As the fiscal year draws to a close, the government is turning to banks, especially the central bank, to secure funds to cover its expenses amid a decline in revenue collection.

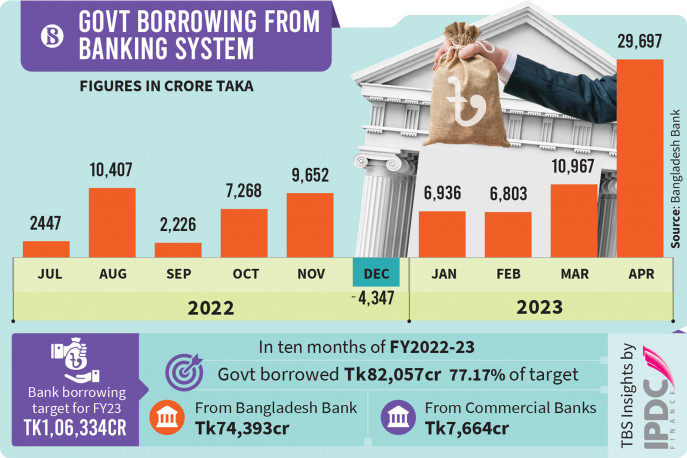

Data from the Bangladesh Bank shows that the government borrowed Tk29,697 crore from banks in April, the highest amount borrowed in a single month during the fiscal 2022-23.

In March, the borrowing was Tk17,770 crore, while in February, it was Tk6,803 crore.

According to the Bangladesh Bank, from July to April in FY23, the government borrowed a total of Tk82,057 crore from the banking system, and around 80% of this fund was provided by the central bank.

It is worth noting that when a central bank lends money to the government by printing additional currency, it is referred to as high-powered money, which can potentially result in higher inflation.

Professor Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue, told The Business Standard, “The borrowing from the central bank is high-powered money. It has an inflationary effect on the economy. Besides, loans taken from commercial banks will reduce the amount of loanable funds in the private sector.”

“However, as the revenue is less than the target, the government has to borrow to meet its expenditure. The government should now pay more attention on how to underwrite government expenditure by increasing domestic resource mobilisation. Otherwise, it will be challenging to control inflation,” added the economist.

Analysts predict that the government’s borrowing from banks may surpass the target of Tk1,06,334 crore for fiscal this year, considering the remaining two months and the typical rise in borrowing during this period, coinciding with increased expenditure.

According to data from the central bank, the government’s total borrowing from the country’s banking system stood at Tk3.56 lakh crore till April. Of the amount, Tk2.22 lakh crore has been taken from commercial banks.

Several senior officials at the central bank said that the government had a tendency to repay the loans of the commercial banks even though it increased borrowing from the Bangladesh Bank in most of the months of the current financial year. However, the government’s borrowing from commercial banks also increased slightly in March and April.

A large part of the amount borrowed from the central bank has been provided through government treasury bills and bonds. The central bank itself buys them by releasing money from the vault; this is called “devolvement”, a part of which is supplied again by printing money.

The central bank made devolvement of more than Tk11,000 crore in April, which stood at over Tk66,000 crore in the first 10 months of the fiscal year.

Earlier in a central bank report, the government was asked to reduce borrowing from banks and take loans from the non-bank sector.

Explaining the matter, a central bank official, who did not wish to be named, said that inflation is already higher than normal. When the central bank makes devolvement the money supply in the country’s economy increases. When new money enters the market, it triggers inflation.

He also said there was a liquidity crunch in the banking sector a few days ago. Later, due to an increase in lending to commercial banks through repo and liquidity facilities from the central bank, the crisis decreased. However, if the government increases borrowing from commercial banks, there may again be a liquidity crunch in the banking sector.

The government had set a target of borrowing Tk1,06,334 crore from the banking sector to meet the budget deficit for the fiscal 2022-23. By the end of April, the government had met 77.17% of this target.

According to data from the central bank, the government has borrowed around Tk1 lakh crore from the banking sector in the last one year, starting in April 2022, the majority of which is from the central bank.

Officials said that the government takes loans from the banking sector to meet the deficit budget. Most of the loan is spent on the Annual Development Programme.

In the current financial year, the government had set a target of borrowing Tk40,000 crore from the non-banking sector – Tk35,000 crore from savings tools and Tk5,000 crore from non-bank financial institutions (NBFIs) and other sources.

Borrowing from other sectors, including NBFIs, stood at Tk8,841 crore till April, the central bank said. However, instead of increasing, borrowing from savings tolls has decreased by Tk4,162 crore.