Infographic: TBS

The central bank continues to utilise a potentially inflation-fuelling tool – lending money to the government by printing it – as Bangladesh continues to grapple with high inflationary pressure, the extent of which has been declining in many countries.

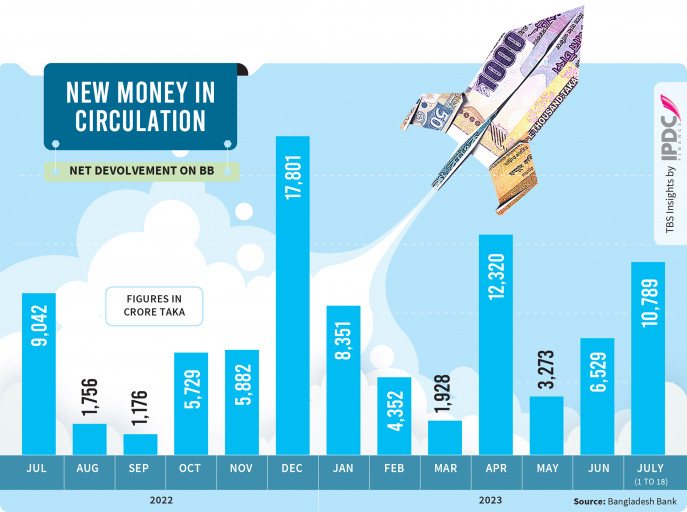

The latest data from the Bangladesh Bank reveals that in the first 18 days of July, the central bank injected Tk10,800 crore into circulation to meet the government’s expenditure needs. This surge in high-powered money comes in response to a revenue shortfall – around Tk45,000 crore – from the target and lower-than-expected foreign funds.

Significant increase in money injection

Comparing this year’s data with that of the immediate past fiscal year, it becomes evident that the amount of money injection has increased significantly. In FY23, the government borrowed Tk1,24,122 crore from the banking system, with Tk78,140 crore provided by the central bank, averaging Tk6,500 crore per month. Even in June, the last month of FY23, the central bank provided the government with Tk6,529 crore.

In contrast, during the first 18 days of the current fiscal year, the central bank has already provided Tk6,074 crore through 91-day and 364-day Treasury Bills, and an additional Tk4,715 crore through 2, 5, and 10-Year Treasury Bonds.

This process of devolving undertaken by the Bangladesh Bank involves the central bank buying treasury bills and bonds from the government instead of raising funds from commercial banks by selling treasury bills and bonds.

In FY24, the government planned to borrow Tk1,32,395 crore from the banking sector and Tk1,02,490 crore from external sources. If the government borrows from the central bank by devolvement, it means an injection of fresh money into the economy.

Crucial for cenbank to monitor financial mechanism

Economists said it is crucial for the central bank to monitor and manage these financial mechanisms carefully to mitigate the risk of exacerbating inflationary pressures in the economy.

Commenting on the central bank’s devolvement strategy, Ahsan H Mansur, the executive director of the Policy Research Institute, said it aims to keep the interest rate of treasury bills down. He also pointed out that the new landing rate formula acts as a cap, as the base rate of treasury bills is not market-based.

According to a senior official from the central bank, the Six Months Moving Average interest rate of 182-day Treasury bills (SMART) is now used as the lending rate. Also, the central bank will announce a new lending rate every month starting in July by adding a maximum of 3% with SMART.

The Bangladesh Bank aims to maintain a neutral determination process for SMART. As a result, devolvement is not being done for the 182-day Treasury Bill in July, the official said.

The official further explained that due to the immaturity of the market for the country’s bills and bonds, leaving the determination of interest rates up to the market could grant commercial banks more influence over the rates.

Another senior official of the central bank, on condition of anonymity, said, “The interest rate is being somewhat controlled through devolvement. However, as the government needs to borrow from these sources, banks are demanding higher interest rates. Therefore, the central bank is using devolvement to keep the interest rate slightly down.”

He also mentioned that the interest rate of Treasury Bills and Bonds increased slightly in July compared to June.

Borrowing from commercial banks can cause liquidity crisis

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, called money printing the opposite approach to controlling inflation.

“It is not the right time to comment on how the inflationary pressure will increase in the entire financial year due to the printing of money at the beginning of FY24. However, the government is on the same course at the beginning of the new financial year as it was in FY23. Nothing has changed here,” he said.

Borrowing money from commercial banks can lead to a liquidity crisis, Zahid said, “Borrowing from banks reduces the available money supply for lending to the private sector and this will create a crisis for businessmen. From that point of view, it is relatively easy to borrow from the central bank. Although the pressure of inflation increases on the consumers due to the borrowing.”

The huge circulation of new money caused the reserve money growth to surge to 10% this June, up from negative 0.3% in the same period last year. However, it was far lower compared to the monetary target of 14% set for the monetary policy of FY23. Though the central bank set no target for reserve money growth for the first six months of FY24, as they are trying to control the money circulation by interest rates.

The low reserve money growth is due to the central bank having withdrawn Tk1.41 lakh crore from the market by selling $13.58 billion in FY23.

According to the central bank data, net domestic asset growth was 16.17% year-on-year in May this year when net foreign asset growth was negative 15.28%.

The high growth in domestic assets is because the Bangladesh Bank is creating new money against government treasury bills and bonds, which will trigger inflation. While the negative growth of foreign assets is due to the massive dollar selling pressure which means the country is losing its capacity for foreign payment.

‘Inflationary pressure may increase’

Ahsan H Mansur of The Policy Research Institute said, “The inflationary pressure in the economy may increase due to devolvement. If Tk1 lakh crore is injected into the economy, it is transformed into Tk5 lakh crore, but it does not happen in a day. Devolvement that is being done now may take six months to 2-3 years to see its inflationary impact. That is, we will see in future the full impact of the amount of money printed in the last year to give loans to the government. People must bear the inflationary pressure due to this.”

The economist also advised the government to reduce unnecessary expenses.

‘Blame is convenient’

Sadiq Ahmed, vice chairman of the Policy Research Institute, said, “Bangladesh’s inflation continued to rise throughout FY2023 even as the global inflation rate fell sharply. Countries like the USA, Canada, EU, India, Thailand and Vietnam all experienced substantial declines in domestic inflation rates in the first half of 2023. But it was still high at 9.74% in June in Bangladesh.”

“So, blaming the Russia-Ukraine war and global inflation for domestic inflation is politically convenient but not factually true,” Ahmed said.

He said countries that saw sharp declines in domestic inflation benefited from the reduction in global energy prices, but they also took sustained demand reduction measures through targeted increases in the domestic interest rates.

Since Bangladesh did not reduce demand and instead pushed demand growth through interest control and higher fiscal deficit, it did not experience a reduction in inflation despite the reductions in global energy prices and global inflation, Sadiq Ahmed added.