Analysts and stakeholders came up with the optimism at a discussion event in the capital

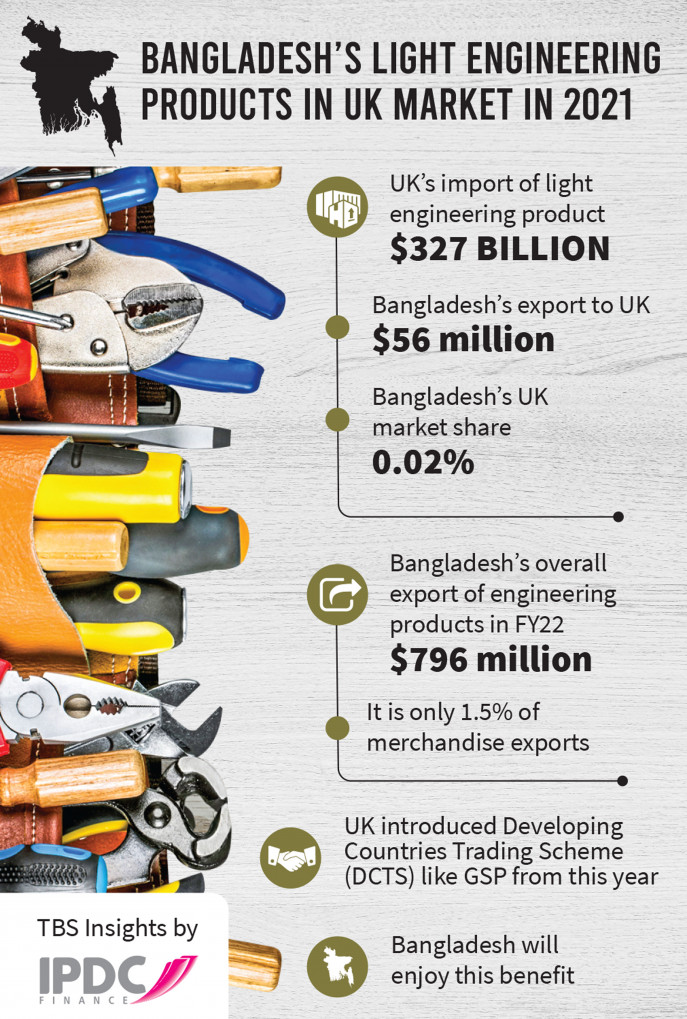

Bangladesh can have a bigger slice of the $327 billion worth light engineering market of the United Kingdom, sector insiders and analysts said, as the northwestern European country offers developing nations privileged access to its markets with a new arrangement, called Developing Countries Trading Scheme.

The generous scheme that came into effect early this year has replaced the UK’s earlier Generalised Scheme of Preferences or GSP. Developing countries like Bangladesh, under the scheme, can now enjoy reduced tariffs and relaxed rules to export goods to the UK.

“The new scheme can be a game changer for Bangladesh to break into non-RMG export sectors, such as light engineering,” Research and Policy Integration for Development (RAPID) Chairman Mohammad Abdur Razzque said.

“With the preferential trading scheme for developing countries, the UK relaxed local value-addition requirements from 30% to 25%, liberal product-specific rules, extended cumulation facilities, and removed the requirement of ratification of certain international conventions,” he said while presenting the keynote at a meeting that the RAPID organised at a capital hotel to discuss opportunities and challenges in exporting light engineering goods to the UK.

As a result, Bangladesh will enjoy benefits and flexibility in exporting goods to the UK market more than the EU, he said.

Talking to The Business Standard after the event, Abdur Razzaque said the competitive labour force is one of the key strengths of Bangladesh, which can significantly help increase exports of diversified products like light engineering.

“Bangladesh exporters, however, are not linked with the international supply chain, which is a key bottleneck,” he further added.

According to the International Trade Centre data, the UK imported light engineering goods worth $327 billion in 2021, while Bangladesh’s contribution was worth $56 million or 0.02% only.

In the meantime, the Bangladesh government announced light engineering goods as an emerging export item beyond RMG.

Bangladesh’s overall export of engineering products in FY22 was $796 million, according to the Export Promotion Bureau (EPB) of Bangladesh, which is 1.5% of the merchandise export of the country.

In the discussion, stakeholders identified some challenges behind the poor performance in the export of the item.

Lack of value chain connection, complexity in customs, absence of international standard testing facilities, lack of access to finance, problems with LC opening, unavailability of skilled labour force, and disruption in energy supply are the major problems, among others, they added.

Industry representatives also talked about the complexity of the generalised scheme of preferences verification from the UK end.

“The customs department sets higher values, instead of actual values in the case of raw material imports. As a result, we pay higher taxes and our production costs go up, which ultimately decreases our competitiveness,” said Rashed Mahmud, managing director of Kitty Industries Limited – an electrical product manufacturer.

For example, customs counted the price of our raw material at $2160 on Tuesday, which was $1450 in actual, he explained and added that there are some other complexities in taxation.

Lutful Bari, secretary general of Bangladesh Bicycle Manufacturers and Exporters Association, said, “We did not receive Tk5 crore in refunds from the Duty Exemption and Drawback Office over the past 11 years.”

Abdur Rouf, deputy executive director of Walton Group, said the government approved a new import policy order which is expected to ease the duty-free raw material import for the partial importers, but NBR told us that they were not notified of the matter.

Speaking at the event, Additional Commerce Secretary Abdur Rahim Khan hoped that the cabinet will okay the new tariff policy soon and the next budget will have its reflection.

“So, the NBR will consider some issues.”

Md Abu Eusuf, executive director of RAPID, also spoke at the event, among others.

Source: TBS News