Banks’ investments of more than Tk 16,000 crore have remained almost stuck in the stock market for the last one year owing to a thin presence of buyers amid the floor price, which has hit lenders’ bottom line and brought down their liquid assets.

The Bangladesh Securities and Exchange Commission (BSEC) set the floor price of every stock to halt their free fall amid global economic uncertainties brought on by the dragging coronavirus pandemic in 2021.

The floor price, the lowest price at which a share can be sold, was lifted for 169 companies in December before being reintroduced again in March this year as economic uncertainty deepened.

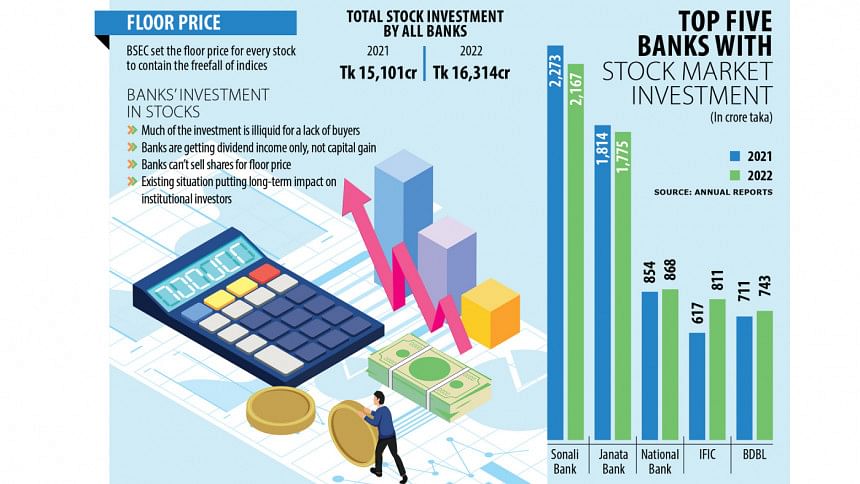

Fifty-three banks invested Tk 16,314 crore in the stock market in 2022, up from Tk 15,101 crore in the previous year, according to their financial statements.

But the investments yielded almost no capital gains, which stem from the rise in the value of securities, last year as stocks were not tradable in the absence of buyers. Their only consolation came from dividends, which were largely flat in 2022 compared to a year ago.

Bankers describe the floor price-induced situation as unique for them, saying banks don’t prefer to invest in stocks that are not liquid.

“The floor price has put us in a tight spot,” said a banker.

Muhammad A (Rumee) Ali, a former deputy governor of the central bank, said globally banks don’t invest in stock markets, but in Bangladesh, they are encouraged to invest in the stock market.

“But since a stock market investment carries risks, there should have a proper guideline.”

The noted banker thinks banks should not invest in the stock market. Rather, they should lend to entrepreneurs.

All local private commercial banks have investments in the stock market but the proportion is higher among state-run banks.

Six state-run lenders collectively invested Tk 5,904 crore last year in the stock market, representing 36 percent of the total investment of the banking industry.

Sonali Bank invested Tk 2,167 crore in 2022, the highest among the lenders. The second highest investment came from Janata Bank and it stood at Tk 1,775 crore.

National Bank’s investment was Tk 868 crore, the third highest.

“There was no scope to rebalance the portfolio and make capital gains in 2022 as stocks were depressed,” said Md Moniruzzaman, managing director of Prime Bank Securities.

He said banks earned money in the form of dividend gains last year on their investments.

A top official of a merchant bank says if banks see that their stock market investment may become illiquid, they will not make further investment in the market.

“It may impact the market negatively in the long run.”

Investment income from the stock market fell for many banks. For instance, Sonali Bank’s investment income nosedived 86 percent to Tk 72 crore, IFIC Bank’s earnings plunged 99 percent to Tk 1 crore, and National Bank’s income plummeted 71 percent to Tk 10 crore.

A lower profit for banks means lower dividends for investors. For example, City Bank announced a 10 percent dividend for 2022, which was 12.50 percent in 2021.

A merchant banker said there is apprehension among general investors that if the floor price, which is almost unprecedented in most stock markets across the world, is withdrawn, foreign investors and many other investors would sell off, bringing the market down. But the market would ultimately rebound as being seen in other countries.

Moniruzzaman said even blue-chip stocks, which are typically large, well-established, financially-sound companies with an excellent reputation, are not sought-after by investors since institutional investors and high-net-worth individuals are not coming up with large volumes of funds in the market.

Selim RF Hussain, chairman of the Association of Bankers, Bangladesh, a platform of the chief executive officers of banks in the country, terms the floor price a restriction.

“No restrictions are expected in the stock market.”

He said the restriction has turned the market almost immovable and is not benefitting any party in the market.

“Artificial pricing cannot be lucrative for anyone. We urge the BSEC to lift the floor price fast.”

All stakeholders from brokers and merchant bankers to asset management companies have long opposed the floor price mechanism as their business has been seriously affected.

But BSEC Chairman Shibli Rubayet-Ul-Islam last month said the stock market regulator would withdraw the floor price as soon as the economy returns to normalcy.

Bangladesh’s economy is going through a difficult situation owing to the volatility in the foreign exchange market, driven largely by the Ukraine war, and the conflict shows no sign of coming to an end anytime soon.

This means banks might continue to see a large volume of their funds, which are basically depositors’ money, remain stuck in the stock market in the coming months, yielding insignificant returns, which will ultimately hit their bottom line.