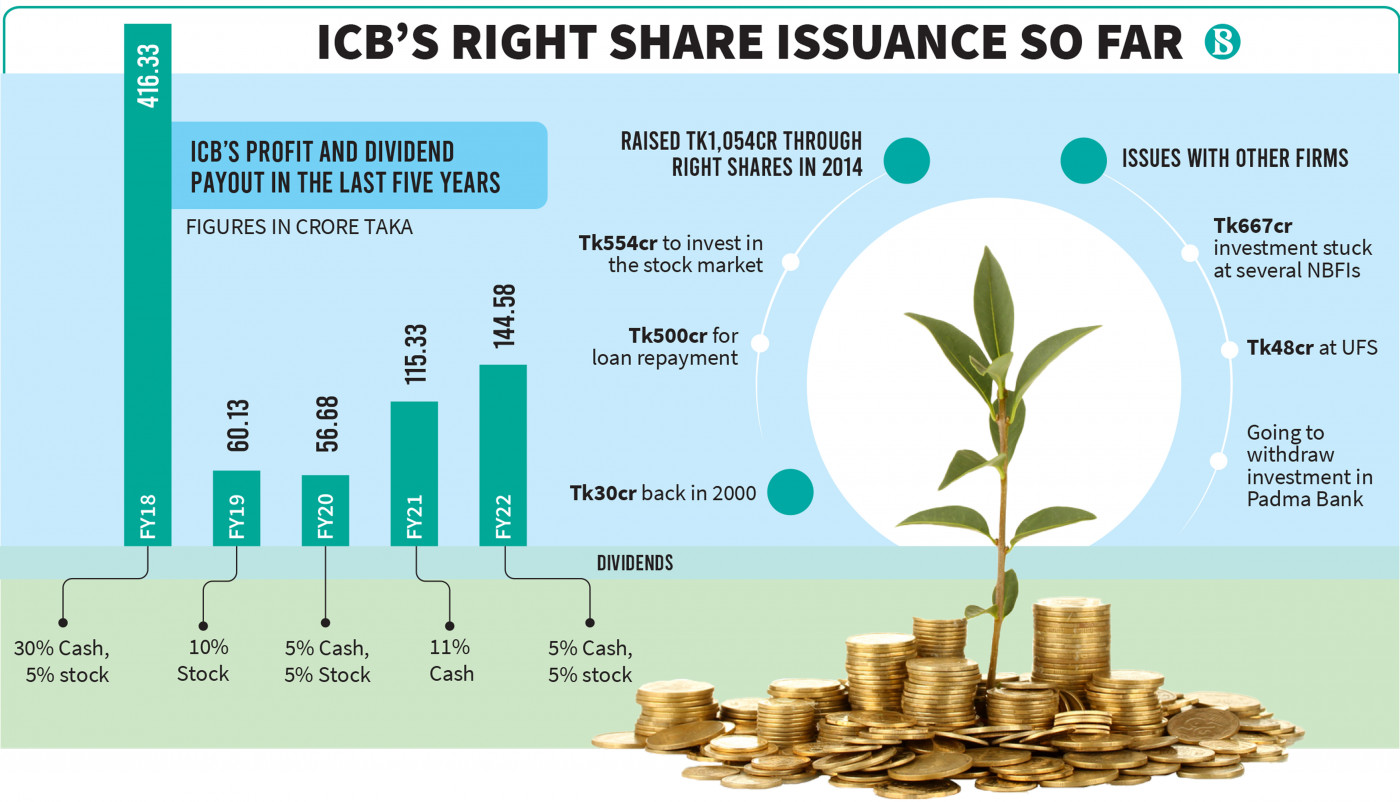

In 2014, ICB raised Tk1,054 crore through issuing right shares

The Investment Corporation of Bangladesh (ICB), which has been facing a shortage of funds, intends to raise money by issuing right shares to inject fresh funds into the capital market.

On 23 January, the state-owned company formed a five-member committee in this regard.

ICB Managing Director Md Abul Hossain told The Business Standard, “The committee has been asked to submit a report after analysing the money market and capital market. The authorities will take a decision on issuing right shares after that.”

He said that the committee has been formed as part of the feasibility study before taking any decision.

“A decision cannot be taken without market verification. Because, there is no guarantee that shares will be subscribed,” he added.

Issuing right shares is an invitation to existing shareholders to purchase additional new shares in the company. This process grants the existing shareholders securities called right. With the right, the shareholder can purchase new shares at a discount to the market price on a stated future date.

Officials stated that prior to making any decisions regarding the issuance of right shares at the ICB board meeting, the approval of the shareholders is mandatory. Once secured, the corporation will then submit an application to the Bangladesh Securities and Exchange Commission (BSEC) in connection to this matter.

They said that ICB will utilise the funds collected from the right shares by investing them in the capital market. At present, it is unable to sell its shares due to the floor price restriction imposed by the regulators.

In the first half of the current fiscal, from July to December, the profit of ICB declined drastically as they failed to gain capital from share sales.

Meanwhile, around Tk667 crore of the corporation has got stuck in different non-bank financial institutions due to bad investment choices.

Md Abul Hossain said, “Some institutions have already renewed their contract by paying the interest and some companies are yet to do so. We are trying to recover the capital.”

The ICB has fallen into another woe as the Universal Financials Solution’s (UFS) owner has fled away embezzling around Tk158 crore.

According to its latest annual report, the ICB has invested Tk48 crore in three mutual funds under the UFS asset management company.

In 2014, ICB raised Tk1,054 crore through issuing right shares.

At that time one right share was issued against every two shares. Each share was issued at Tk500 with an issue price of Tk100 and a premium of Tk400.

It invested Tk554 crore from the amount raised in the stock market and Tk500 crore was used to repay loans.

Seeking anonymity, an official of the Bangladesh Securities and Exchange Commission told TBS, “The commission is taking new initiatives to increase liquidity in the market. As a result, initiatives are being taken to increase the capacity of ICB. In the current situation of the capital market, the commission has taken the initiative of issuing right shares positively.”

Keeping depository funds out of exposure limits

ICB collects funds in the form of term deposits from public and private banks for investment in the capital market, which is calculated in the exposure of the respective banks.

Recently, ICB requested the Bangladesh Bank to keep term deposits out of exposure due to a fund crisis.

Senior officials of ICB held a meeting with the central bank to get this facility. However, the central bank has not announced any decision in this regard.

Md Abul Hossain said, “Banks will be keen to invest in ICB if depository funds are kept out of exposure. And if funds are available, ICB can increase investment in the capital market. Besides, ICB has also sought Tk1,000 crore from the central bank.”

According to the financial report of ICB, till June 2021-22 FY, the corporation has raised a capital of Tk5,774 crore as term deposits from different banks and non-bank financial institutions, which is 17% less than the previous year.

In the first half of the current financial year, ICB’s profit fell by 67% to Tk46.50 crore due to a decrease in capital gain.

At the same time in the previous fiscal, its net profit was Tk140.08 crore.

Its capital gain from shares has declined by 59% to Tk208.61 crore in July-December 2023, which was Tk512.31 crore at the same time in the previous fiscal.