The country’s foreign currency reserves have dipped to $29.78 billion amid a dollar crisis

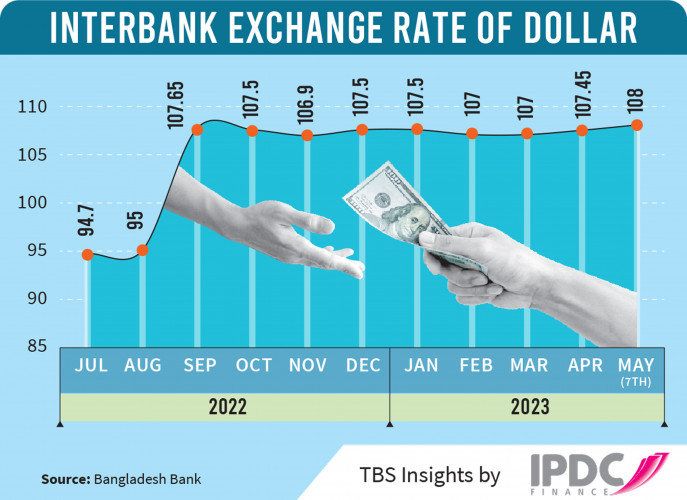

The interbank dollar rate, at which one bank sells dollars to another, rose to a record Tk108, but transactions on the platform were poor due to a shortage of greenbacks in the country.

And the country’s foreign currency reserves have dipped to $29.78 billion.

According to data from the central bank, banks on Sunday transacted dollars among themselves between Tk107.30 and Tk108.

The interbank dollar rate had risen to Tk107.65 at its highest earlier.

According to bankers, the interbank dollar rate has risen mainly due to an increase in remittance rates.

Earlier on 30 April, the Association of Bankers Bangladesh (ABB) and Bangladesh Foreign Exchange Dealers’ Association (Bafeda) raised the dollar rate by Tk1 to Tk108 for remitters.

ABB Chairman and Managing Director of Brac Bank Selim RF Hussain told TBS that dollar transactions in the interbank market are now much lower than before.

“One of the reasons for the decrease in dollar transactions in the interbank market is that the dollar market is not yet free-floating. If the market is not free-floating, it is normal for the interbank market to be inactive,” he added.

Earlier, the dollar rate of remittance was Tk107 for about six months, although several banks have brought remittances with higher rates in March.

Since September last year, these two platforms of banks’ managing directors have been fixing the dollar price for export proceeds and remittances.

According to senior officials at several banks, at the beginning of 2022, when there was no dollar crisis in the country, the interbank platform used to see an average daily transaction of $15-25 million.

However, as the dollar crisis intensified in the middle of last year, its interbank transactions started to decrease. Due to an obligation to trade dollars on the interbank platform at its selling rate from the reserves, the transactions almost stopped at one stage, they added.

Later in September, transactions on the interbank platform resumed after the central bank allowed banks to transact at a rate determined based on the rate for remittances.

Senior officials from several private banks, who wished to remain anonymous, have stated that even if the dollar rate of remittance is considered the base rate, it is still much lower than the active market rate. Although a maximum charge of Tk0.50 can be added to the remittance rate.

Besides, banks do not have enough dollars to sell. Due to the dollar crisis, they have reduced the opening of import letters of credit. So banks are now doing interbank dollar transactions on request from other banks. Currently, an average of $1.5-2 million is transacted on this platform every day.

According to a Bafeda report, banks traded $1 million at the rate of Tk107.30 and $50,000 at the rate of Tk108 on the interbank system on Sunday.

Forex reserves stand at $29.78 billion

After clearing the import bills of the Asian Clearing Union (ACU), the country’s foreign currency reserve stood at $29.78 billion on 7 May, according to Bangladesh Bank Spokesperson Md Mezbaul Haque.

He told The Business Standard that the Bangladesh Bank has cleared import bills of $1.18 billion for the ACU.

The ACU payment gateway covers monetary transactions by its nine member countries – Bangladesh, Bhutan, India, Iran, the Maldives, Myanmar, Nepal, Pakistan, and Sri Lanka – for regional imports. The bills are cleared every two months.

Earlier in March, the central bank cleared $1.05 billion in import bills to the union, which brought down the reserves to $31.15 billion.

Source: The Business Standard