Richard de Rosario, president of the DSE Brokers Association, told TBS, “Institutional investors have been suffering losses after their deposits got stuck in Asiatic’s account following the suspension of the company’s IPO. If the investors had that money they would invest it in the capital market, benefitting both themselves and the capital market, but now they cannot do that.”

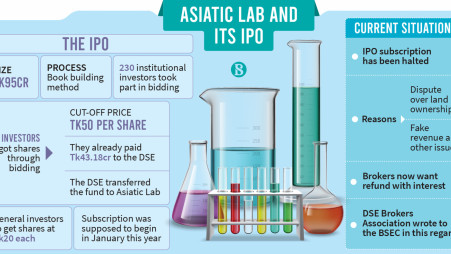

Institutional investors who bid for Asiatic Laboratories’ initial public offering (IPO) shares through book-building method have demanded their deposits back as the subscription process has been held up by the securities regulator since January this year.

The securities regulator suspended the subscription process after receiving a complaint that the company overstated in fixed assets.

Around Tk43.18 crore of 92 institutional investors who participated in the bidding is stuck in a Dhaka Stock Exchange (DSE) account for around a year, said sources.

An institutional investor is a company or organisation that invests money on behalf of other people. They include asset management companies, brokerage houses, merchant banks, etc.

The DSE Brokers Association of Bangladesh – a platform of trading right entitlement certificate (TREC) holders of the premier bourse – sent letters in this regard to the Dhaka Stock Exchange and the Bangladesh Securities and Exchange Commission (BSEC) last month.

The auction to determine the cut-off price of Asiatic Laboratories’ shares was held in October 2022. Institutional investors deposited money to the DSE’s account to participate in the bidding process at that time. The DSE then transferred the money to Asiatic’s account. The securities regulator suspended the company’s IPO subscription process in January this year.

Richard de Rosario, president of the DSE Brokers Association, told TBS, “Institutional investors have been suffering losses after their deposits got stuck in Asiatic’s account following the suspension of the company’s IPO. If the investors had that money they would invest it in the capital market, benefitting both themselves and the capital market, but now they cannot do that.”

“The BSEC has held up the IPO subscription, but a final decision should be taken on the matter. Due to the downturn in the capital market, institutional investors are desperate to get their money back,” he added.

In the book-building method, institutional investors participate in the bidding process for IPO shares by depositing money to the DSE’s bank account. The DSE keeps the money of the bidders who get share allotment and return the other bidders’ money.

The investors’ money then is transferred to the company’s bank account. The company can start spending it in the areas stipulated in its prospectus after its stock market listing.

Why the IPO subscription was held up

On 15 January, the BSEC held up the electronic subscription of Asiatic Laboratories’ IPO shares until further notice.

The decision was taken due to some complaints against Asiatic Laboratories, the gravest of which were regarding overstatement of the company’s fixed assets, and dispute over its ownership.

The securities regulator has formed an enquiry committee to look into the matters, but they have not made a decision regarding its IPO.

The Financial Reporting Council (FRC) has found that Asiatic Laboratories overstated the value of its properties. Market insiders said the pharmaceutical company did that in an attempt to obtain better prices for its shares.

The council submitted its findings to the commission.

In August last year, the securities regulator allowed Asiatic Laboratories – a manufacturer of pharmaceutical products – to raise Tk95 crore through IPO under the book-building method.

The company said in its IPO prospectus that it will use the fund to begin producing anti-cancer drugs.

Of the Tk95 crore, it will use Tk58.05 crore to buy and install machinery, Tk6.26 crore to build a factory, and Tk28 crore to repay bank loans.

Earlier, in a bidding through the electronic subscription system by the institutional investors, the cut-off price of the company’s shares was determined at Tk50 each.

The general investors will get the shares at Tk20 each as per the BSEC rules.

Source: The Business Standard