The pending money, along with the barrier to borrowing from the call money market, kept non-bank financial institutions in a liquidity crisis for long

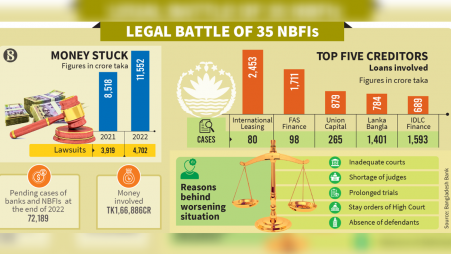

Around Tk11,552 crore of non-bank financial institutions (NBFIs) is stuck in 4,702 lawsuits with the money loan court – formally known as Artha Rin Adalat – as of 31 December 2022, according to the latest Bangladesh Bank data.

Of the amount, the top five out of 35 creditors have some Tk6,500 crore, more than half of the claimed money.

Sector insiders said the gradual rise in cases, inadequate courts, shortage of judges, prolonged trials, stay orders from the High Court, and absence of defendants are the key reasons behind the worsening situation.

The number of cases filed by NBFIs with the court was 3,919 involving Tk8,518 crore at the end of 2021. The case number increased by 783 and the claimed amount rose by Tk3,034 crore over the next year, the central bank report said.

“The number of pending cases in the money loan court has been on a gradual rise but the number of courts and judges remain limited. Moreover, loan defaulters look for various tactics to delay trials. They even remain absent in hearings day after day,” said Kaiser Hamid, managing director and chief executive officer of Bangladesh Finance.

“As a consequence, the trial process is delayed and financial institutions suffer. On top of that, defaulting customers have the option of seeking bail from the High Court by depositing a certain portion of their loans, which they often misuse,” he told The Business Standard and added that various types of complications in settling cases at the money loan court are also in place.

Bangladesh Bank Panel Lawyer Ruhul Amin Bhuiyan echoed the same. “The trial process at the money loan court is time-consuming for several reasons. Taking a long time in issuing summons and defendants’ move to the Higher Court are the key causes,” he told TBS.

“In many cases, creditors even fail to recover their money after the settlement at the money loan court due to forgery on documents. When they [lenders] attempt to recover their money from the mortgage kept against loans, they find that the security [asset] is overvalued. Big borrowers commit such irregularities with the connivance of officials,” Ruhul Amin said and noted that lenders do not cross-check documents before granting loans in some cases.

“Besides, owners of banks and non-bank financial institutions also take loans, when officials are forced to follow their instructions. This is a big problem for this sector,” he added.

The pending money, along with the barrier to borrowing from the call money market, kept non-bank financial institutions in a liquidity crisis for long, sector insiders said.

The central bank on 1 February instructed non-bank financial institutions not to borrow from the interbank call money market. Instead, NFBIs were asked to raise long-term funds by issuing bonds.

The Bangladesh Bank report also said the number of pending cases at money loan courts, including those of banks, reached 72,189 involving Tk1,66,886 crore at the end of 2022, up 3,918 cases involving Tk23,192 crore year-on-year, amid surges in deflated loans.

Of the amount, state-owned banks claimed the highest Tk71,764 crore, specialised banks Tk2,468 crore, private banks Tk88,858 crore and foreign banks Tk3,795 crore.

“Although the money loan court settled a lot of cases involving a huge amount of money, the recovery has been nominal, which means that there is weakness in our financial system,” said Ahsan H Mansur, chairman of Brac Bank and director of the Policy Research Institute of Bangladesh.

“Banks do not lend to good customers, which is why borrowers become defaulters after some time. Besides, the security [mortgage] that is kept against loans is often considered higher value than actual,” he said, while adding if borrowers go bankrupt or die, lenders fail to recover money from the mortgage.

According to the Ministry of Finance, the money loan court settled 2,22,348 cases involving Tk2,49,184 crore until December 2022 since its establishment in 2003. The Bangladesh Bank data said the amount of defaulted loans in the banking sector at the end of December 2022 was Tk1,20,000 crore or 8.16% of total banking sector loans, while it was Tk17,327 crore or 24.61% for non-banking financial institutions at the end of September 2022.