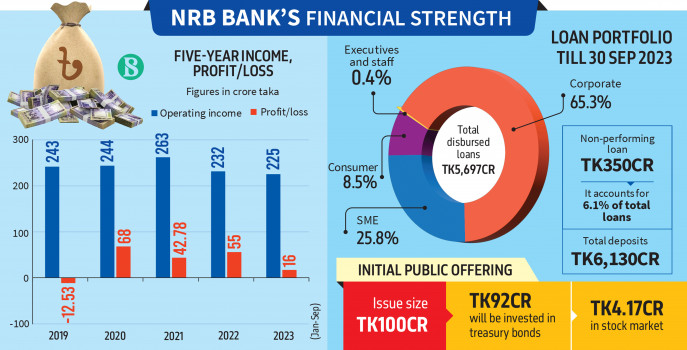

Earlier, on 9 November, the bank received approval from the Bangladesh Securities and Exchange Commission (BSEC) to raise Tk100 crore.

The lender plans to invest Tk92 crore in government securities, Tk4.17 crore in the secondary market, and the remainder to cover IPO expenses.

However, other fourth-generation banks that were listed in recent years failed to meet investors’ expectations, as they did not generate significant returns from their IPO shares.

Global Islami Bank and Union Bank are currently trading below their face value of Tk10 each, while Midland Bank, SBAC Bank, and NRB Bank shares are hovering between Tk12 and Tk14.

What EBL Securities says

One of the leading brokerage firms, EBL Securities, published a report on the financial strength of NRB Bank on its website on 25 February.

The broker noted that NRB Bank exhibited a 5-year compound annual growth rate (CAGR) of 16% in loans and advances and 18% in deposits from 2018 to 2022.

These figures surpass the industry average of 12% for loans and 10% for deposits, indicating the bank’s strong performance in deposit mobilization and loan disbursements.

The bank has the potential to further enhance its interest rate spread and net interest margin by strategically minimising the cost of funds, the report added.

But investors have concerns about the bank’s profitability due to surging non-performing loans.

The EBL Securities report highlighted a potential concern for investors, noting that the non-performing loan ratio of the bank rose significantly to 6.1% by September of last year, compared to 3.2% in 2022.

Furthermore, the report emphasised that the return on assets and return on equity of the bank are considerably lower than the industry average. This suggests that the bank has encountered notable challenges in effectively utilising its assets to generate satisfactory returns for its stakeholders.

Source: The Business Standard