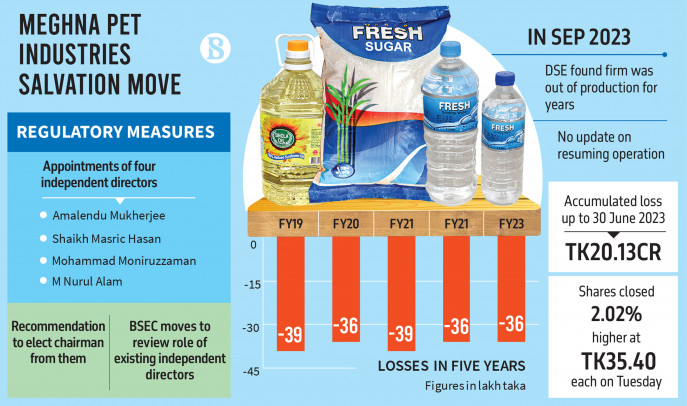

In directing the nomination or appointment of the new directors in mid-January, the market regulator recommended selecting a chairman from among the independent directors.

The Bangladesh Securities and Exchange Commission (BSEC) has appointed four independent directors to the board of Meghna Pet Industries Limited, which has been closed for years, in order to protect the interests of investors.

In directing the nomination or appointment of the new directors in mid-January, the market regulator recommended selecting a chairman from among the independent directors.

Meghna Pet, a concern of Meghna Group of Industries KA, has been facing tough times, resulting in years of losses and shareholders being deprived of any returns in the form of dividends from the company.

According to the BSEC letter sent to the company, the newly appointed directors are: Amalendu Mukherjee, former additional secretary of the Financial Institutions Division; Shaikh Masrik Hasan, associate professor of the finance department at Jagannath University; Mohammad Moniruzzaman, associate professor at the accounting and information system department at Dhaka University; and M Nurul Alam, chief executive officer of MNA Associates.

The BSEC appointments come in compliance with a condition outlined in a directive issued in 2020, which relates to ensuring that sponsor-directors of a listed company jointly hold 30% shareholding of its paid-up capital.

No officials could be contacted regarding the matters as the company did not provide any contact person, such as a company secretary, at the Dhaka Stock Exchange (DSE).

The regulator has also decided to review the eligibility and role of the existing two independent directors, ATM Ataur Rahman and Engineer Md Nurul Islam, on the board.

According to the BSEC letter, the company should seek approval from the commission to continue the independent directors in line with the Corporate Governance Code of 2018.

In September of last year, the DSE found that the operations of Meghna Pet Industries had been closed for years, and the information about the factory closure was disseminated through its website. After the disclosure, no information was provided regarding the resumption of its operations or factory activities.

In April 2022, the securities regulator formed a four-member committee to investigate the business activities of Meghna Pet Industries along with another peer firm, Meghna Condensed Milk.

According to an inquiry report, the BSEC found multiple irregularities at the listed pet bottle-maker in 2023 and fined its Chairman Muhammad Zakaria and Managing Director MF Kamal Tk1 crore each, and three directors Wali Ullah, Kabir Ahmed, and Abu Taher Tk50 lakh each for violating securities laws.

After visiting the factory premises and head office of Meghna Pet last year, an investigation team submitted a report to the enforcement department of the BSEC. The team found that Meghna Pet’s production had been suspended since 2004, but the company did not disclose this news as price-sensitive information.

The company showed Tk2.26 crore worth of inventories in its report, but according to the BSEC team, there were no inventories in its factory. Furthermore, the company’s management failed to provide evidence to authenticate its loans and deposits.

The commission called the company’s owners and management to a hearing to defend themselves against the findings of the inquiry team. During the hearing, Meghna PET Director Alamgir Hossain and Company Secretary provided a written statement to the BSEC.

“We have several complexities in separating the two groups. The Kha group always tries to harass us. They have even occupied our land without handing it over to us. Besides, we have a capital crisis. And because of these reasons, we are not able to do business,” Hossain wrote in the statement.

Meghna Pet started its business in 1997, mainly producing PET (Polyethylene Terephthalate) bottles. It was listed on the stock exchange in 2001. Currently, the company’s paid-up capital is Tk12 crore, and its shares closed at Tk35.4 each at the DSE on Tuesday.

As of January 31st, sponsors and directors jointly held 43.55%, and general investors held 56.45% of the company’s shares.

Source: The Business Standard