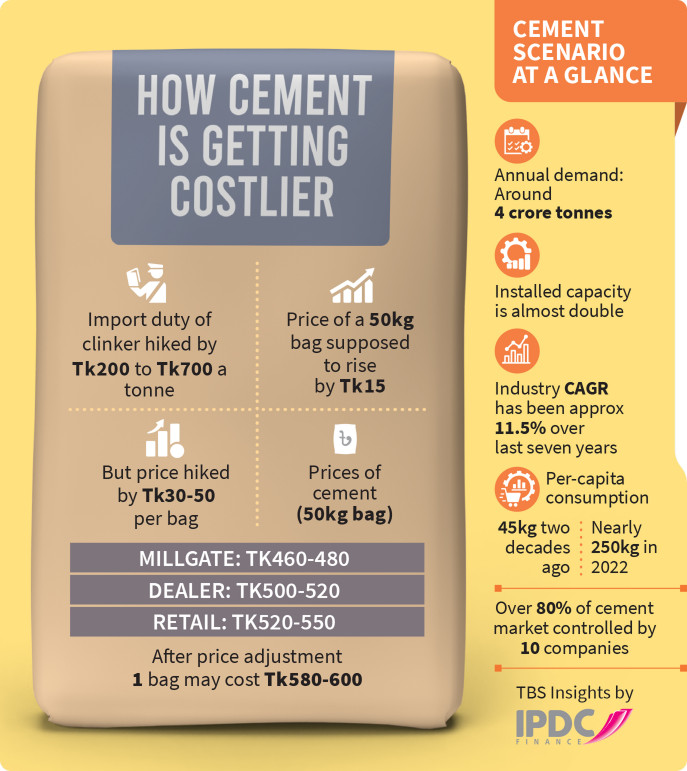

Cement prices may increase by Tk30 to Tk50 at the retail level

The duty structure proposed in the new budget is supposed to add Tk15 to the cost of production of cement per bag, but manufacturers mull a Tk30-Tk50 hike per bag at retail level, which will further increase the construction cost at all levels.

Such an abrupt rise in the price of cement, a crucial ingredient for construction work, will add to the already high costs of other building materials including rod – be it for houses, offices, roads, mega projects, or factories, builders and contractors fear.

In the proposed budget for the fiscal 2023-24, import duty on clinker, the primary raw material for cement, has been raised to Tk700 per tonne from the earlier Tk500. Besides, the new budget proposes increasing the specific rate of duty from Tk750 to Tk950 for commercial importers.

Once the cement made from the new clinker supply comes to the market, the cost of production would go up and cement prices may shoot up to as high as Tk580 per bag at the retail level from Tk550 now depending on various brands, factory owners and dealers have hinted.

This situation will make the lives of contractors miserable as they have been awarded projects prior to the increase in cement prices, as reported by contractors.

What cement makers say

The import duty on cement clinker has already been in force even before the budget for FY24 could be passed.

The customs authorities started levying the new duty rate on clinker imports on 1 June, said Barrister Badruzzaman Munshi, deputy commissioner of Chittagong Custom House.

Premier Cement Managing Director Amirul Haque told The Business Standard that they are planning to raise the price of their cement by Tk20-Tk25 per bag at the factory gate soon.

Factory owners set the price of their cement in coordination with costs which will increase according to the new import duty rate, he said.

“The dollar price has increased by about 25%, pushing various other costs to increase. These additional costs have to be included in the increase in the price of the product,” he added.

About 13,000 tonnes of their cement clinker will be released on 12 June, said Zahir Uddin Ahmed, managing director of Confidence Cement and second vice-president of the Bangladesh Cement Manufacturers Association (BCMA).

Additional money has to be paid as per the new duty rate to release the clinkers, he said.

His company too is planning to increase cement prices after the budget is passed. “We will increase the price according to the amount of additional money spent on import duties and other taxes,” he said.

Cement retailer Arman Chowdhury, owner of Fahim Traders in Chattogram, said the price of cement varies depending on the area and transportation costs at the retail level.

Several factory owners have already informed him that a price hike is coming soon, he said.

Stages of cement price

The cement industry was already under stress due to the Covid-19 pandemic, the logistics problems stemming from the Russia-Ukraine war, and the increase in shipping fares for transporting goods.

Factory owners and dealers said if the production cost jumps again, cement will be sold at Tk580 to Tk600 per bag at the retail level, badly hurting the country’s infrastructural development.

Currently, at the factory gate, cement is sold at Tk460 to Tk480 per bag.

The prices go up to Tk500-Tk520 at the dealer level.

And at the retail level, different brands of cement are sold at Tk520 to Tk550 per bag.

Spillover effects

Md Shahidullah, first vice president of the BCMA and managing director of Metrocem Cement, told TBS that they are now only able to import 40% of the clinker demand due to the dollar crisis.

“In a pre-budget discussion, I proposed that the government reduce the import duty from Tk500 to Tk200 and slash advance income tax to 0.5% from 3%,” he mentioned.

“However, not only our demands were ignored, the duty on clinkers was raised,” he said.

Industry insiders said the additional duty is a blow for the sector which is already reeling from a high tax burden, fuel crisis, increase in transport fares, and dollar crisis.

The price of almost every construction material has increased by 18%-70% in the last two years, badly affecting the country’s real estate industry, they said.

Real Estate and Housing Association of Bangladesh (Rehab)’s Chattogram chapter President Abdul Kauiam Chowdhury said that the country’s housing sector is in an extreme crisis due to the abnormal increase in construction materials.

“On top of that, the duty increase of clinkers will have a major impact on the construction industry,” he said.

Warning that the move will rather reduce the government’s revenue collection effort, Abdul Kauiam demanded the withdrawal of the additional duty.

Meanwhile, the Bangladesh Cement Manufacturers Association (BCMA) has demanded that the import duty of clinker be reduced to Tk200 per tonne.

To press their demand home, the organisation has called a press conference in Dhaka on 12 June.

BCMA representatives said customs duty stands at around 12%-13% of the import value with the new rate, which is vastly disproportionate to other imports.

What contractors say

Shafiqul Haque Talukder, former President of the Bangladesh Association of Construction Industry (BACI) told TBS the burden of higher cement prices will fall entirely on the consumer.

It will also adversely affect the ongoing government projects as the costs were estimated with previous material costs, he noted.

“Now, if the price of cement goes up, the contractors will have to spend money from their own pockets. By doing this, the flow of work in the ongoing projects will get slower,” Shafiqul Haque feared.

About 30% of the country’s total construction materials are used in government projects, according to Mezbaur Rahman Ratan, general secretary of the Bangladesh Contractors Association.

Contractors are already finding it hard to repay bank loans and pricier cement will further increase their woes, ASM Mainuddin Monem, managing director of Abdul Monem Construction Limited told TBS.

According to the data of December last year, 1,018 development projects worth 4.5 lakh crore of seven government entities were stalled due to various reasons, including the high market price of construction materials.

People concerned said those projects are still seeing slow progress.

Naimul Hassan, director of Rehab said, due to the increase in the price of materials, the construction of residential buildings in the capital has decreased by about 40% “Few housing companies are starting new projects this year.”

Cement in Bangladesh

Bangladesh has 34 cement producers. Among them, four are multinational.

These companies have the capacity to produce 10 crore tonnes of cement.

However, due to economic stress in the country, only 3.5 crore tonnes of cement was sold last year.

Over the last seven years, the compound annual growth rate of the cement industry had been approximately 11.5%.

Per capita consumption of cement was nearly 250kg in 2022, up from 45kg two decades ago.

Over 80% of the cement market is controlled by 10 companies.